Bitcoin mining faces surging power demands and record-low fees

The Bitcoin network is expanding on an industrial scale, with power-hungry mining rigs driving energy consumption to unprecedented highs even as the flow of transactions slows to a trickle. Yet, the network seems to be under tension as rising hashrate and infrastructure collide with weak fee revenue and rare mempool clearings that leave miners earning little beyond the block subsidy.

- Bitcoin’s mining network is growing into an energy-intensive giant, drawing more than 33 gigawatts to keep new blocks flowing even as on-chain transactions slow to their weakest levels in nearly two years.

- The GoMining Institutional report portrays an ecosystem where hashrate and hardware deployments continue to climb, but fee revenue and overall activity remain subdued, creating a mismatch between network scale and miner income.

- Observers say this imbalance may linger for years, with operators dependent on a diminishing block subsidy that halves every four years until the final bitcoin is mined sometime around 2140.

The Bitcoin (BTC) network is entering a phase of striking contrasts: its appetite for electricity is soaring, while the economic rewards for miners are under pressure from low transaction activity. A new report by GoMining Institutional, seen by crypto.news, sketches a landscape of accelerating energy use, muted mining difficulty, and an unusually quiet on-chain environment, raising questions about how sustainable the current trajectory may be.

According to the report, the network’s estimated energy consumption has grown at what researchers described as “an unprecedented pace.” Drawing on data from CoinMetrics Labs, GoMining notes that Bitcoin mining power use rose from 15.6 gigawatts (GW) in January 2024 to 24.5 GW in January 2025. By the end of May 2025, it had climbed again to 33.1 GW, a more than 100% increase in just 17 months.

Much of that surge has been concentrated in the early part of 2025. “The January-to-May jump alone — a 35% rise in energy demand — reflects both heightened deployment of more energy-dense mining infrastructure following the April halving,” the report reads.

Industry analysts cited in the report suggest that although individual mining rigs are more efficient than ever, their proliferation is overwhelming those gains. “Efficiency gains at the machine level are increasingly offset by the sheer volume of deployed hardware,” the report said, adding that the importance of innovation now extends beyond ASIC design to how and where miners source their power.

Steepest decline since 2021

The accelerating energy use comes as the network’s mining difficulty — an indicator of how hard it is to verify new blocks — has been comparatively subdued. The first half of 2025 saw 13 difficulty adjustments, with the metric rising from 109.78 trillion at the start of the year to 116.96 trillion by the end of June. That represents a year-to-date increase of just 6.54%, with an average monthly climb of 1.09%.

The report frames this slowdown against 2024’s rapid expansion, when difficulty rose 4.48% per month on average. The relative calm in 2025 was punctuated by moments of volatility: a 6.81% upward adjustment on April 5 and a 4.38% increase on May 30 pushed difficulty to an all-time high of 126.98 trillion. But that peak quickly gave way to a sharp reversal.

By late June, heat waves across North America forced some operators to limit activity, sending hashrate down by 147 EH/s. “Bitcoin’s difficulty adjusted downward by -7.48%, the steepest decline since July 2021,” the report noted, drawing a comparison to the post-China mining ban era.

If the network’s power draw is climbing, its transaction layer tells the opposite story. On-chain activity in the first half of 2025 has slumped to levels not seen since October 2023. The seven-day moving average of daily transactions also fell to about 313,510 by June 25, with a low of 256,000 confirmed transactions on June 1.

That weakness has translated into historically low fees. Throughout the year, users have been able to broadcast transactions at the bare minimum fee of 1 satoshi per virtual byte, regardless of priority. “Throughout H1, there were multiple occasions when transactions — regardless of priority level — could be broadcast for the bare minimum fee of just 1 sat/vB, highlighting the persistently low demand for blockspace across the network,” the report said.

Ghosted mempool

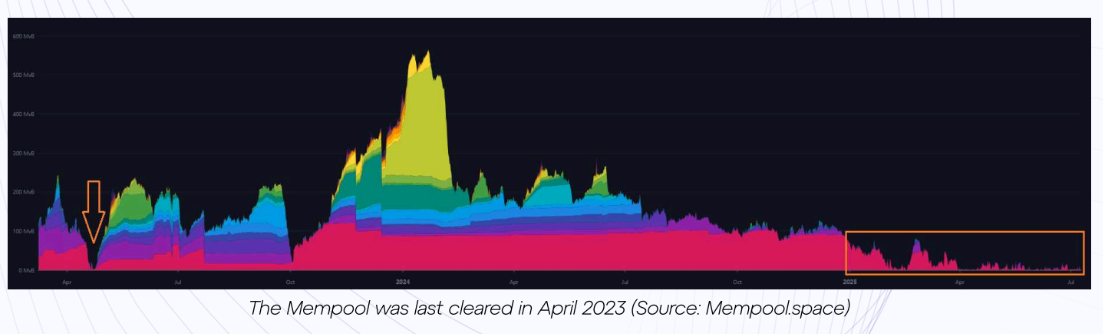

The environment has produced a rare phenomenon: a fully cleared mempool. The mempool — a waiting area for unconfirmed transactions — emptied twice in 2025 for the first time in nearly two years. The last comparable event was in April 2023, when Ordinals and BRC-20 token activity had not yet crowded block space to current norms.

When the mempool clears, the report notes, miners briefly operate with “almost no transaction fee revenue,” relying almost entirely on the block subsidy. That dynamic underlines one of Bitcoin’s long-term economic questions. As the fixed subsidy halves roughly every four years — eventually disappearing entirely — the network will rely on transaction fees to sustain miners. Low-fee environments, while welcome for users, can pinch operators already grappling with high energy costs.

For Bitcoin miners, the tension between rising power demand and thinning revenue is becoming harder to ignore. Extreme heat in key U.S. mining regions has already demonstrated the fragility of hashrate under environmental pressure. Meanwhile, the doubling of network energy consumption since early 2024 hints at infrastructure scaling faster than transaction activity or fee income.

Industry observers suggest that this paradox may persist. Mining firms continue to deploy energy-dense fleets to secure the network and capture block rewards, but their long-term economics are tethered to factors outside their control, network activity, user demand for block space, and the pace of Bitcoin’s programmed halvings, which are expected to continue roughly every four years until around 2140, when the final BTC is projected to be mined and the block subsidy drops to zero.

You May Also Like

Nasdaq-listed carbon management company DevvStream (DEVS) announced the launch of its crypto-asset reserve strategy, investing $10 million in Solana and Bitcoin. The company previously raised $300 mil

Bitcoin Plunges Below $115K Amid Trump Nuclear Threats and Fed Shake-Up