MSTR stock outlook: Traders watch key resistance after Friday rebound

MicroStrategy (MSTR) stock is back on traders’ radars heading into the new week after it surged roughly 26% in Friday’s session, a sharp rebound that followed weeks of downside pressure alongside Bitcoin’s pullback.

- MSTR stock surged roughly 26% on Friday, rebounding sharply from recent lows as Bitcoin stabilized after weeks of downside pressure.

- Michael Saylor’s weekend posts highlighted MicroStrategy’s outsized Bitcoin exposure, reinforcing its role as a leveraged proxy for BTC price moves.

- Despite the rally, MSTR remains below key technical resistance, with traders watching whether momentum can extend in the week ahead.

Attention is now shifting to whether the move has enough momentum to extend, or whether it proves to be a short-lived relief rally driven by positioning rather than a shift in trend.

The renewed interest comes as executive chairman Michael Saylor posted a series of messages on X over the weekend referencing charts that highlight MicroStrategy’s Bitcoin (BTC) heavy balance sheet and the company’s outsized leverage to crypto market activity.

Bitcoin leverage remains the core MSTR trade

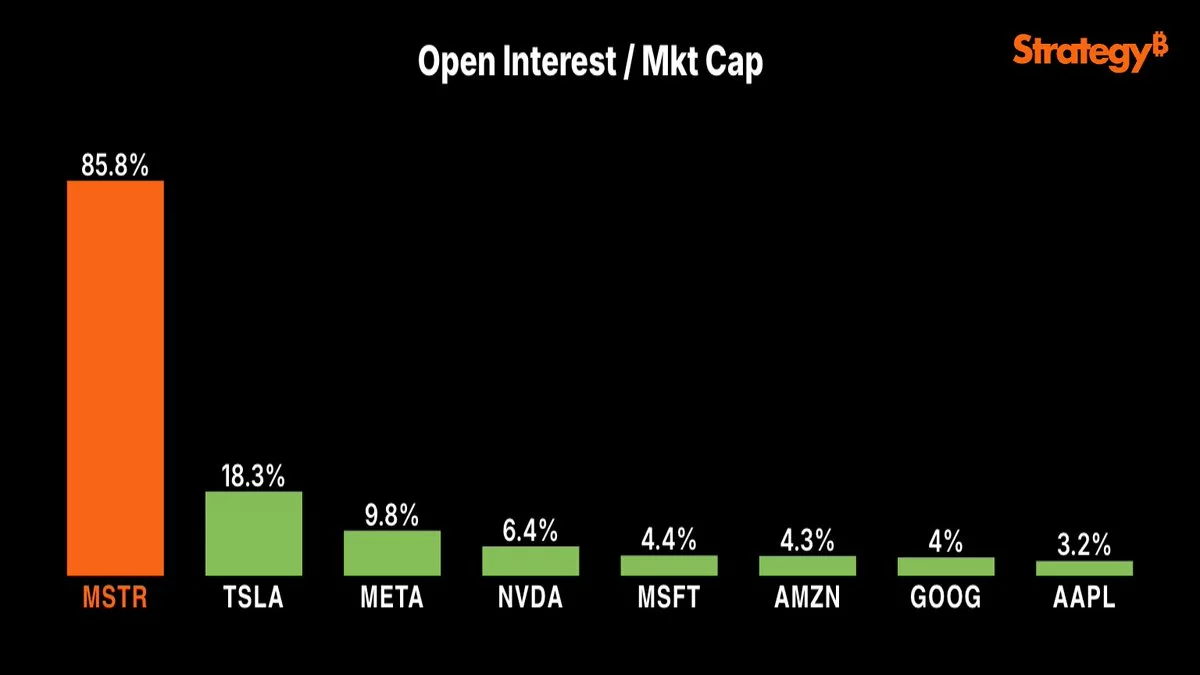

One chart shared by Saylor shows open interest relative to market capitalization, with MSTR standing out at 85.8%, far exceeding large-cap names such as Tesla, Nvidia, and Apple.

The data shows why MicroStrategy continues to trade more like a leveraged Bitcoin instrument than a traditional equity, often exaggerating moves in either direction.

Another graphic tracks Strategy’s long-term Bitcoin accumulation, with “orange dots” marking each purchase. As of early February, the company holds approximately 713,502 BTC, with a reported Bitcoin reserve value of about $50.7 billion.

Strategy’s average purchase price sits near $76,000, leaving the position modestly underwater following Bitcoin’s recent slide.

MSTR stock technical picture: Bounce meets resistance

On the daily TradingView chart, MSTR closed Friday near $135 after rebounding from lows around $105, marking its strongest single-session gain in months.

Despite the surge, the stock remains below its 50-day simple moving average near $163, a level traders are likely to treat as key resistance in the days ahead.

Momentum indicators point to stabilization rather than confirmation of a new uptrend. The RSI has recovered from oversold levels below 30 to the low 40s, suggesting selling pressure has eased, but not yet flipped decisively bullish.

For now, MicroStrategy’s setup reflects a familiar dynamic: sharp upside when Bitcoin steadies, followed by a test of conviction as volatility returns.

Whether Friday’s rally marks the start of a broader recovery, or simply resets positioning before the next move, will likely depend less on company-specific news and more on Bitcoin’s ability to hold key support levels in the week ahead.

Ayrıca Şunları da Beğenebilirsiniz

ETH Exit Queue Gridlocks As Validators Pile Up

TheWell Bioscience Launches VitroPrime™ 3D Culture and Imaging Plate for Organoid and 3D Cell Culture Workflows