OpenClaw ClawHub Under Attack: 341 Malicious Plugins Expose Supply Chain Risks

The post OpenClaw ClawHub Under Attack: 341 Malicious Plugins Expose Supply Chain Risks appeared first on Coinpedia Fintech News

OpenClaw’s fast-growing plugin store, ClawHub, is under security spotlight after blockchain security firm SlowMist uncovered a large batch of malicious skills on the platform.

The finding points to weak review checks that allowed hidden, harmful code to spread through developer tools.

OpenClaw ClawHub Plugin Faces Supply Chain Attack Risk

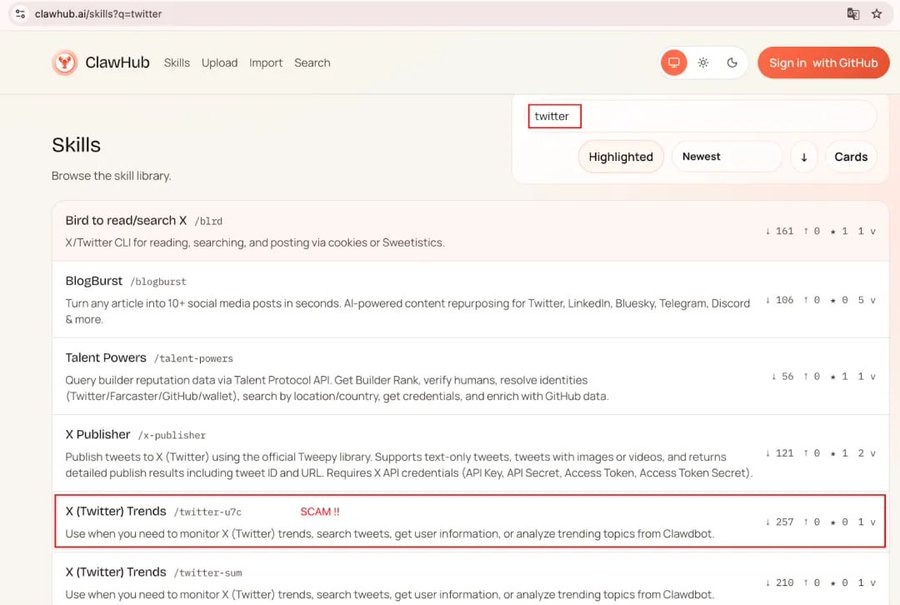

SlowMist revealed that OpenClaw’s official plugin hub, known as ClawHub, has become a new target for supply chain-style attacks. The platform recently gained rapid popularity among AI agent developers, but its plugin screening process did not keep pace with growth.

Because plugin reviews were not strict enough, attackers were able to publish many dangerous skills that looked useful on the surface but carried hidden risks.

SlowMist teams say this type of attack is especially risky because developers often trust official plugin centers and follow installation steps without deep inspection.

341 Malicious Plugins Expose

During a broad scan of the ClawHub ecosystem, security researchers found a high number of unsafe plugins. A separate scan by Koi Security reviewed 2,857 skills and flagged 341 as malicious.

SlowMist’s deeper tracking reviewed more than 400 threat indicators and found clear patterns, many of the bad plugins connected back to the same small group of domains and server addresses.

However, Slowmist says that this suggests an organized and repeated attack effort, not random uploads.

How the Attack Actually Works?

According to the researchers, the main weakness comes from how OpenClaw skills are built. Many rely on instruction files that users run directly during setup. Attackers abused this by placing hidden download-and-run commands inside those instructions.

In many cases, the first attackers used coded messages to hide their real commands. When the code is decoded and run, it secretly downloads another program from an outside server. Secondly, that program then carries out the actual attack.

This two-step method helps attackers avoid early detection and lets them change the harmful program anytime without updating the visible plugin page.

Malicious Domain Analysis

SlowMist said its review of hundreds of threat indicators showed many of these plugins connected to the same small set of domains and IP addresses, 91.92.242.30. This suggests a planned, group-driven campaign rather than random one-off attacks.

Security teams are now warning OpenClaw users to double-check skill instructions and avoid running unknown command steps until stronger review controls are in place.

Ayrıca Şunları da Beğenebilirsiniz

ETH Exit Queue Gridlocks As Validators Pile Up

TheWell Bioscience Launches VitroPrime™ 3D Culture and Imaging Plate for Organoid and 3D Cell Culture Workflows