Kyle Samani Slams Hyperliquid Days After Leaving Multicoin

Kyle Samani stepped down from Multicoin Capital on February 5, 2026, after nearly a decade as co-founder. Today, he is publicly criticizing Hyperliquid (HYPE) as on-chain data shows Multicoin purchased over $40 million in HYPE tokens.

The close timing has fueled speculation that internal conflicts over investment strategy prompted the departure of one of the most notable Solana advocates in the crypto industry.

Multicoin, Hyperliquid, and Kyle Samani: Coincidence or Clash?

Samani’s departure announcement on February 5 marked a significant shift for Multicoin Capital, a leading force in institutional crypto investment.

Despite his departure, Samani stated he would remain engaged in cryptocurrency, especially within the Solana ecosystem.

The announcement came only days after MLM analysts flagged wallets believed to be linked to Multicoin accumulating large amounts of Hyperliquid’s HYPE token in late January.

They highlighted purchases totalling tens of millions of dollars. Additional analysis suggests that substantial ETH flows were rotated into HYPE over several days via intermediary wallets.

Notably, no official confirmation has linked the trades directly to Multicoin’s internal strategy decisions.

Today, February 8, just three days after his formal exit, Samani is criticizing Hyperliquid on social media, making his position unmistakably clear.

This strong criticism stands in direct contrast to Multicoin’s high-profile investment in HYPE tokens. As a result, observers wondered if Samani’s views clashed with the firm’s recent decisions, helping drive his exit.

Solana Investment Philosophy Versus HYPE Strategy

Multicoin Capital earned its reputation as a vocal backer of Solana. In September 2025, the firm led a $1.65 billion private investment into Forward Industries, working with Jump Crypto and Galaxy Digital to create what they called “the world’s leading Solana treasury company.”

Samani was named Chairman of Forward Industries’ Board, underlining his importance to Multicoin’s Solana focus.

The Solana investment strategy centered on transparent yields through staking, DeFi protocols, and capital efficiency. Multicoin highlighted Solana’s infrastructure as offering better economics than Bitcoin treasury models, citing native yields of 8.05% as of September 2025.

The firm also released research on Solana projects like Jito, which by March 2025 powered over 94% of all Solana stake via custom block production technology.

Hyperliquid, meanwhile, represents a contrasting approach. The platform is a decentralized perpetual futures exchange with its own blockchain.

It is popular for high leverage and low fees, but faces criticism for its centralized validator system, closed-source code, and regulatory risks. These features appear to oppose the principles Samani promoted at Multicoin.

Tensions between strategies became more evident as analysts speculated about internal dynamics.

Kyle Samani did not immediately respond to BeInCrypto’s request for comment.

Supporters Defend Hyperliquid as Samani’s Exit Sparks Ideological Debate

Some investors and traders pushed back strongly against Samani’s criticism. They argue that Hyperliquid represents a return to crypto’s original principles rather than a departure from them.

Hyperliquid’s decision to direct revenue toward token buybacks and community incentives reflects a model designed to more closely align users and infrastructure than many venture-backed projects.

The divide highlights a deeper ideological split emerging within crypto markets. On one side are investors who prioritize transparency, decentralization, and community ownership as defining principles.

On the other hand, there are those who champion performance, liquidity depth, and institutional-grade infrastructure, even when those systems require trade-offs in governance or architecture.

Samani’s departure itself has not been formally tied to any specific investment decision. Neither Multicoin nor Samani has publicly stated that Hyperliquid or portfolio positioning played any role in the transition.

Sometimes, leadership changes at venture firms often stem from long-term strategic shifts, personal decisions, or fund-structure considerations that may not be visible externally.

Still, the timing has proven difficult for markets to ignore. In crypto, an industry where narratives travel quickly, the combination of on-chain transparency and social media speculation often fills gaps left by limited official disclosures.

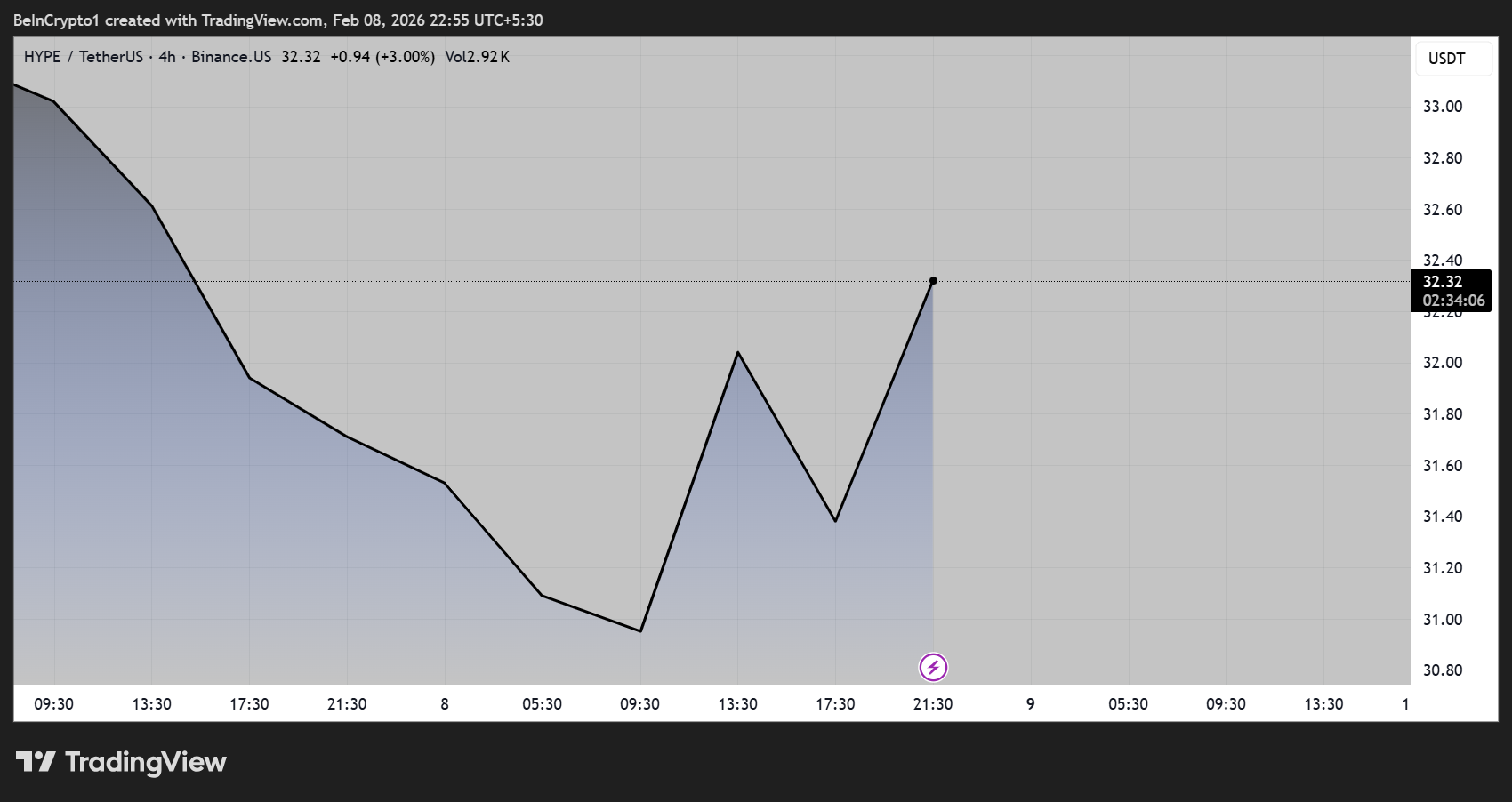

Hyperliquid (HYPE) Price Performance. Source: TradingView

Hyperliquid (HYPE) Price Performance. Source: TradingView

Meanwhile, the HYPE token is nurturing a recovery, with a higher low on the 4-hour timeframe, suggesting a trend reversal if buyer momentum sustains.

Ayrıca Şunları da Beğenebilirsiniz

Huawei goes public with chip ambitions, boosting China’s tech autonomy post-Nvidia

Tron Makes Bold Moves in TRX Tokens Acquisition