YoungHoon Kim Predicts XRP Price Surge Amid Institutional Demand

The post YoungHoon Kim Predicts XRP Price Surge Amid Institutional Demand appeared first on Coinpedia Fintech News

YoungHoon Kim, the world’s highest IQ holder, predicts XRP could flip Ethereum by 2026, even as the XRP remains under pressure in the short term. If that happens, XRP’s price could rise toward $6-$6.5 per token, even as it currently trades near $1.86 amid short-term market weakness.

XRP Could Flip Ethereum Market Cap

According to comments shared by YoungHoon Kim, growing interest in XRP is no longer limited to retail traders. He pointed to recent integrations beyond the XRP Ledger, including Solana-related developments, as a key reason behind shifting sentiment.

XRP’s focus on cross-border payments and fast settlement gives it a real use case that could attract banks and financial firms.

Kim, once known as a Bitcoin maximalist, now says XRP’s expanding role in payments and liquidity is changing the market narrative.

For now, Ethereum is still much larger. ETH’s market cap is around $345 billion, while XRP’s is near $113 billion. For XRP to overtake Ethereum, its value would need to rise by nearly 3x, or capital would need to move steadily out of ETH.

How High Can XRP Price Go If It Flips Ethereum?

As of now, XRP is trading near $1.86 with a market cap of around $113 billion, while Ethereum’s market cap stands close to $345 billion.

XRP has roughly 55 billion tokens in circulation. If XRP grows to match Ethereum’s market cap, its price would need to rise to about $6–$6.50 per token.

Institutional Demand Supports XRP Outlook

While XRP is trading below 50% of its peak, institutional interest remains strong. U.S.-listed spot XRP ETFs have now attracted $1.14 billion in total inflows since launching in mid-November.

Together, these ETFs now account for nearly 1% of XRP’s total market value, showing strong interest from institutions.

Over the past five days, spot Ethereum ETFs have seen heavy outflows, and even Bitcoin ETFs have recorded consistent withdrawals. In contrast, XRP ETFs continue to see steady inflows.

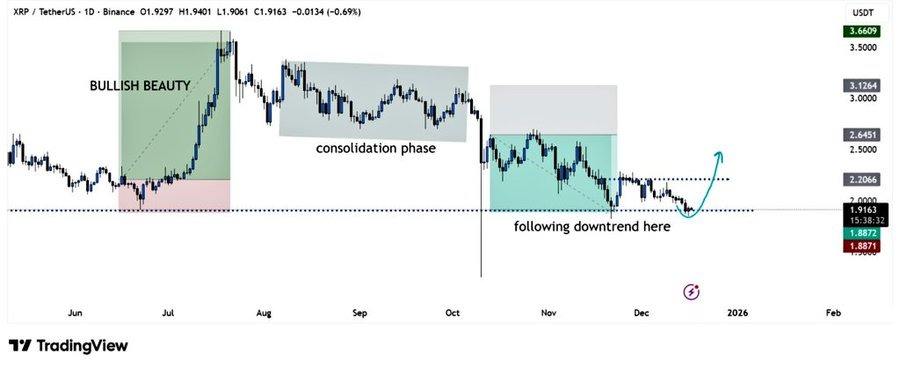

XRP Price Forms Strong Base Near $1.90

XRP price is showing early signs of stabilization after weeks of a long downtrend and forming a base near the $1.85–$1.90 support zone. This is the same area where selling pressure starts to fade, and price begins to curve upward, a common early sign of accumulation.

If XRP holds above this support, the first upside target sits near $2.20–$2.30, where the price previously faced resistance.

A clean break above this level could open the door to the next zone around $2.60 and later toward $3.30 if momentum builds.

Ayrıca Şunları da Beğenebilirsiniz

Fed rate decision September 2025

Why IPO Genie ($IPO) Is Being Called a Top Crypto Presale by Analysts