Ethereum, Solana, and XRP Look Bullish—But Ozak AI Prediction Outpaces Them All

Crypto market momentum continues heating up as Ethereum, Solana, and XRP all show strong bullish structures heading into the next major expansion phase. These three blue-chip assets remain top choices for institutional and long-term investors, each backed by deep liquidity and strong fundamentals. Yet despite their strength, the project dominating ROI projections for 2025–2026 is Ozak AI (OZ)—a real-time intelligence engine already functioning during Ozak AI presale.

With millisecond-level predictive systems, ultra-fast market signals, and autonomous multi-chain AI agents, Ozak AI carries a growth curve far steeper than even the most established large caps. While ETH, SOL, and XRP look bullish, Ozak AI’s compounding intelligence architecture is what analysts believe could rewrite ROI expectations for the upcoming cycle.

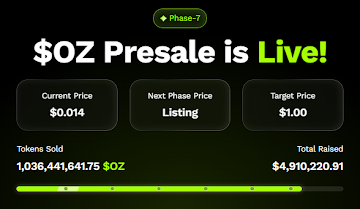

Ozak AI (OZ)

Ozak AI’s rise has been driven by its status as an AI-native intelligence infrastructure built directly for Web3. Unlike traditional projects that launch with ideas and roadmaps, Ozak AI enters the market with real utility already live. Its predictive engine interprets blockchain conditions in milliseconds, pulling ultra-fast 30 ms signals from HIVE and powering autonomous strategy-driven agents through SINT — agents that react to multi-chain conditions instantly.

With Perceptron Network’s 700K+ nodes feeding continuous data, Ozak AI becomes smarter, faster, and more precise every day. This compounding intelligence effect is the reason its presale has already surpassed $4.9 million and why analysts believe Ozak AI could become one of the most explosive performers of the 2025–2026 cycle, with projections ranging from 50x to 100x as adoption accelerates.

Youtube embed:

OZ Explained: The AI + Blockchain Project Changing Data Analytics 🌐

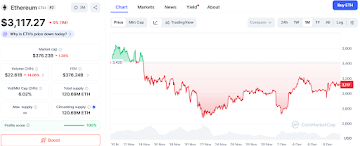

Ethereum (ETH)

Ethereum trades around $3,117 and remains one of the most structurally reliable assets in the entire crypto market. Support near $3,050 holds the short-term trend, with deeper structural zones at $2,990 and $2,940 forming the long-term base that institutions frequently accumulate.

Ethereum begins building breakout momentum as it approaches resistance at $3,180, with higher challenge regions at $3,240 and $3,310 marking the zones that historically trigger powerful upside continuation. As staking activity grows and Layer-2 ecosystems expand aggressively, analysts project ETH to reach $10K–$14K in a full bull market. But its large market cap naturally limits how fast and how far it can move compared to early-stage intelligence layers like Ozak AI.

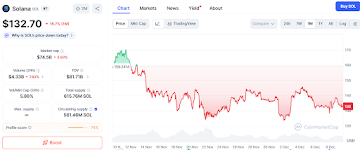

Solana (SOL)

Solana trades near $132 and maintains one of the clearest bullish formations among large-cap ecosystems. Support sits near $129, with deeper foundations at $124 and $118 reinforcing strong long-term demand. Solana begins accelerating upward as it pushes toward resistance at $137, followed by additional breakout levels at $142 and $148 — areas historically associated with significant SOL rallies.

Developer activity continues rising, network expansions remain robust, and Solana is widely projected to reach new highs in the coming cycle. But even with powerful momentum, Solana’s mature valuation narrows its multiplier potential when compared to early-stage assets entering the market with functional AI systems like Ozak AI.

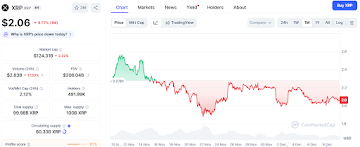

XRP

XRP holds strong near the $2 region and continues to operate with one of the most stable macro bases among major altcoins. Support at $1.96 anchors immediate price action, while deeper accumulation zones at $1.90 and $1.84 reinforce long-term confidence among large buyers.

XRP begins forming upward continuation when it approaches resistance at $2.10, with additional pressure zones emerging at $2.16 and $2.23 — levels that have historically triggered strong rallies. With regulatory clarity strengthening and institutional use cases expanding, XRP is positioned for a meaningful run in the next cycle. Still, its growth curve remains steady rather than exponential.

Why Ozak AI Outpaces All Three

- Ethereum brings unmatched network depth.

- Solana brings elite speed and scalability.

- XRP brings enterprise-grade settlement infrastructure.

But Ozak AI brings something none of them offer—exponential, self-improving intelligence. Its value grows not only from adoption or liquidity but also from computation, accuracy, data intake, and autonomous multi-chain performance. Every day of operation strengthens Ozak AI’s predictive engine, giving it a compounding growth model that analysts believe could produce returns far beyond even the strongest large caps.

ETH, SOL, and XRP all look bullish. Ozak AI looks transformative. As investors seek high-ROI opportunities for the next cycle, Ozak AI stands out as the project with the steepest long-term upside—outpacing even the market’s top-performing potential giants.

About Ozak AI

Ozak AI is a blockchain-based crypto project that provides a technology platform that specializes in predictive AI and advanced data analytics for financial markets. Through machine learning algorithms and decentralized network technologies, Ozak AI enables real-time, accurate, and actionable insights to help crypto enthusiasts and businesses make the correct decisions.

For more, visit:

Website: https://ozak.ai/

Telegram: https://t.me/OzakAGI

Twitter: https://x.com/ozakagi

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Ethereum, Solana, and XRP Look Bullish—But Ozak AI Prediction Outpaces Them All appeared first on Live Bitcoin News.

Ayrıca Şunları da Beğenebilirsiniz

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

Crypto Casino Luck.io Pays Influencers Up to $500K Monthly – But Why?