Weekly: Fed Cut Rate, Do Kwon Jailed, Ukraine Leads in Stablecoins, and US Banks Integrate Cryptocurrencies

The Incrypted editorial team has prepared another digest of the week’s main events in the Web3 industry. In it, we will tell you about the Fed’s rate cut, Do Kwon’s jail term, Ukraine’s leadership in the use of stablecoins, the integration of cryptocurrencies into US banks, and much more.

Bitcoin

- Market dynamics and forecasts

Bitcoin continues to range from $88,000 at the beginning of the week to over $94,000 as of 9 December. At the time of writing, the asset is trading at $90 002, according to TradingView.

Daily chart of BTC/USDT on Binance. Source: TradingView.

Daily chart of BTC/USDT on Binance. Source: TradingView.

Meanwhile, Standard Chartered Bank has lowered its forecast for the price of the first cryptocurrency in 2025 to $100,000, pointing to weakening institutional demand and the exhaustion of the effect of aggressive purchases by treasury companies (DAT).

At the same time, the market received atypical signals: after 12 years of hibernation, wallets associated with Silk Road transferred almost 34 BTC, which again raised the issue of old stocks. At the same time, Nvidia CEO Jensen Huang called bitcoin an “energy storage” tool, reinforcing the narrative about its role in the global energy economy.

- Corporate bitcoin treasuries: results and plans

In 2025, the DAT business model came under pressure: the median drop in shares of such companies in the US and Canada reached 43%, and the rate of bitcoin addition to balance sheets almost stopped in the fourth quarter, according to CryptoQuant.

Against this backdrop, individual players are demonstrating different strategies: Strategy has pledged not to sell bitcoin until 2065 and raised $1.44bn to cover its obligations, while Strive plans to issue up to $500m in shares for further BTC purchases.

In general, most companies hold up to 500 BTC, and the concentration of risks and difficulties with capital are forcing the market to revise expectations.

Ethereum

BlackRock has filed an application with the Securities and Exchange Commission (SEC) for the iShares Staked Ethereum Trust, a spot Ethereum ETF with staking that could expand institutional access to the network’s returns.

At the same time, Ethereum co-founder Vitalik Buterin proposed to create an online market for gas futures that would allow users to fix future commissions based on the base commission. Both initiatives are aimed at developing the Ethereum infrastructure by combining institutional tools and risk management mechanisms for users.

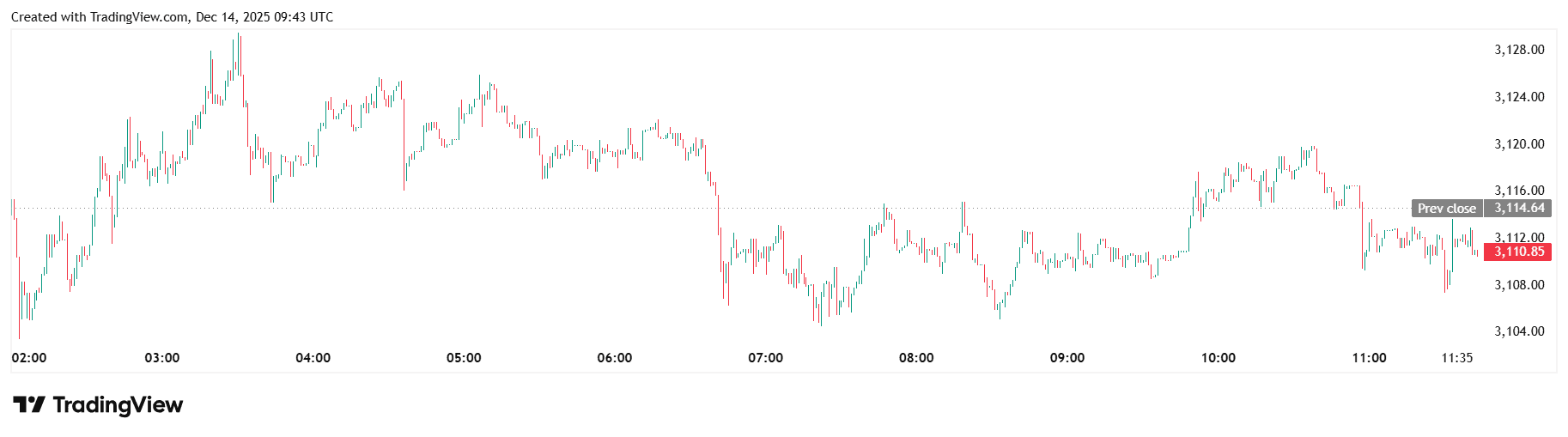

At the time of writing, the price of Ethereum is at $3110, according to TradingView.

Daily chart of ETH/USDT on Binance. Source: TradingView.

Daily chart of ETH/USDT on Binance. Source: TradingView.

Crypto ETFs and market expectations

- Market weakness and consolidation signals (results)

Outflows from ETFs continue — in the first week of December alone, Bitcoin and Ethereum ETFs lost more than $150 million, while iShares Bitcoin Trust recorded outflows for the sixth week in a row.

Analysts from Bloomberg, WuBlockchain, and Binance Research agree that the market has entered a cooling phase:

- The market capitalization dropped by 15% in November

- Spot volumes fell by 28%

- Traders in options are laying a bitcoin sideways until the end of 2025

Against this backdrop, activity is concentrated in Bitcoin and Ethereum at low leverage, with expectations fluctuating between $85,000 and $100,000 by the end of December — with no clear trend.

- Long-term optimism and structural shifts (plans)

Despite the short-term weakness, Bitwise CIO Matt Hougan predicts the market will grow 10-20 times in 10 years and chooses the strategy of “investing in the market” rather than in individual assets — in contrast to the current pessimistic signals.

Meanwhile, the cryptocurrency division of venture capital firm Andreessen Horowitz (a16z crypto) is opening its first office in South Korea, betting on Asia with record crypto activity, which contrasts with the decline in Western exchanges.

At the same time, Arkham shows that the transparency of the ecosystem is increasing (deanonymizing a part of Zcash’s $420 billion transactions), highlighting the market’s technological maturity amid a cyclical correction.

Do Kwon sentenced to 15 years in prison for Terra crash

A US federal court has sentenced Terraform Labs co-founder Do Kwon to 15 years in prison for fraud and conspiracy related to the collapse of the Terra ecosystem and investor losses of around $40 billion. During the hearings, the court heard testimony from victims from different countries, and Kwon himself had previously pleaded guilty to some charges. Judge Paul Engelmeyer emphasized that the entrepreneur deliberately misled the market by publicly downplaying the risks of the Terra USD algorithmic stablecoin.

a16z and Bybit: what the crypto market will look like in 2026

a16z has published a report with 17 key trends that, in its opinion, will determine the development of the crypto industry in 2026. The main areas include stablecoins as a payment infrastructure, asset tokenization, AI agents, prediction markets, and privacy technologies that should make the crypto economy the “financial layer” of the Internet. A special emphasis is placed by a16z on the integration of stablecoins into everyday payments without a complete restructuring of banking systems.

At the same time, Bybit CEO Ben Zhou said that 2026 could be the year of real-world tokenised assets (RWAs), especially in markets with underdeveloped financial infrastructure. At the same time, he drew attention to the liquidity shortage, which, according to his estimates, will persist at least until early 2026. According to Zhou, the market will remain sluggish in the short term, but regulatory interest in RWAs could be a catalyst for the next stage of growth.

Stablecoins

- Ukraine: results of real use

Ukraine has topped the global ranking in terms of the ratio of stablecoin transactions to GDP, becoming a leader in practical use in 2025. It is already demonstrating results, outperforming even developed financial jurisdictions in this regard.

- Mass adoption of stablecoins in payment services

YouTube has launched payments in the PYUSD stablecoin for US content creators via PayPal without interacting directly with crypto assets. This is in contrast to regulatory initiatives by governments, as it is not a matter of policy, but of ready commercial use within the existing payment infrastructure.

- Regulatory plans and institutional support for stablecoins

The United Arab Emirates and the United Kingdom, among others, rely on stablecoins as part of their financial infrastructure:

- Circle has obtained a full ADGM license and appointed a regional head for the Middle East and Africa region

- while the Financial Conduct Authority and the Bank of England are preparing common rules and a regulatory sandbox for pound-based stablecoins

Unlike the UK, which is only formulating a framework for 2026, Abu Dhabi has already moved to practical implementation through licensing global issuers.

Project news

- Tokenisation of capital and assets

Tether, State Street/Galaxy, and Mubadala Capital with KAIO are betting on tokenisation as an alternative to classic financial instruments:

- Tether is considering tokenizing its own shares and buybacks after a round of up to $20bn, while blocking secondary sales at a discount

- State Street and Galaxy are launching the SWEEP tokenized liquidity fund on Solana in 2026

- Mubadala and KAIO test tokenized access to private strategies for institutional investors

- Prediction markets and financial derivatives

Crypto exchanges Coinbase and Gemini are simultaneously strengthening the forecasting market segment. On December 17, Coinbase will introduce prediction markets and tokenized shares on its own infrastructure. Gemini has received approval from the US Commodity Futures Trading Commission (CFTC) to launch the regulated Titan market with binary contracts.

In addition, ICE records demand from more than 50% of institutional clients for Polymarket data. Unlike Coinbase, which is just preparing to launch, Gemini already has regulatory approval, and ICE is entering the segment as an infrastructure player, not a crypto exchange. This indicates the transition of predictive markets from a niche crypto product to a tool for professional finance.

- Mass adoption, governments and infrastructure

Trust Wallet, Sei, Polygon, Bhutan, and US President Donald Trump’s projects show different vectors of mass entry into the crypto economy:

- Trust Wallet has integrated Revolut Pay for instant purchases in Europe

- Sei embeds a crypto wallet in Xiaomi smartphones and tests retail stablecoin payments

- Polygon accelerated its network with Madhugiri hard fork for RWA and stablecoins

At the same time, Bhutan is launching the gold-backed TER token as a state financial instrument, while Trump is promoting crypto projects through the Gold Card and a mobile game with the TRUMP token. The contrast between state tokenization, infrastructure upgrades, and political and media crypto projects highlights how different ways crypto is entering the mainstream.

Hackers

A Canadian man who defrauded crypto investors of more than $42 million via Discord has been charged in the US, while he has already been arrested in the UK, illustrating how social platforms remain a key vector for fraud.

Other attackers also hacked Binance co-CEO Yi He’s WeChat account to promote the Mubarakah memecoin, earning about $55,000, but she publicly promised to compensate the victims.

In another case in the United States, two brothers were charged with attempting to destroy government databases using artificial intelligence (AI) tips, demonstrating a shift from financial crime to critical infrastructure sabotage.

Against this backdrop, Bloomberg notes the rise of wrenching attacks, which force crypto traders — unlike traditional investors — to invest not only in cyber but also in physical security by storing their keys themselves.

Regulation

- Fed rate cut

On December 10, the Federal Reserve cut its interest rate by 25 bps to a range of 3.5-3.75%, which the market had almost fully priced in before the meeting. The day before, investors had estimated the probability of such a move at 96.6%, but attention was focused not so much on the decision itself as on signals of a pause in policy easing in 2026.

Additional uncertainty is created by political pressure and the upcoming change in the Fed’s leadership — Donald Trump is already preparing for the final interviews with candidates, where Kevin Hassett is considered a favorite. Against this backdrop, the crypto market reacted with restraint, and Incrypted trader considered three scenarios for bitcoin: from a rebound after liquidity is collected to a move in the range of $87,000-$93,000 or a deeper correction.

- Political and legislative controversies around crypto assets

The Trump administration has published a National Security Strategy that mentions AI, biotechnology, and quantum computing, but completely ignores crypto assets, despite previous promises to make the US the “crypto capital of the world.”

In the US Senate, the debate over the bill on the structure of the crypto market has escalated, with Democrats introducing new demands and the teachers’ union opposing the Responsible Financial Innovation Act due to potential risks to pension funds.

The heads of the largest US banks will meet with senators to discuss the regulation of stablecoins, the risks of illegal activities and the competitive pressure of crypto platforms.

- Regulatory initiatives and jurisdictional determinations

The CFTC has launched a pilot program allowing bitcoin, Ethereum, and USDC to be used as collateral for derivatives trading, with enhanced monitoring and reporting.

At the same time, SEC Chairman Paul Atkins said that many initial coin offerings (ICOs) do not fall under the Commission’s jurisdiction, and the regulator only deals with tokenized securities. Thus, the SEC and the CFTC formally delineate their competence over cryptocurrencies, which creates parallel approaches to market regulation.

- Integration of the crypto market into the US banking system

The US Office of the Comptroller of the Currency (OCC) has conditionally approved the applications of five companies — Circle, Ripple, BitGo, Paxos, and Fidelity Digital Assets — for trust banking licenses, which strengthens the integration of crypto companies into the federal banking system.

In addition, the regulator allowed national banks to conduct risk-free cryptocurrency transactions as principals, subject to strict compliance with the law and risk control. This decision stands in contrast to the political controversy in Congress, as the OCC has been pushing for the practical incorporation of crypto assets into the banking infrastructure.

- Regulatory changes around the world

Regulators in different jurisdictions are moving in opposite directions. While Hong Kong is preparing for the tax exchange of data on crypto assets from 2028 and has launched a public consultation, the European Commission plans to unify capital markets under ESMA supervision by 2027, including crypto companies.

At the same time, Argentina is considering liberalization — allowing banks to work with crypto assets as early as 2026, while in France, the 1649AC initiative on self-custody reporting has provoked strong community opposition and calls for “civil resistance.” Against this backdrop, Norway has taken a cautious stance, recognizing the launch of CBDC as inappropriate at this time, emphasizing the reliability of the current payment system but leaving research into the digital krone open for the future.

Artificial intelligence

- AI development and implementation

OpenAI has introduced GPT-5.2 for professional use, emphasizing reasoning, programming, and enterprise scenarios, while warning of the “high” cyber risk of future models:

DeepSeek and Microsoft are actively investing in AI, with the former using banned Nvidia Blackwell chips in China and the latter allocating $23bn to infrastructure in India and Canada, demonstrating global competition for technology.

- Legal, ethical, and regulatory challenges of AI

OpenAI and Microsoft are at the centre of a lawsuit over allegedly exacerbating ChatGPT user psychosis, while the EU has launched an antitrust investigation against Google for training AI on publishers’ and YouTube content. At the same time, the US allowed Nvidia to export advanced H200 chips to China, which demonstrates the contrast between US policy and EU regulatory restrictions.

- Investments and commercial projects based on AI and technology

Tether launches QVAC Health for personal health data and invests in Generative Bionics to develop humanoid robots, highlighting the active diversification of its technology projects.

JPMorgan notes the benefits of its $18 billion annual investment in AI and blockchain, generating at least $2.5 billion in profits, demonstrating the commercial impact of innovation compared to startup experiments like DeepSeek.

- Entertainment and crypto stories: Netflix is preparing a comedy about an attempt to regain access to a $35 million crypto wallet, while Vitalik Buterin criticizes Musk for using Plaform X as a tool for online bullying

- Cars and crypto payments: Porsche and Lamborghini have started accepting cryptocurrency, showing the growing integration of digital assets into the retail sector

- IPOs and major financial deals: SpaceX is planning a record-breaking IPO valued at $1.5 trillion, HashKey Group and Anthropic are preparing to raise funds through IPOs, and Tether has made a bid to buy a controlling stake in Juventus

- Users and exchanges: Binance reached 300 million users, but suspended an employee for insider trading, and Upbit plans to completely withdraw assets from hot wallets, demonstrating different approaches to security and customer trust

- Traders and mining: one trader increased his capital 340 times in a week on memcoin, while another lost more than $3 million in 14 hours on Ethereum; a lone miner with a hashrate of 270 TH/s earned $285,000 per block, highlighting the contrasts of risk and reward in the crypto economy

- Investments and financial guarantees: Ripple Labs investors received lucrative buyout guarantees worth $500 million

- Technical changes in networks: ZKsync announced the closure of ZKsync Lite in 2026

- Global platform expansion: Robinhood enters the Indonesian market after acquiring a local broker and crypto platform.

Airdrops

Guides and activities:

- BingX Trading Tournament;

- Tempo;

- Surf.

Updates:

- Zama — New Testnet;

- Citrea Guild.

- We’ve gathered the key investments in blockchain, cryptoassets, and AI over the past week in one article.

- We regularly update the Incrypted crypto calendar, where you will find a lot of interesting events and announcements.

Ayrıca Şunları da Beğenebilirsiniz

👨🏿🚀TechCabal Daily – Sun King makes it rain

Cathie Wood: “We Sold Some $TSLA Near Highs and Bought #Crypto”