Best Crypto to Buy Now – Aave Price Prediction

The decentralized finance remaining one of crypto market’s most important long-term growth drivers. Among DeFi protocols, Aave stands out as one of the largest and most established lending platforms, known for its resilience, innovation, and strong user adoption.

The ecosystem has paid over a billion dollars in interest and processed trillions in cumulative deposits, highlighting its scale and relevance in the broader blockchain space. $AAVE’s price is back in focus as the token hovers around $195 following a modest dip in the latest session.

Recent updates around the Aave app and protocol upgrades have renewed interest in the project, especially as market participants look for fundamentally strong assets during periods of volatility.

With ongoing upgrades to design, usability, and security, Aave is reinforcing its role in DeFi, leaving investors focused on Aave price prediction and whether it is the best crypto to buy now.

How Aave V4 Redefines Lending with Smarter Liquidations

The Aave V4 upgrade introduces a major advancement in decentralized lending by replacing rigid, outdated systems with adaptive mechanisms that respond dynamically to market conditions.

Central to this upgrade is a redesigned liquidation process that shifts from a broad, one-size-fits-all approach to a precision-based system benefiting both borrowers and liquidators.

Traditional liquidation models caused market inefficiencies, but V4 precisely restores a borrower’s Health Factor, reducing over-liquidation. This approach limits sudden market impacts and enhances collateral efficiency.

Borrowers gain enhanced protection during volatile periods, while liquidators receive fairer compensation for their participation. The upgrade also strengthens overall stability, making the protocol more resilient to market fluctuations.

By implementing sophisticated risk management tools, Aave V4 increases capital efficiency and cost-effectiveness. Ultimately, these improvements solidify Aave’s position as a leading DeFi platform while enhancing safety and reliability for all users.

Aave Price Prediction

$AAVE’s price outlook highlights continued volatility but improving structure, with the asset holding above key April lows and avoiding a new lower low. Strong support is identified around the $187–$200 zone, while a critical level to defend remains near $120.

On the upside, resistance is concentrated around the $260–$214 range, where repeated rejections have occurred. Short-term charts suggest a potentially bullish setup, forming an ascending triangle that could trigger a modest breakout.

A successful move higher may target $280 first, with larger resistance zones beyond if momentum builds. However, failure to break resistance could send price back toward $187 support.

Best Crypto to Buy Along Aave

While Aave provides stability through proven fundamentals, many investors are also looking toward crypto presales as higher-risk, higher-reward opportunities. Below are two of the best crypto presales of 2025, poised to make significant market impact.

Bitcoin Hyper (HYPER)

Bitcoin Hyper is one of the most promising crypto projects of 2025, generating significant attention in the presale market. The project has quickly raised nearly $30 million, reflecting strong investor interest and a rapidly growing community.

Designed as the fastest Bitcoin layer 2 chain, Bitcoin Hyper offers an ecosystem that includes a wallet, explorer, bridge, staking, and meme coin integration, allowing users to interact with Bitcoin in new decentralized ways.

Source – Borch Crypto YouTube Channel

Its tokenomics are particularly compelling, with substantial allocations for marketing, development, exchange listings, and treasury. Investors are drawn to its simplicity, efficiency, and potential for high returns, making it one of the best crypto to buy for those seeking early-stage opportunities.

With the presale momentum continuing, Bitcoin Hyper is poised to expand rapidly, combining innovative technology with strong financial planning to create a highly attractive investment proposition.

Visit Bitcoin Hyper

Pepenode (PEPENODE)

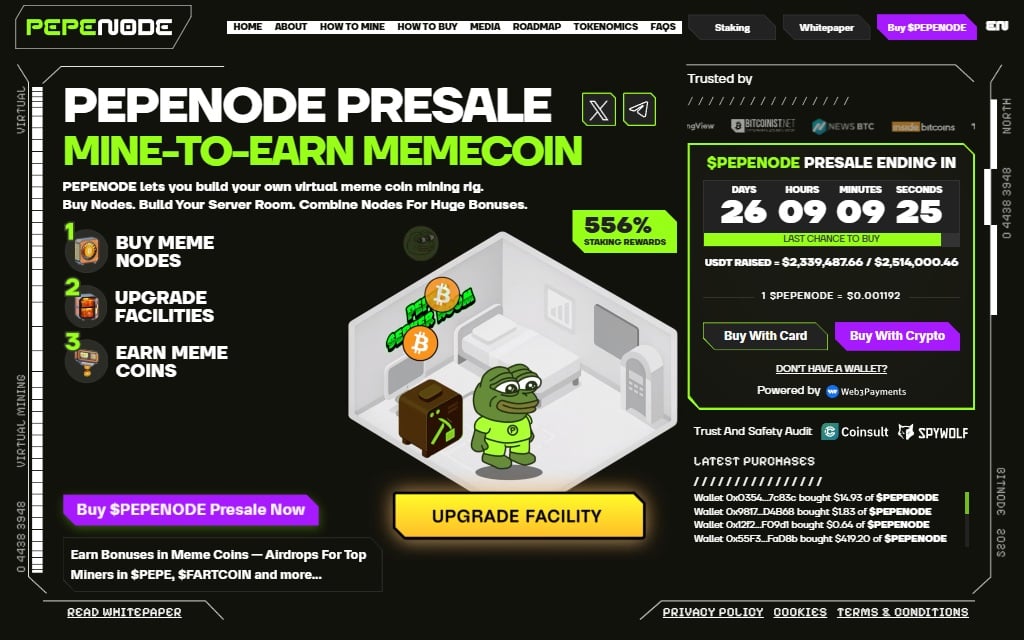

Pepenode is a unique meme coin project that allows users to virtually mine meme coins through a distinctive node system. By purchasing Pepenode tokens, investors can build their own virtual mining rigs, upgrade facilities, and combine nodes to increase mining power.

The platform is entirely virtual, requiring no additional computing power, making it accessible and easy to use. The presale has already raised an impressive $2.3 million, with each token priced at $0.001192 and under 30 days remaining to join.

With this limited window, early participants have the chance to be among the first in the world to engage in virtual meme mining. The project’s design, rewards system, and engaging mechanics position it as one of the best meme coins to buy.

Visit Pepenode

Conclusion

Presale projects often enter the market at lower valuations, offering greater upside potential if adoption and execution meet expectations. These early-stage tokens can complement more mature assets by adding growth exposure to a portfolio.

A balanced approach that combines established protocols with carefully researched presale projects may offer better risk-adjusted opportunities, especially for investors positioning ahead of the next major crypto expansion.

This article has been provided by one of our commercial partners and does not reflect Cryptonomist’s opinion. Please be aware our commercial partners may use affiliate programs to generate revenues through the links on this article.

Ayrıca Şunları da Beğenebilirsiniz

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

Crypto Casino Luck.io Pays Influencers Up to $500K Monthly – But Why?