Bitcoin Whales Unload $3.4B in December; BTC Stalls at $92K Resistance: Glassnode

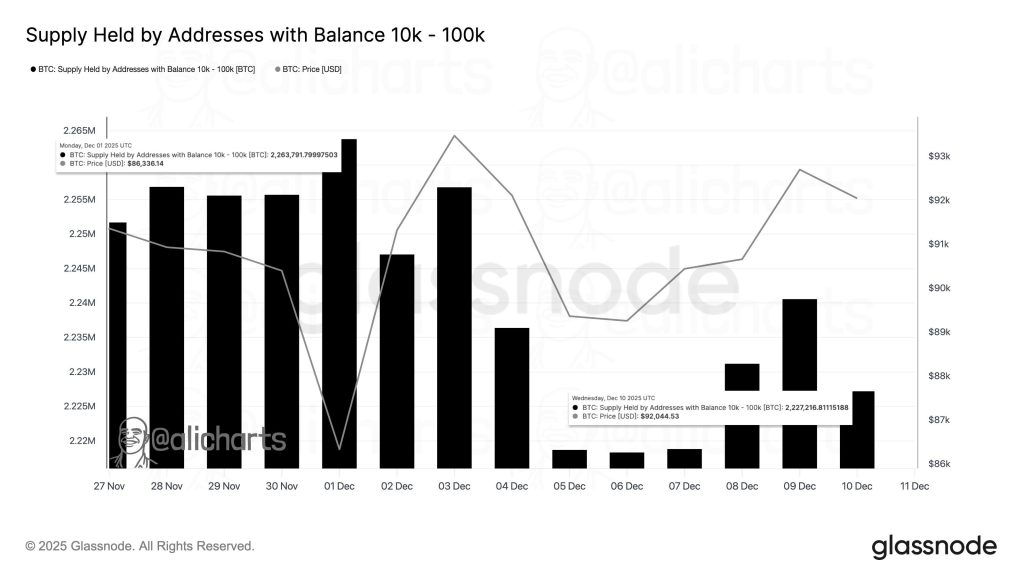

Bitcoin’s largest non-exchange holders are de-risking. The 10,000 to 100,000 BTC cohort has sold or redistributed 36,500 BTC (approx. $3.4 billion) since December 1, according to Glassnode data.

The distribution coincides with Bitcoin’s struggle to break the $94,000 resistance level following Wednesday’s Federal Reserve rate cut. BTC traded at $92,250 (-0.2%) during the early Asian session Friday.

The Data Points

- The Cohort: Entities holding 10k-100k BTC (often institutional custodians or early miners).

- The Volume: ~$3.37 billion in selling pressure over 12 days.

- The Trend: This marks a shift from accumulation to distribution for this specific class, contrasting with retail sentiment which remains elevated.

Liquidity Drought

Market depth is thinning. Stablecoin liquidity, a proxy for buying power, has dropped significantly. Data cited by FX Leaders notes a 50% decline in stablecoin inflows since August, suggesting the current price levels lack the fresh capital support needed for a breakout above $100,000. Bitcoin is trading steadily near $92,000 as markets digest the Fed’s rate cut alongside its plan to inject liquidity by purchasing $40 billion in Treasury bills each month. While this liquidity boost will have a stronger long-term impact, near-term sentiment is also improving, supported by renewed institutional flows, noted Akshat Siddhant, Lead Quant Analyst, Mudrex.

The Institutional Take

This divergence is the signal to watch. While retail chases the “Fed pivot” narrative, the smart money (10k-100k BTC tier) is using the liquidity to exit. The $3.4B outflow from this cohort, combined with the 50% drop in stablecoin reserves, indicates the current range ($88k-$94k) is being used for distribution, not accumulation. Expect volatility to increase if BTC loses the $88,000 support handle.

Ayrıca Şunları da Beğenebilirsiniz

Tether’s Uruguay Bitcoin Mining Plans Could Be Over

Oil jumps over 1% on Venezuela oil blockade