Moniepoint launches Moniebook to help businesses manage daily operations

Moniepoint Inc., Africa’s prominent fintech platform, has today launched Moniebook, an “all-in-one” Point-of-Sale (POS) initiative designed to help small businesses manage their daily operations.

In a statement seen by Technext on Wednesday, Moniepoint explained that Moniebook is tailored for small and medium-sized businesses and multi-location enterprises. The solution, which just emerged from its beta phase, is already showing hitting key milestones.

Providing further explanation on the new feature, Babatunde Olofin, Managing Director, Moniepoint MFB, noted that the latest addition is a testament to its goal of providing businesses with the tools needed for success. He mentioned that Moniepoint wants to be a growth partner for businesses.

“This is in strong consonance with our mantra of creating financial happiness even as we consistently power the dreams of the millions of Nigerians who have come to love and trust the brand as an enabler of progress, as businesses or as individuals,” he said in the statement.

Babatunde Olofin, Managing Director, Moniepoint MFB

Babatunde Olofin, Managing Director, Moniepoint MFB

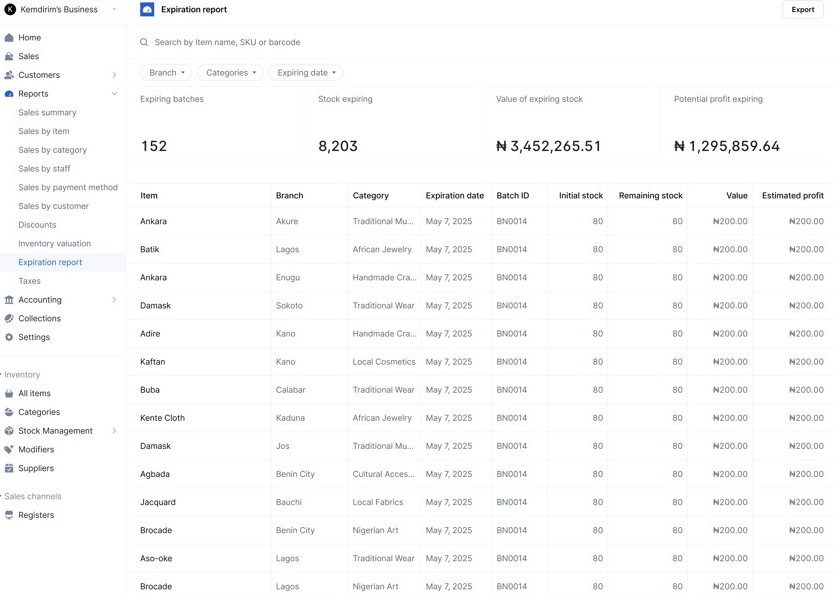

Moniebook provides businesses with a real-time overview of their sales, staff, customers, and inventory. The e-book helps owners and corporate organisations to gain control over their daily transactions and increase profits.

“Moniebook combines robust software with reliable hardware, helping business owners streamline operations, boost efficiency, and empower business owners with data-driven insights for growth,” part of the statement reads.

On how to get it, the company said Moniebook is available in two pricing tiers: Core (N6,000/month) for small business operations and Pro (N8,500/month) for advanced, multi-location enterprises.

Also Read: Moniepoint hits $1 billion valuation after fresh $90 million raise.

Why Moniebook?

Oluwole Adebiyi, Head of Product at Moniebook, explained that the initiative provides solutions to everyday challenges faced by Nigerian business owners.

Explaining the complexity, Oluwole pointed out that “For too long, small and medium-sized business owners have had to juggle multiple, disconnected tools to manage critical operations, from tracking inventory to processing payments and understanding their sales data.”

Providing more context, he noted that Moniebook helps entrepreneurs focus on serving customers and growing their enterprises while handling real-time record-keeping. He added that the initiative is another step by Moniepoint to foster a thriving business ecosystem in Nigeria.

“For us, whether you’re running a supermarket, a restaurant, or multiple retail outlets, you shouldn’t have to juggle five different systems,’ he said.

Moniebook

Moniebook

Some Moniebook’s features

- Inventory management for stock monitoring to minimise waste and prevent stockouts.

- Integrated payment processing that enables seamless transactions via Moniepoint terminals.

- A multi-location management system that controls and monitors inventory, sales, and staff across multiple store locations from a single platform.

- Tracking sales for visibility into daily sales performance, customer behaviour, and staff metrics.

Others include extra registers, staff and role management, and implementation support, making it unique for growing businesses.

Ayrıca Şunları da Beğenebilirsiniz

Is Putnam Global Technology A (PGTAX) a strong mutual fund pick right now?

US-wed Irishman with no criminal record detained for months in 'traumatizing' conditions