Crypto Analysts Review September’s Top 3 Trending Cryptocurrencies: MAGAX, Dogecoin, and Solana

Dogecoin’s Staying Power in the Meme Market

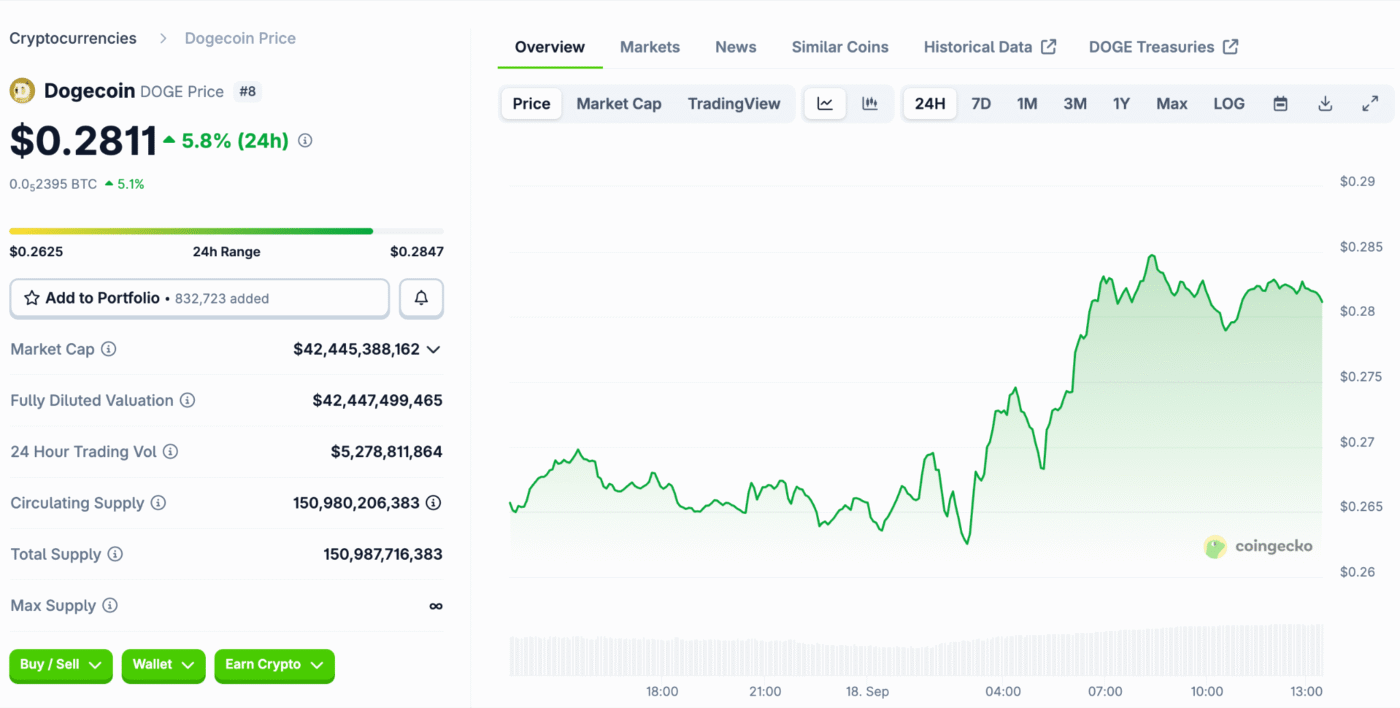

Dogecoin (DOGE), once considered a joke, continues to prove its critics wrong. With a market cap still in the tens of billions, it remains one of the most recognizable meme coins. September has seen Dogecoin’s trading volumes rise, fueled by retail enthusiasm and renewed celebrity mentions. DOGE currently trades around $0.2811, reflecting steady interest despite broader market fluctuations.

Dogecoin’s community sustains its relevance despite an inflationary supply and limited utility, making it a stable meme coin but unlikely to yield significant ROI soon.

Source: CoinGecko – Dogecoin – Price Chart

Solana’s Resilience Fuels Investor Confidence

Solana (SOL) is enjoying a resurgence in September 2025, trading around the $240 mark. Known for its lightning-fast transactions and scalability, Solana remains a hub for decentralized applications (dApps), NFTs, and blockchain gaming.

Increased institutional support from hedge funds and venture capital firms highlights Solana’s growing exposure. Despite past network issues, recent improvements and a robust developer ecosystem position Solana as a leading layer-1 blockchain, making it a key altcoin and a long-term investment in blockchain infrastructure.

MAGAX: The Presale Shaking Up the Market

Moonshot MAGAX is the breakout presale of 2025, combining meme culture with sustainable mechanics. Unlike hype-driven tokens, MAGAX introduces a Meme-to-Earn system, where users earn rewards by creating and sharing memes. This innovation transforms digital creativity into financial value, giving the community an active role in adoption.

Currently in Stage 2 at $0.000293 per token, MAGAX has already drawn over 80,000 participants. Each presale stage raises the price while reducing supply, creating built-in scarcity that rewards early buyers. Backed by a CertiK audit and powered by Loomint AI for fair engagement, MAGAX is showing investors it has substance beyond hype.

Why These Three Lead September’s Conversation

The September spotlight on DOGE, SOL, and MAGAX reflects the variety of opportunities in today’s market. Dogecoin represents cultural staying power, Solana embodies scalability and developer growth, and MAGAX delivers high-upside potential through its presale.

Investors are diversifying across these narratives to balance both risk and reward. Each token serves a distinct role in portfolios: DOGE for meme-driven recognition, SOL for infrastructure bets, and MAGAX for viral growth and ROI potential. Together, they illustrate how different crypto segments can thrive side by side in 2025.

Why Diversification Across Narratives Is Key for Q4 2025

- Dogecoin remains a cultural icon but has limited upside due to inflationary supply.

- Solana solidifies its role as a high-speed, developer-focused blockchain with growing institutional adoption.

- MAGAX combines memes, AI, and deflationary tokenomics for exponential growth potential.

- Presales like MAGAX offer rare opportunities for early entry and high multiples.

- Diversifying across these narratives helps investors capture both stability and breakout potential.

Where Investors Should Focus Next

The biggest takeaway from September is that investors are no longer limiting themselves to Bitcoin and Ethereum. Meme coins, high-speed infrastructure chains, and innovative presales are all carving their place in portfolios.

This shift highlights the evolving maturity of the crypto market, where multiple narratives can coexist. MAGAX stands out by merging the best of both worlds: community engagement and long-term mechanics.

Analysts suggest its potential 100×–166× upside makes it one of the most compelling presales of 2025. Dogecoin and Solana remain strong bets, but MAGAX is quickly becoming the name investors whisper when discussing future market leaders.

Moonshot MAGAX: The Most Dynamic Presale of 2025

Dogecoin, Solana, and MAGAX represent three different stories, but only one offers the chance for life-changing gains. With Stage 2 of the presale live at $0.000293, MAGAX is rapidly gaining traction as the meme-to-earn leader. Early entry ensures maximum upside as each presale stage increases the price.

Secure your MAGAX allocation today and join the movement turning memes into millions before Stage 2 closes.

The post Crypto Analysts Review September’s Top 3 Trending Cryptocurrencies: MAGAX, Dogecoin, and Solana appeared first on Blockonomi.

Ayrıca Şunları da Beğenebilirsiniz

Robert W. Baird & Co. Discloses Core AI Design Parameters and Launches Public Testing of Baird NEUROFORGE™ Equity AI

Best Crypto to Buy as Saylor & Crypto Execs Meet in US Treasury Council