RWA

Share

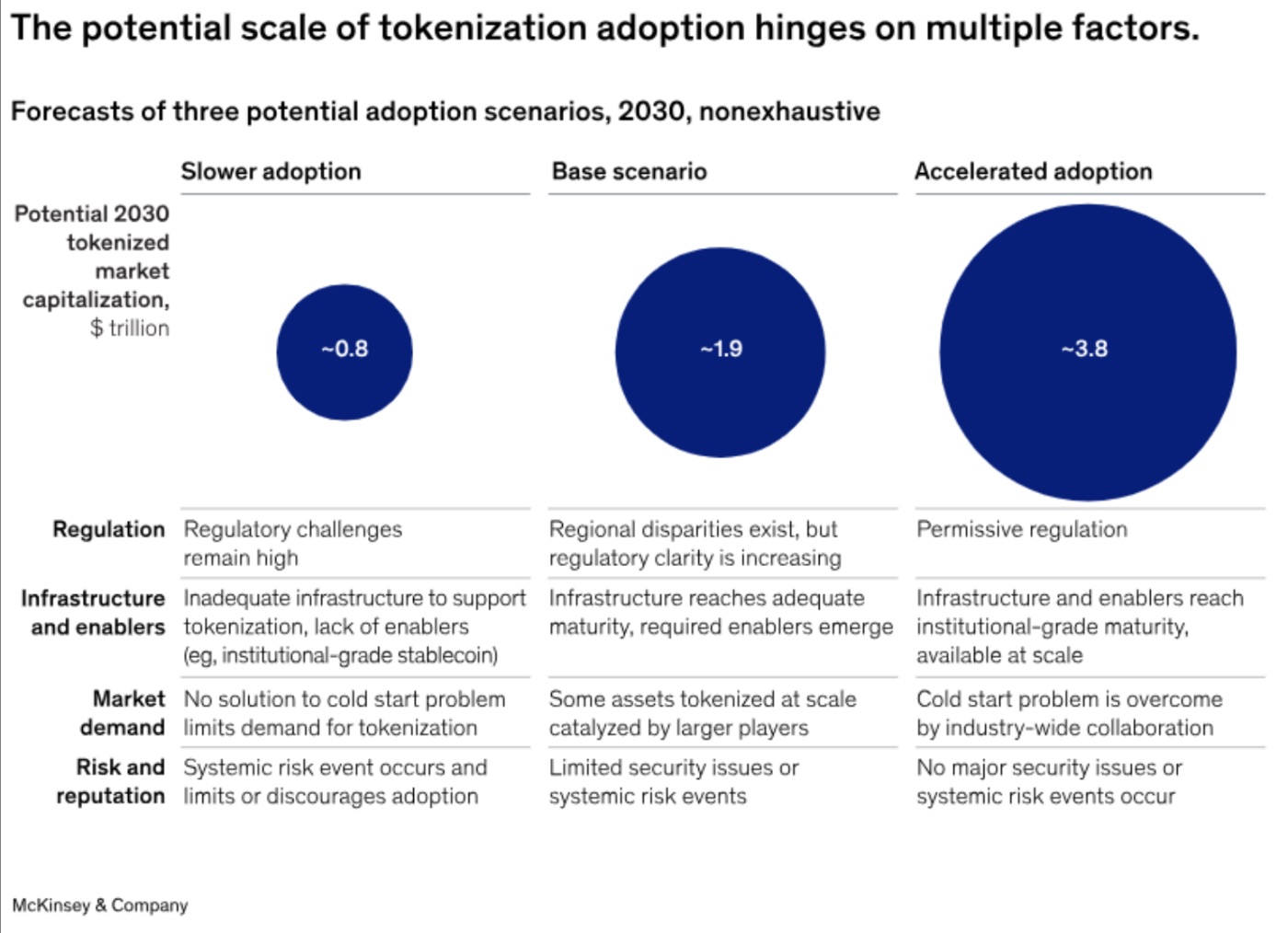

RWA (Real World Assets) refers to the tokenization of tangible assets—such as real estate, private credit, and government bonds—on the blockchain. By bringing traditional financial instruments on-chain, RWA protocols like Ondo and Centrifuge provide DeFi users with stable, real-yield opportunities. In 2026, the RWA sector is a multi-trillion-dollar bridge between TradFi and DeFi, enabling fractional ownership and global liquidity for previously illiquid assets. Follow this tag for insights into on-chain credit markets, regulatory compliance, and asset-backed security innovations.

42706 Articles

Created: 2026/02/02 18:52

Updated: 2026/02/02 18:52

The 2025 U.S. Open By The Numbers

Author: BitcoinEthereumNews

2025/08/22

Share

Recommended by active authors

Latest Articles

With $21 million in funding, how will Bluff build the next-generation entertainment-oriented prediction market?

2026/02/05 20:35

South Korea Probes ZKsync After 970% Price Surge Sparks Manipulation Concerns on Upbit

2026/02/05 20:17

South Korea Boosts Crypto Oversight With AI and Faster Action

2026/02/05 20:07

Tether’s USDT Sets Multiple Record Highs in Q4 2025, Despite Market Crash

2026/02/05 17:24

US Stocks and AI Cryptos Plunge Amid Segment’s Rally Concern

2026/02/05 17:22