Expert Predictions For Altcoin Season Trigger: When Will Bitcoin Dominance Finally Fall?

Bitcoin’s grip on the market has remained firm. Its dominance, measured as a percentage of total crypto market capitalization, currently hovers near 63.9% after hitting a high of 65.3% in May.

Historically, such strength from Bitcoin precedes a broad shift where traders rotate profits into smaller assets. Yet this time, that shift hasn’t materialized on a meaningful scale. People are wondering: When will altcoin season begin?

Many expected 2025 to be the year altcoins made their comeback, but that optimism is starting to wear thin halfway through the year.

EXPLORE: OnlyFans Rich List 2025: Sophie Rain Steals Crown as Cracks Emerge in Creator Inequality

Still, Experts Agree: Altcoin Season Is Not Dead, Just Delayed

Several factors explain this unusual dynamic. One of the most significant is the rise of institutional investors, who now view Bitcoin as a regulatory-safe entry point into crypto. With the launch and rapid adoption of spot Bitcoin ETFs, large-scale capital flows directly into BTC.

In earlier cycles, altcoins sometimes served as speculative stand-ins for Bitcoin. Today, institutions can access BTC directly. This is exactly what they’re doing. This shift has had a dampening effect on the rest of the market.

Bitcoin remains the consensus trade among institutions. The perception of BTC as a safer bet, backed by regulatory clarity and operational reliability, makes it difficult for capital to rotate toward altcoins. In contrast, many altcoins are still grappling with smart contract risks, unclear regulations, and high centralization. This makes institutional investors reluctant to venture beyond Bitcoin, at least for now.

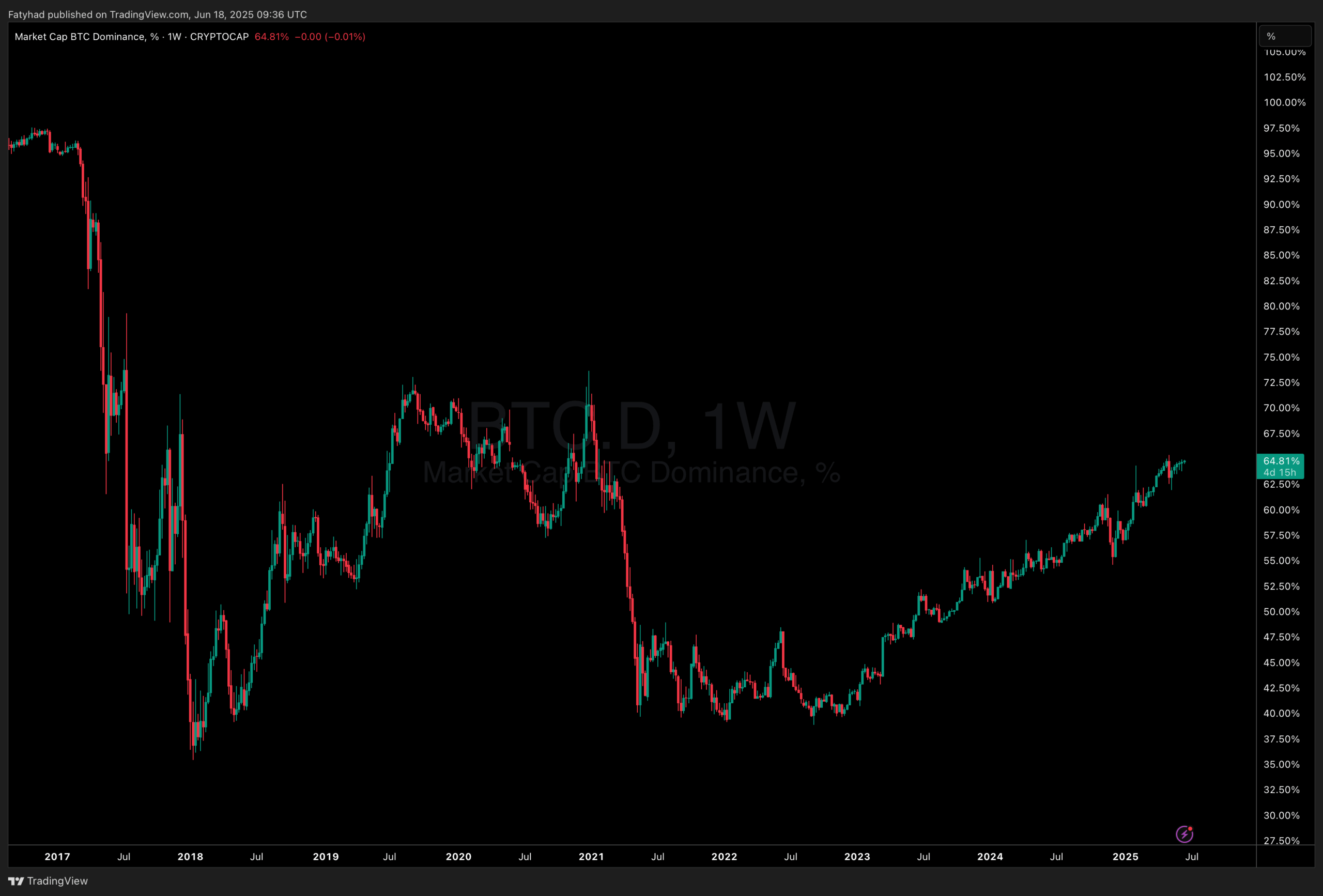

Bitcoin Dominance Chart Signals: Still in a BTC-Led Phase

(BTC.D)

A look at the Bitcoin dominance chart reinforces this narrative. Around 64.8% of Bitcoin’s market share has been climbing steadily since late 2022. In contrast to the 2020–2021 bull run, when BTC dominance peaked at ~73% before rapidly falling and sparking a full-fledged altcoin season, there is no sign of reversal yet.

The weekly chart shows consistently higher highs and higher lows, with capital continuing to flow into Bitcoin while most altcoins lag. This dominance becomes even clearer in the ETH/BTC chart.

(BTCETH)

Ethereum has struggled to outperform BTC. While it has remained relatively stable against the U.S. dollar, it has lost ground against Bitcoin for nearly two years. Simply put, holding BTC over ETH during this period delivered a better ROI.

Why this matters: ETH/BTC is often seen as a proxy for altcoin confidence. When ETH performs well against BTC, it typically signals growing risk appetite and a healthier altcoin market. A falling ETH/BTC ratio, on the other hand, suggests defensive positioning and capital consolidation into Bitcoin.

Jess Houlgrave, CEO of Reown, notes that altcoins lag because hype rather than fundamentals still drives many. Meanwhile, Bitcoin has solidified its reputation with institutional trust, consistent utility, and macro relevance.

Some crypto influencers believe the biggest altcoin season in history could still begin in June—echoing previous cycles. But macroeconomic factors can’t be ignored. Geopolitical tensions, interest rate uncertainty, and a cautious risk environment have made investors hesitant to embrace volatility. Liquidity is also spread thin across an ever-growing pool of new altcoin projects, diluting market attention.

The result is a fragmented environment where few altcoins manage to sustain significant momentum.

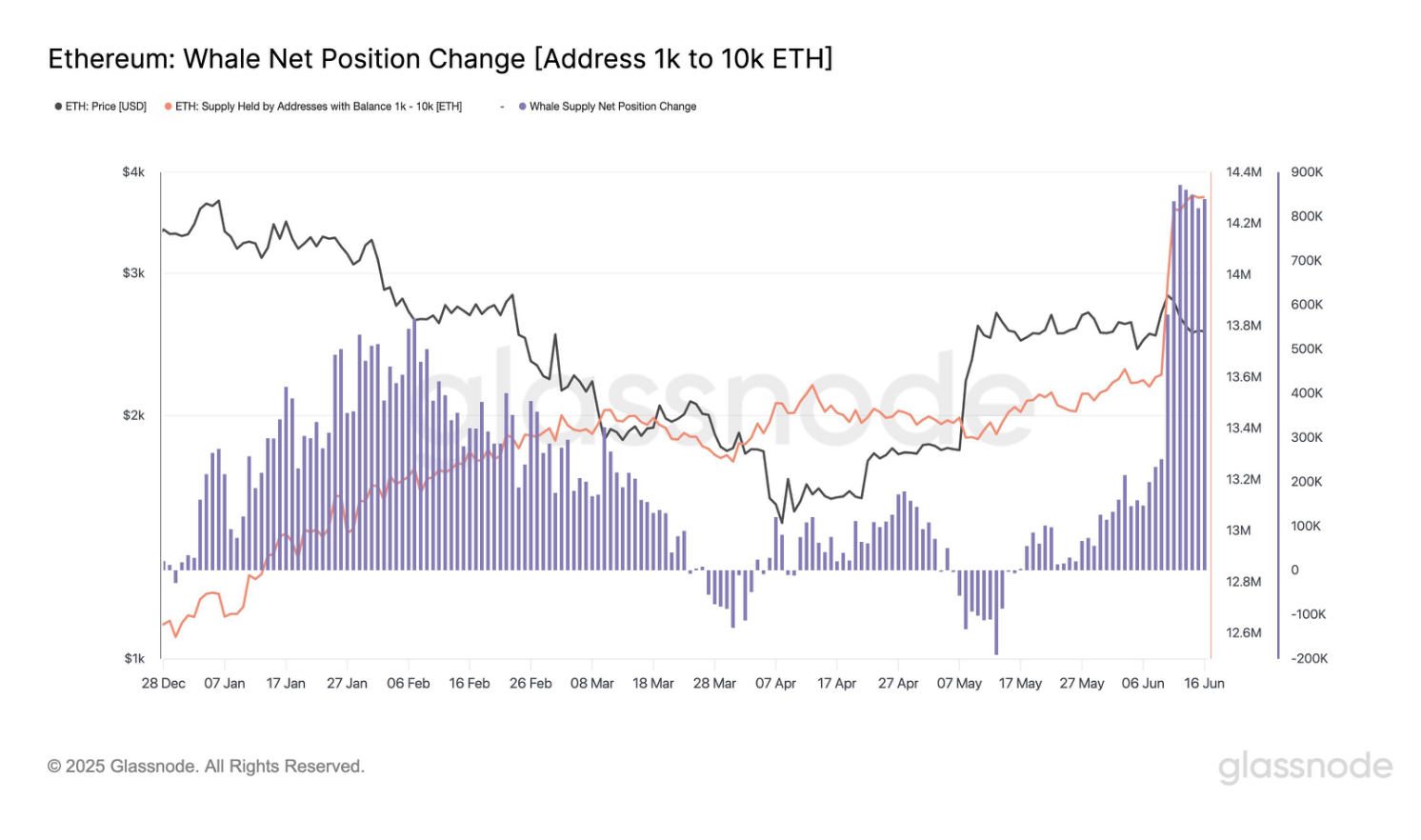

Ethereum Accumulates Quiet Strength as Bitcoin Dominance Holds

On the bright side, Ethereum is seeing strong accumulation from whales and steady inflows into spot ETFs: over 870,000 ETH was bought in one day recently, the highest since 2017. ETFs have now seen 19 consecutive days of net inflows, totaling over $500 million.

(Source)

Despite this, ETH’s price has dipped slightly due to a sharp rise in short positions on CME futures, with net shorts now at $1.55 billion. This reflects a popular delta-neutral strategy: investors go long via ETFs or spot while shorting futures to hedge and earn yield without direct price exposure.

If staking is approved for U.S.-based ETH ETFs, this strategy could expand significantly, offering yields close to 8%. For now, Ethereum’s strong fundamentals are being weighed down by sophisticated hedging activity.

For crypto enthusiasts wondering when Bitcoin dominance will finally fall, the answer may be: not yet, but soon. Altcoin season may be taking its time, but it’s far from canceled. As Bitcoin’s surge plateaus and fresh capital looks for higher returns, the altcoin market could stage a comeback, potentially as we near the end of 2025 or enter 2026.

The post Expert Predictions For Altcoin Season Trigger: When Will Bitcoin Dominance Finally Fall? appeared first on 99Bitcoins.

You May Also Like

XRP Ledger to Launch XAO DAO to Adopt Decentralized Governance

FOMC and Canadian ETF Debut Fail To Pump XRP Price: What Catalyst Does XRP Need?