XRP price prediction: Will Ripple break $2 or slide lower?

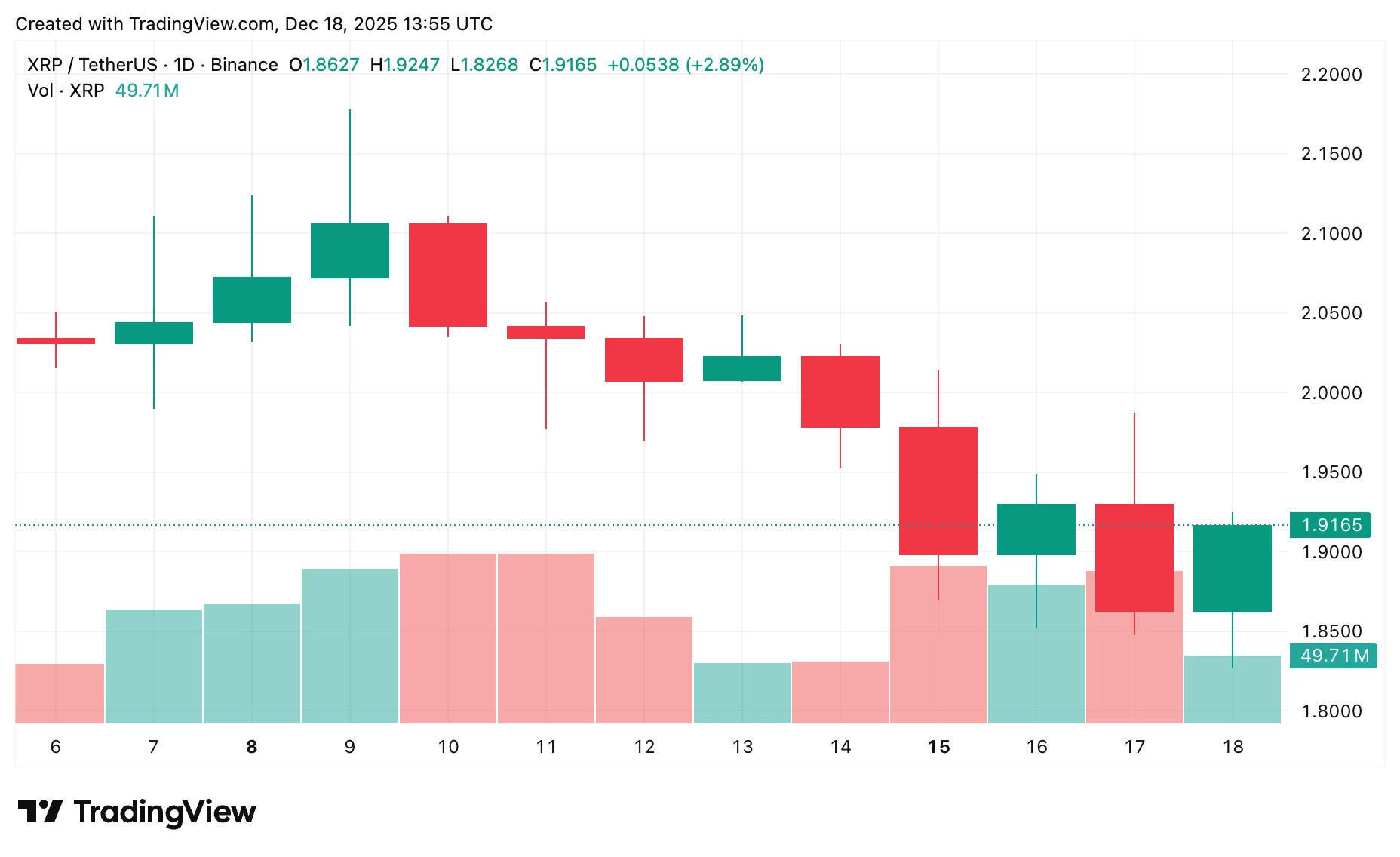

Over the past 24 hours, the XRP price has been volatile, bouncing between $1.83 and $1.98 as market nerves remain high. With losses of around 4.5% this week and nearly 11.3% over the month, short-term confidence has taken a hit.

Even so, XRP hasn’t slipped out of focus, as it’s hovering near important technical levels that could shape its next move.

Table of Contents

- Current market scenario

- Upside outlook

- Downside risks

- XRP price prediction based on current levels

Current market scenario

Ripple (XRP) is hovering around $1.92 as of December 18, down roughly 0.04%. The $2 level, once support, is now acting as resistance, and rallies toward it are quickly rejected. Sellers are still active.

Upside momentum is limited. The XRP price staying below $1.96–$2 suggests that any bounce is temporary, and traders are waiting for stronger signals before making larger moves.

- XRP’s $2 level has turned into key resistance, limiting upside, while the $1.80–$1.90 zone serves as critical support.

- XRP is likely to remain range-bound between $1.80 and $1.96 for now, with a break above $2 needed to trigger a stronger rally.

- Despite recent weakness, the longer-term outlook remains constructive, and near-term dips may be temporary corrections rather than a prolonged downtrend.

Upside outlook

Upside momentum for XRP is limited as long as it remains below $1.96–$2.00. Taking back that range would be a big win for buyers, but until then, the market looks range-bound.

The $1.80–$1.90 zone is central to the XRP outlook and has historically served as support. If it holds, XRP could run toward $1.96, but the XRP forecast only turns bullish once $2 is convincingly cleared.

Downside risks

If XRP can’t stay above $1.80–$1.90, it might dip toward $1.77 or even further if sellers pile in. That would probably push out some weak hands and see if the long-term holders stick around.

Even with the recent weakness, XRP’s overall setup still looks decent. It managed to beat major cycle highs earlier this year, so there’s still a reason to be positive. Any near-term pullback might just be a temporary correction rather than a full-blown downtrend.

XRP price prediction based on current levels

According to our XRP price prediction, price action is likely to stay range-bound for now. The $1.96–$2 zone has been tough to crack, and rallies are getting sold off, keeping buyers on the sidelines.

For now, XRP is expected to trade between $1.80 and $1.96. Staying above $1.80 keeps the market calm, but clearing $2 could trigger a more decisive move up, while dropping below $1.80 could spark another decline.

You May Also Like

Buterin pushes Layer 2 interoperability as cornerstone of Ethereum’s future

Trump rethinks China tech curbs amid Nvidia H200 review