Aave price confirms bullish reversal setup as TVL recovers, is a breakout brewing?

Aave price has confirmed a breakout from a bullish reversal pattern that could potentially set it up to recover from its losses this year.

- Aave price has rebounded after dropping nearly 60% from its August high.

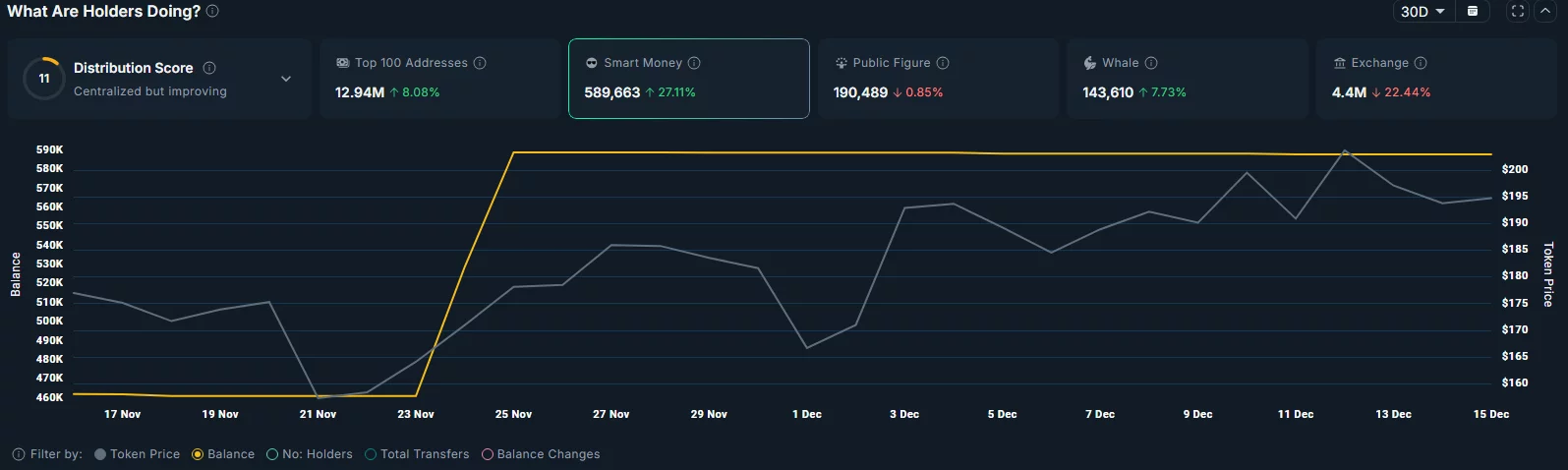

- Whales and smart money have increased their holdings over the past month.

- A bullish reversal pattern was confirmed on the daily chart.

According to data from crypto.news, Aave (AAVE) fell 60% from its year-to-date high of $377 reached on Aug. 24 to $150 over the following three months. While it has since managed to recover to $194.5 at press time, it is still down 49% from its August high.

Aave price dropped as activity on its network has slowed over the past few months. Data from DeFiLlama shows that the TVL locked in DeFi applications on the network had declined from its yearly high of $76.49 billion to $50.9 billion observed on Nov. 23.

When the TVL on the platform is in a downtrend, it indicates reduced participation from traders and weaker protocol usage, which in turn could prompt investors to seek better-performing alternatives or exit their positions altogether. This, along with the broader market downturn in recent months, played a key role in keeping investor appetite subdued.

Despite this, a slew of catalysts likely helped AAVE bounce back over recent weeks. The TVL on the network has moved back above $56.7 billion, a sign of improving user activity that could have boosted investor sentiment.

Data from Nansen also reveals a renewed accumulation trend among whales and smart money investors over the past month.

Notably, the amount of tokens held by smart money wallets has increased by 27% during this period, while whale wallets have grown their holdings by 7.7%, currently holding over 143.6k tokens. These developments were accompanied by a 22.4% drop in exchange balances, which now stand at 4.4 million.

Taken together, these trends hint at growing demand from investors and reduced selling pressure, factors that could continue to support potential gains in the short term.

Looking ahead, Aave Labs has proposed deploying Aave V3 on MegaETH before its mainnet launch to leverage the high-speed Ethereum L2 scaling solution’s infrastructure. As this is expected to benefit Aave by increasing user adoption, it has the potential to drive its token price higher.

Aave price analysis

On the daily chart, Aave price has confirmed a breakout from a descending broadening wedge pattern, which typically tends to be followed by a strong bullish reversal trend lasting several weeks or even months.

Adding to this, the 20-day moving average is edging toward a bullish crossover with the 50-day moving average. Such crossovers suggest that control is gradually shifting from sellers to buyers.

As such, the breakout from the wedge pattern points to a rally that could extend to as high as $430 over the coming months. The target is calculated by adding the height of the wedge to the price level at which the breakout was confirmed.

For now, an immediate resistance lies at $204, which aligns with the 38.2% Fibonacci retracement level and has acted as a ceiling for the bulls since November this year. Meanwhile, traders should keep an eye on $189.5 as the nearest support level to watch in the short term.

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

You May Also Like

Unstoppable: Why No Public Company Can Ever Catch MicroStrategy’s Massive Bitcoin Holdings

Eric Trump Says Banks Tried to Shut Him Out – Turns to Bitcoin Instead