Kaspa (KAS) Soars 40% Weekly: Further Gains on the Horizon?

Kaspa (KAS) stands out as one of the best-performing top 100 cryptocurrencies over the past week.

It has outperformed many leading digital assets, including Ripple’s XRP, within that timeframe, and according to multiple market observers, it may rise even more in the near future.

What Happened and What’s Next?

The token has pumped by 40% in the last seven days, with most of the gains coming in the past 24 hours. Currently, it trades at roughly $0.06 (per CoinGecko’s data) with a market capitalization of approximately $1.6 billion. This places KAS as the 72nd-largest cryptocurrency, or bigger than Worldcoin (WLD), Algorand (ALGO), Arbitrum (ARB), and other popular altcoins.

KAS Price, Source: CoinGecko

KAS Price, Source: CoinGecko

The primary catalyst for the latest pump seems to be the opening of the first decentralized Kaspa bridge. Just hours ago, the X account behind Dymension revealed that KAS was voted in as a new base asset on the platform.

The ascent caught the eye of numerous analysts who believe this could be the start of a major rally. X user EuroSniper envisioned the potential jump to $0.16 in the following months. Crypto King predicted a similar outcome, outlining several factors that may support the bullish scenario, including clearing the multi-month downtrend and holding the $0.05 zone as support.

Crypto Tony, an X user with over 550,000 followers who touches upon the performance of numerous cryptocurrencies, also chipped in. The analyst hoped for a further surge to $0.074, saying their “longs need it.”

The Bearish Scenario

While KAS’s recent revival is indeed significant, its current price is far below the peak levels seen during the summer of 2024. Back then, the asset’s valuation shot to $0.20, whereas its market capitalization neared $5 billion.

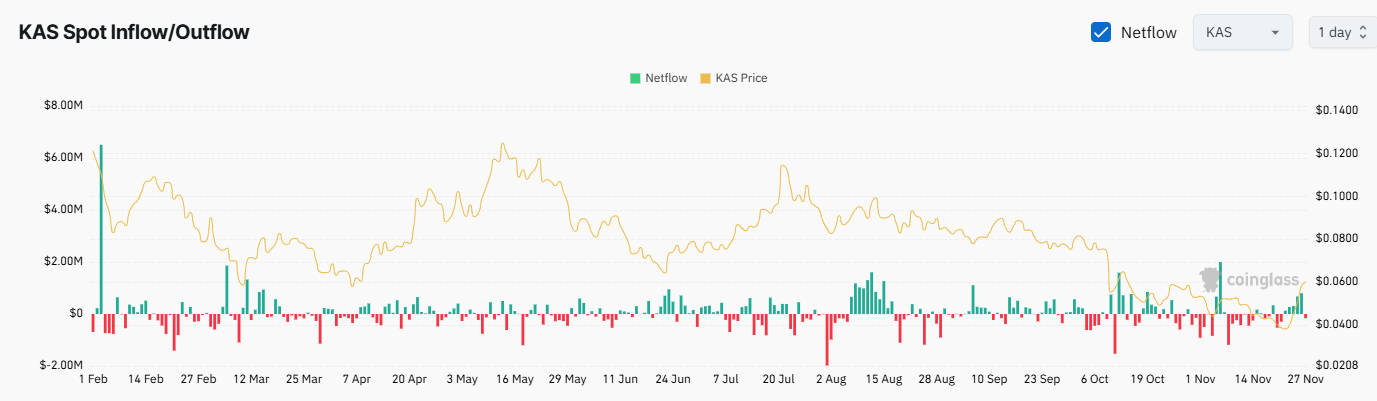

Some technical indicators suggest KAS might not be able to reclaim its former glory (at least in the near future) and could be headed for a pullback. The recent exchange netflow is among those elements.

According to data provided by CoinGlass, inflows have surpassed outflows over the past week, suggesting that investors have abandoned self-custody methods and flocked to centralized exchanges. This is generally considered bearish since it is interpreted as the step before selling.

KAS Exchange Netflow, Source: CoinGlass

KAS Exchange Netflow, Source: CoinGlass

The post Kaspa (KAS) Soars 40% Weekly: Further Gains on the Horizon? appeared first on CryptoPotato.

You May Also Like

Why Is Crypto Down Today? – November 28, 2025

Tomarket Daily Combo Today: November 28, 2025,