Cryptocurrency futures trading, as one of the core derivatives of the blockchain and cryptoasset market, reflects the technological progress and market demand evolution of the entire cryptocurrency industry. From simple futures in the early days to complex perpetual futures and on-chain futures today, cryptocurrency futures have undergone rapid iteration in just over a decade. This article will take you through the development history of cryptocurrency futures, understand its process from scratch, and current innovation trends.

The futures trading of cryptocurrency originated from the traditional futures trading of Financial Marekt. Futures trading can be traced back to the first commodity forward contract exchange opened in London in the 16th century - the Royal Exchange . The first modern futures exchange was established in Chicago, US in 1848, which is also known as the Chicago Futures Exchange.

Cryptocurrency futures trading products officially appeared in 2013. Early cryptocurrency futures trading used the currency-based margin model, which was relatively simple but provided standardized leverage trading tools for investors, allowing them to profit from short positions when the market fell, while improving market liquidity and price discovery capabilities. It was a major breakthrough in the history of cryptocurrency development.

Since 2018, mainstream cryptocurrency exchanges including MEXC have successively launched their own futures trading platforms. The addition of these exchanges has promoted the prosperity of the futures trading market, making futures trading gradually become one of the mainstream forms of cryptocurrency trading.

D. Perpetual futures are more suitable for short-term traders or high-frequency traders. This trading method is more flexible and the price is basically anchored to the spot price, with a smaller spread. Settlement futures are more suitable for medium and long-term investors or risk hedging traders because settlement futures do not require payment of capital fees, have relatively low costs, and clear risks.

Futures trading originated from futures trading, and the original futures trading developed from spot forward trading. As early as ancient Greece and Rome, central trading venues, bulk barter trading, and trading activities with futures trading characteristics appeared. Spot forward trading is a verbal commitment between two parties to deliver a certain amount of goods at a certain time. Later, with the expansion of trading scope, verbal promises were gradually replaced by buying and selling contracts. Thus, the term futures was born.

The initial contract behavior became increasingly complex, requiring intermediaries to guarantee delivery and payment on time. Therefore, the world's first commodity forward contract exchange, the Royal Exchange , was established in London in 1571. The first modern futures exchange was established in Chicago, US in 1848.

In order to adapt to the continuous development of the commodity economy and improve transportation and storage conditions, in 1848, 82 merchants initiated the organization of the Chicago Futures Trading (CBOT); in 1851, the Chicago Futures Exchange introduced forward contracts; in 1865, the Chicago Grain Exchange introduced a standardized agreement called "futures" to replace the previously used forward contracts. This standardized futures allowed futures to be resold and gradually improved the margin system. Thus, a Future Market specifically for buying and selling standardized futures was formed, and futures became an investment and financial tool for investors.

In 2009, Bitcoin was officially launched as the first application of blockchain technology. Initially, Bitcoin transactions were limited to small forums and peer-to-peer transactions, and the transaction form was entirely spot transactions.

Features : No derivatives, only simple "buy" and "sell" operations.

Limitations : Lack of price discovery mechanism, small market size, extremely low trading volume.

In 2010, the first Bitcoin exchange went online, providing centralized trading services for Bitcoin and officially opening the era of digital asset exchanges. Although spot trading is still the main focus, the market's demand for leverage and more complex trading tools is gradually emerging.

From 2011 to 2013, as the volatility of the Bitcoin price intensified, some investors began to try to amplify their profits through leveraged trading. Although the exchange at that time had not yet launched formal futures trading, the concept of futures has gradually been introduced.

Traders sign non-standardized bitcoin futures through over-the-counter (OTC) protocols.

Both parties agreed to buy and sell Bitcoin at a specific price at a certain point in the future.

In 2013, Bitcoin futures trading officially appeared, providing investors with standardized leveraged trading tools, allowing investors to profit from short positions when the market falls, while improving market liquidity and price discovery capabilities.

Bitcoin futures trading has the following characteristics :

Support bullish and bearish operations.

Offer high leverage (up to 20x).

Adopt currency standard (using Bitcoin as margin and settlement unit).

With the popularity of futures trading, the market has gradually exposed the following problems:

Clearing risk: Lack of a sound risk control mechanism, some trading platforms result in user losses due to untimely clearing.

In 2016, the emergence of perpetual futures revolutionized the cryptocurrency futures market: What is perpetual futures : a type of futures with no expiration date that allows investors to hold their positioning indefinitely.

Funding Rate Mechanism : Regularly balance long and short positions through Funding Rate to ensure that the price of perpetual futures closely follows the Spot Market. Features : The upper limit of available leverage is greatly increased; long and short two-way operation; improved trading flexibility, attracting a large number of high-frequency traders.

Since 2018, mainstream cryptocurrency exchanges including MEXC have successively launched their own futures trading platforms. The addition of these exchanges has promoted the prosperity of the futures trading market, making futures trading gradually become one of the mainstream forms of cryptocurrency trading.

Traditional coin-based futures require cryptocurrency (such as Bitcoin ) as margin , resulting in the value of the margin changing with market fluctuations. In 2019, USDT-M futures became popular, characterized by:

Using USDT as margin and settlement unit : avoids the impact of currency price fluctuations on margin value.

More intuitive calculation of profits and losses : All profits and losses are denominated in stablecoins, making risk management easier.

USDT-M futures meet the needs of ordinary investors for fund stability, further expanding the audience of futures trading.

As futures products mature, more and more institutional investors are entering the cryptocurrency market.

The liquidity and depth of the cryptocurrency market have significantly increased, further driving the development of the Future Market.

Perpetual futures have become the core product of most exchanges, and major platforms are constantly optimizing User Experience.

Support high leverage: up to 500x leverage, MEXC perpetual futures products support up to 500x leverage. Currently users can experience BTCUSDT and ETHUSDT up to 500x leverage in MEXC, thus greatly improving their capital utilization efficiency. Diversified trading pairs : Supports Bitcoin, Ethereum, and various mainstream and small-cap tokens. MEXC not only launched USDT-M perpetual futures, but also launched USDC-M perpetual futures and coin-based perpetual futures, providing over 1,500 futures trading pairs, greatly enriching users' trading choices.

Low fees and high liquidity : lower transaction fees and deeper market. The maker fee for MEXC futures trading is as low as 0%, and the taker fee is only 0.02%, currently the lowest in the industry.

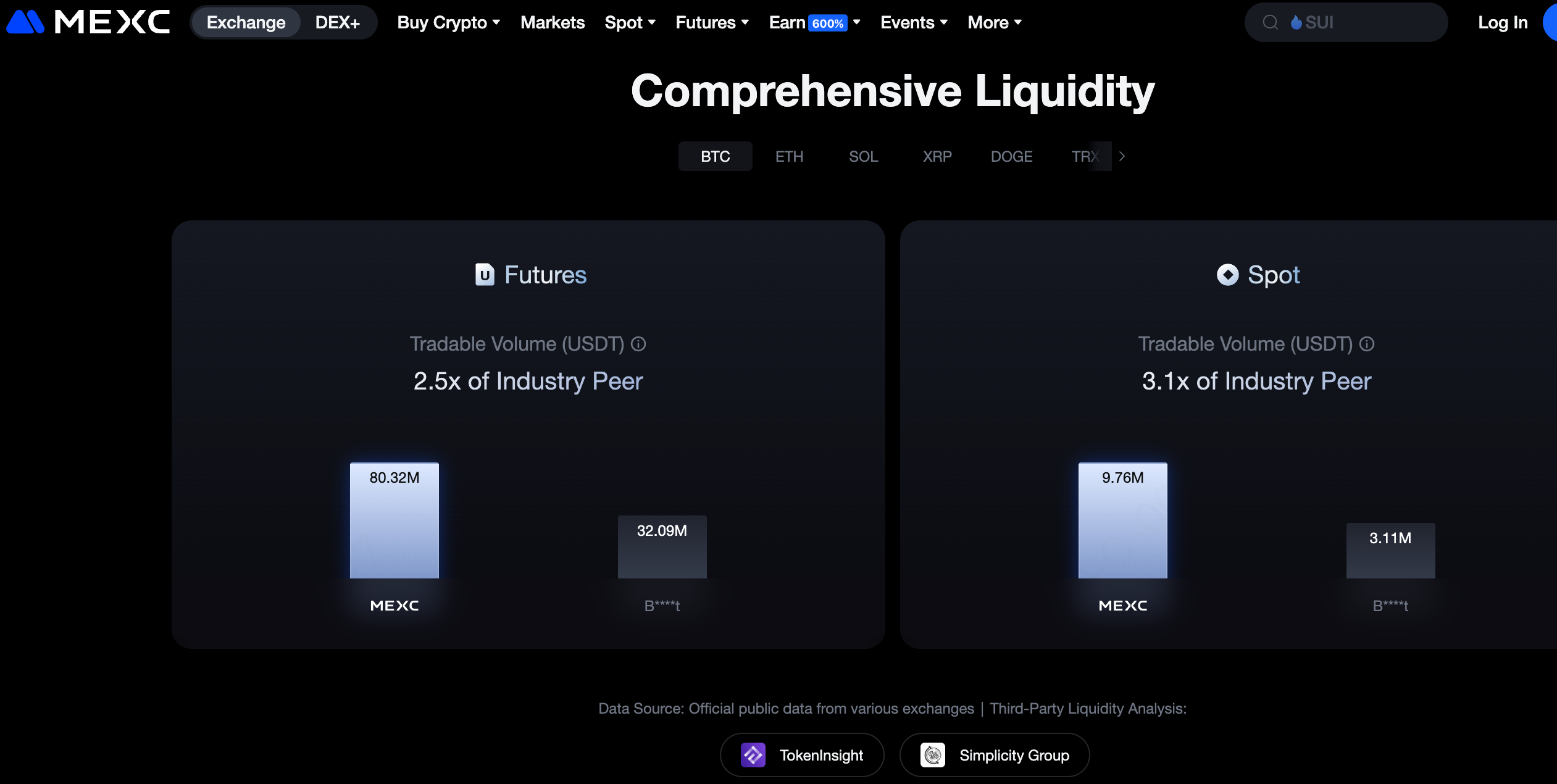

Taking the BTCUSDT trading pair as an example, by calculating the total number of limit orders within ± 5 basis points of the BTCUSDT futures middle price, the MEXC platform is about 80.32 million USDT, while another global top three competing platform is about 32.09 million USDT, MEXC is about 2.5 times higher than the industry leader.

With the explosion of DeFi, decentralized futures trading platforms have emerged, such as:

dYdX : Provides on-chain perpetual futures trading, allowing users to trade with leverage without trusting a centralized exchange. And other decentralized perpetual futures platforms based on the AMM model, lowering the threshold for trading.

Decentralized futures solve the trust and security issues of centralized platforms, while promoting the application of intelligent futures technology.

Options futures : Offer more complex trading strategies such as bullish options and puts.

Leveraged tokens : Leveraged trading is achieved through tokenization, reducing operational complexity.

Grid Trading: The emergence of grid trading products greatly saves users the time cost of futures trading. They only need to develop their own grid strategy, and the trading system will automatically execute according to the established trading instructions. MEXC's futures grid trading products provide long, short, and neutral strategies to meet users' different judgments on future market trends.

The following is a detailed comparison of the two futures in several key dimensions.

| Feature | Perpetual Contract | Delivery Contract |

| Expiration Date | No expiration date. Theoretically, positions can be held indefinitely as long as margin is sufficient. | Has a fixed expiration/delivery date (e.g., current week, next week, current quarter, next quarter). Positions are forcibly settled or physically delivered upon expiration. |

| Price Anchoring Mechanism | Uses a funding rate mechanism that periodically exchanges fees between long and short positions to keep the contract price closely anchored to the spot price of the underlying asset. | Price is formed freely through market supply and demand. The difference between contract price and spot price is called basis. As expiration approaches, the basis tends toward zero. |

| Holding Cost | Requires periodic payment or receipt of funding fees. When the rate is positive, longs pay shorts; when negative, shorts pay longs. | No funding fees, but holding costs are reflected in the basis between contract price and spot price. |

| Liquidity | Usually higher liquidity and more active trading, as most retail traders and high-frequency traders prefer this type of contract. | Relatively lower liquidity, especially for contracts further from the delivery date. |

| Price | Price stays very close to the spot index price, less susceptible to malicious manipulation "wick attacks." | Price may deviate significantly from spot price (basis), especially during high market volatility, making "wick attacks" more likely. |

| Leverage Multiples | Usually offers higher leverage multiples, for example, up to 125x. | Leverage multiples are usually relatively lower. |

Perpetual futures : The biggest innovation is "never expire". This provides traders with great flexibility to hold their positioning for a long time without worrying about being forced to position squaring due to expiration, thus executing longer-term trading strategies.

Settlement futures : Its fixed expiration date determines that all positions must be settled at a specific point in time. This requires traders to manage their positions well before expiration, either by squaring positions in advance or waiting for expiration settlement.

The funding rate of perpetual futures : This is the core mechanism of perpetual futures. In order to prevent the futures price from deviating significantly from the spot price, the exchange will settle the funding fee regularly (usually every 8 hours). If the futures price is higher than the actual price, the market bullish sentiment is strong, the funding rate is positive, and the bulls need to pay fees to the bears, and vice versa. This mechanism incentivizes traders to arbitrage, so that the futures price returns to the spot price.

Basis of settlement futures : The basis is the difference between the spot price and the futures price at a certain moment (basis = Actual Price - futures price). The basis reflects the market's expectations for the future and the cost of holding positions. As the settlement date approaches, uncertainty decreases, and the basis will gradually converge and approach zero.

Perpetual futures are suitable for :

Short-term and high-frequency traders : Ideal for capturing short-term price movements due to high liquidity and leverage.

Novice investors : The mechanism is relatively simple and intuitive, without the need to manage complex expiration date issues.

Arbitrageurs : can use the funding rate for spot arbitrage.

Settlement futures are suitable for :

Long-term trend investors and miners : If you want to hold a position for a long time (e.g. months) to hedging spot risk or bullish, settlement futures can avoid eroding profits due to long-term payment of capital fees.

Institutional investors and hedgers : Settlement futures are a mature tool of traditional Financial Marekt, and their clear maturity date and price expectations are more suitable for large-scale hedging operations.

Basis Trader : Professional traders can carry trades by predicting changes in basis.

Example of perpetual futures operations

Opening position : Assuming the price of BTC is 60,000 USDT, investor Alice opens a long position with 10x leverage, positioning the value of 1 BTC (margin is 6,000 USDT).

Funding Rate: Assuming the current funding rate is 0.01% and the BTC price at settlement time is calculated at 60,000 USDT, Alice needs to pay 1 BTC × 0.01% = 6 USDT funding rate.

Position squaring : If the price of BTC rises to 63,000 USDT, the profit is 1 BTC × (63,000 - 60,000) = 3,000 USDT , and the net profit is after deducting the funding rate (ignoring the handling fee).

Settlement futures example

Opening position : Assuming the BTC price is 60,000 USDT, the investor opens a long position on quarterly BTC futures with 10x leverage.

Settlement at maturity : Assuming that the BTC price at the expiration of quarterly futures is 63,000 USDT, the profit is 1 BTC × (63,000 - 60,000) = 3,000 USDT .

No rate cost : After settlement, the profit and loss are directly settled, and there is no funding rate (ignoring the handling fee).

Cryptocurrency futures have gone through more than a decade of rapid development from scratch. From the earliest simple futures to today's perpetual futures, USDT-M futures, and decentralized futures, the market size and complexity continue to increase. Futures trading not only provides investors with more profit opportunities, but also promotes the maturity and progress of the entire cryptocurrency industry.

In the future, with the deepening of technological innovation and compliance, the cryptocurrency Future Market will become more diversified and standardized, providing global investors with richer financial tools and a safer trading environment.

Currently, MEXC platform has launched a 0 fee activity . By participating in this activity, users can significantly reduce transaction costs and truly achieve the goal of "saving more, trading more, and earning more". On the MEXC platform, you can not only enjoy low-cost transactions with this activity, but also keep up with market trends, keenly capture every fleeting investment opportunity, and start a journey of wealth appreciation.

How to participate in M-Day? Master the specific methods and skills to participate in M-Day, and don't miss the futures bonus airdrop of 70,000 USDT every day

Disclaimer: This material does not provide advice on investment, taxation, legal, financial, accounting, consulting, or any other related services, nor is it advice on buying, selling, or holding any assets. MEXC Novice Academy provides information for reference only and does not constitute any investment advice. Please ensure that you fully understand the risks involved and invest cautiously. All investment behaviors of users are not related to this site.