How to use the MEXC futures trading calculator? More effectively determine the price of profit and stop loss

Abstract of this article:

1. What is MEXC futures trading calculator?

2. What are the benefits of using the MEXC futures trading calculator for investors to trade futures?

3 . What are the main functions of MEXC futures trading calculator?

- The futures calculator is a product feature on the MEXC futures trading page. With this calculator, you can get six types of information: [profit and loss calculation], [target calculation], [forced liquidation price], [available], [opening price] and [ capital fee ].

- The calculation mechanism of the futures calculator is designed based on the calculation formulas of "futures profit/loss" and estimated current "capital cost". Therefore, if you understand the relevant calculation principles, the futures calculator can help you quickly obtain relevant data, saving you the trouble of manual calculation.

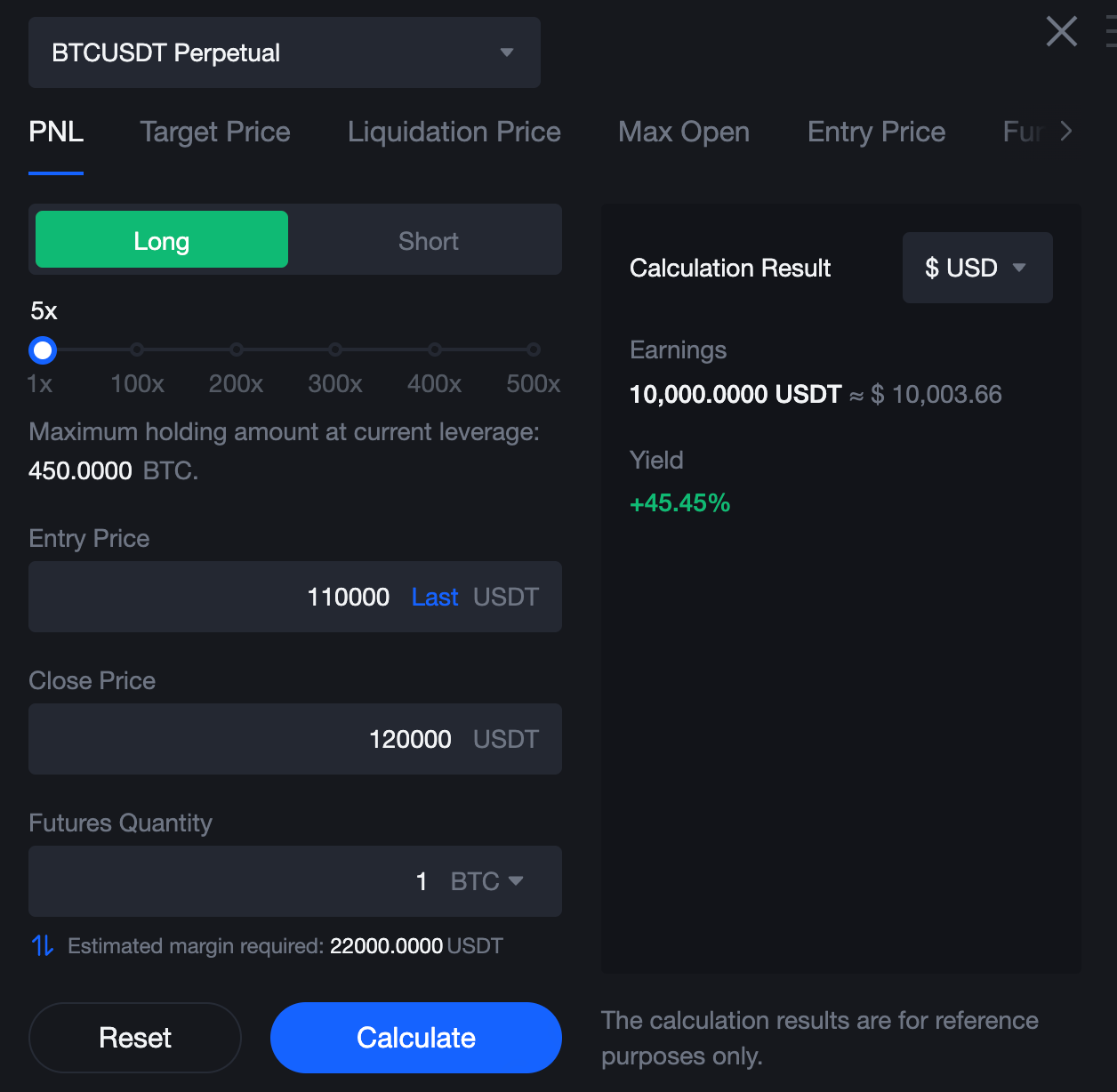

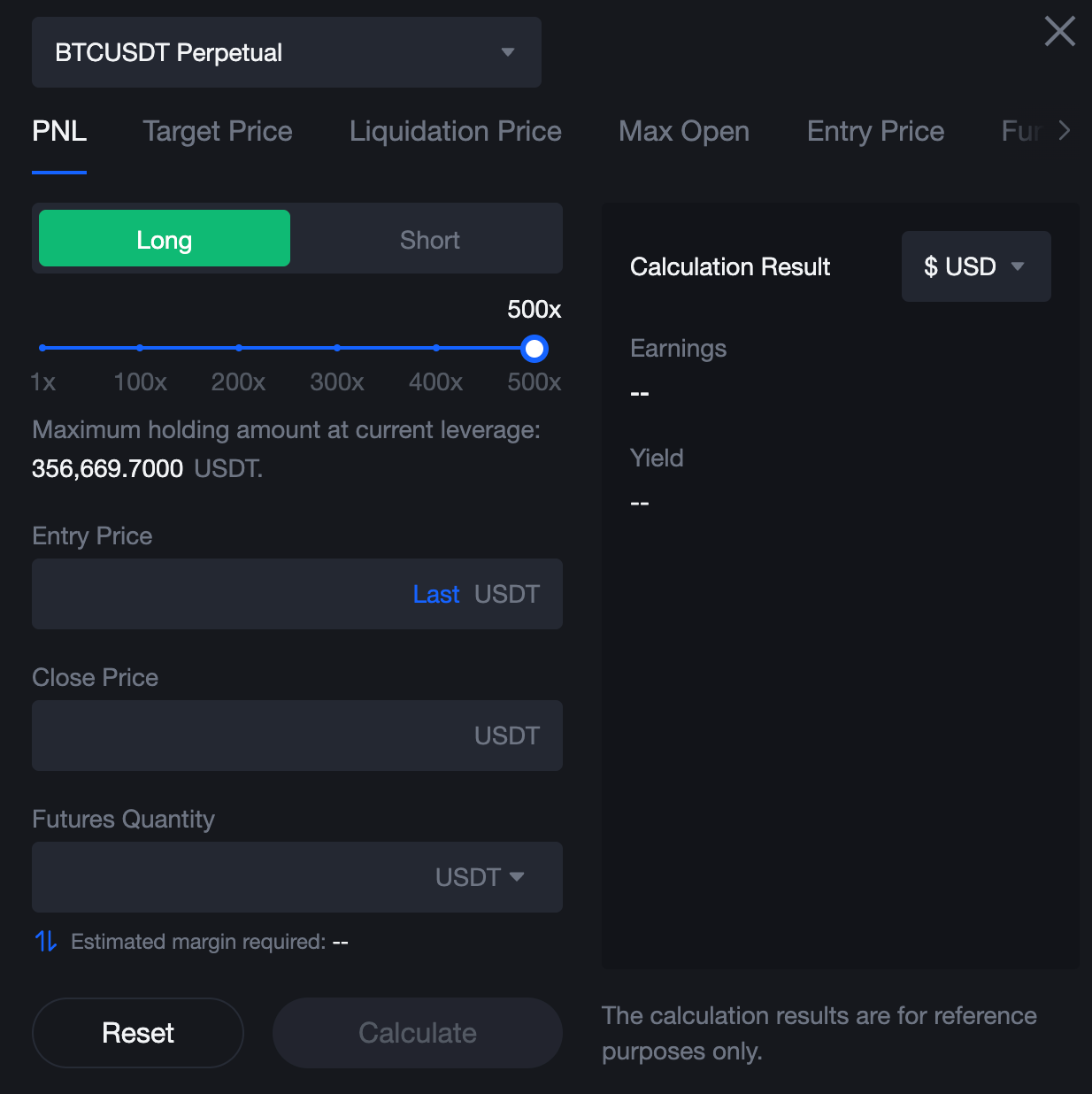

3.1 How to calculate profit and loss ?

- If you need to use the "Profit and Loss Calculation" function, it means you want to know: before/after opening a position, if the reasonable price of futures reaches the price point you judge, how much profit/loss you will make.

- Here, you need to fill in 5 categories of information: [long position/bear position], "leverage size", [opening price], [position squaring price] and [futures quantity] ;

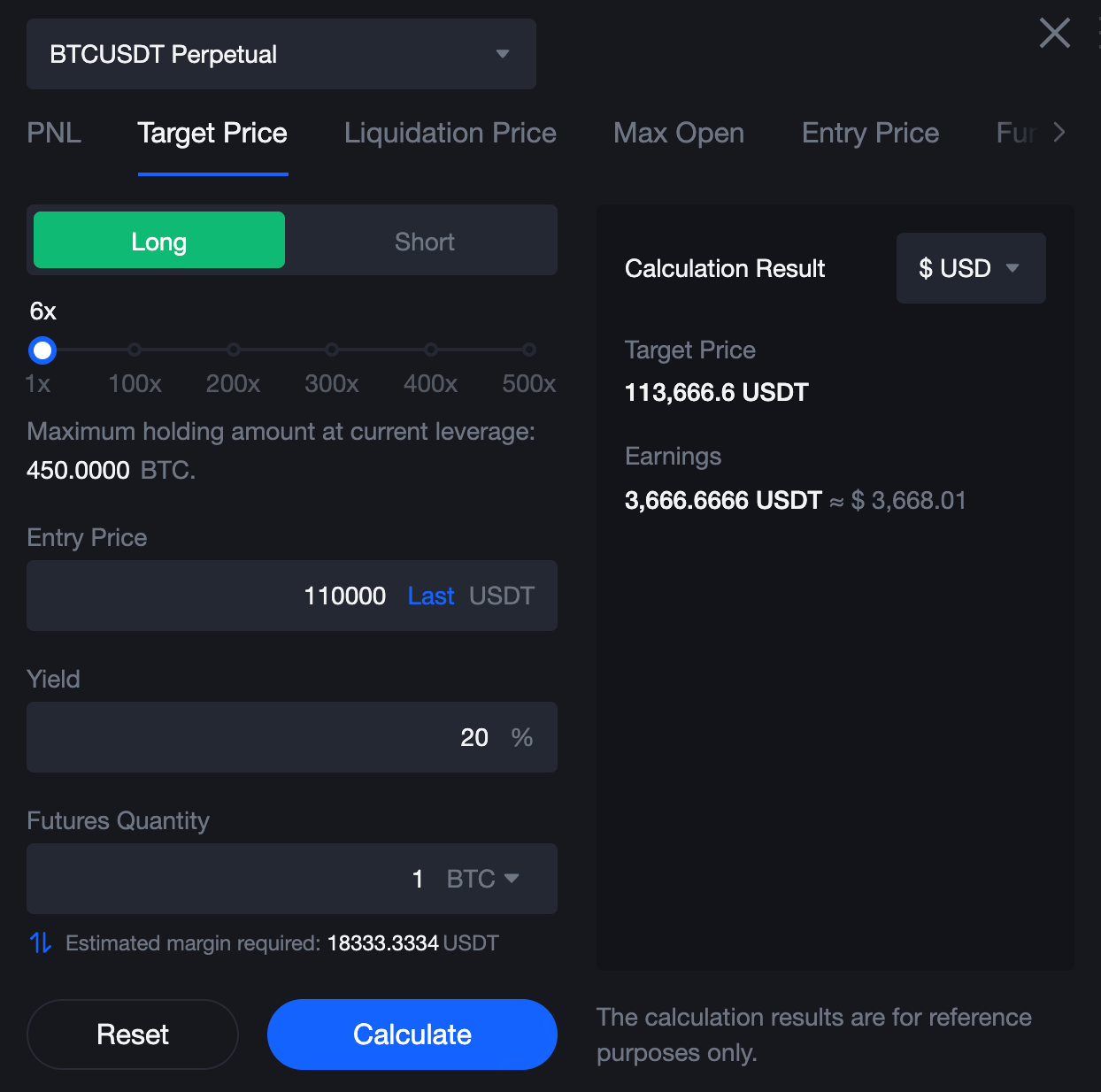

3.2 How to calculate the target price?

- If you need to use the "Target Calculation" function, it means you want to know: before/after opening a position, what is the target point that the reasonable price of the futures needs to reach in order to achieve your expected rate of return?

- Here, you need to fill in 5 categories of information: [long position/bear position], "leverage size", [opening price], [yield] and [futures quantity] ;

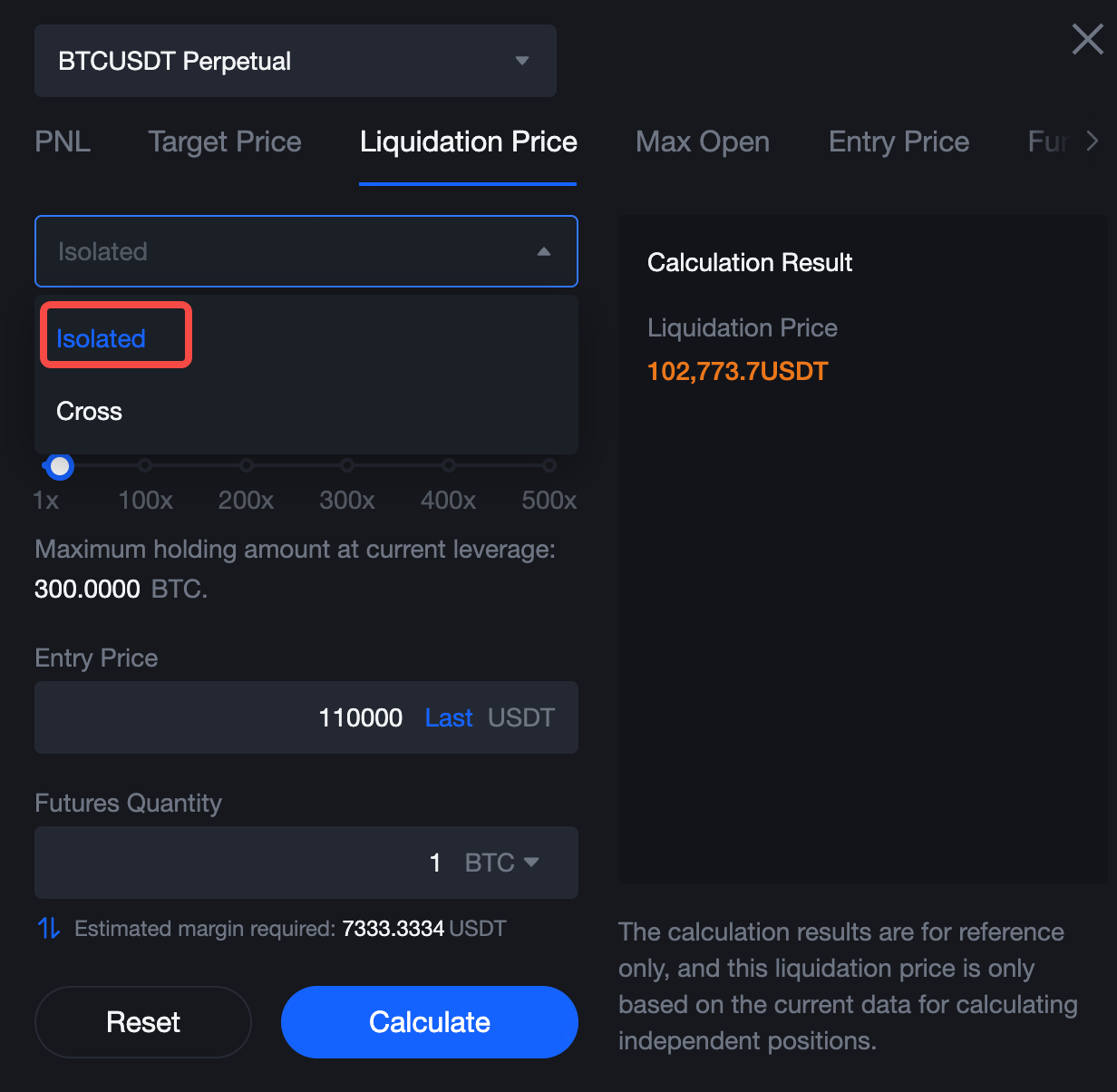

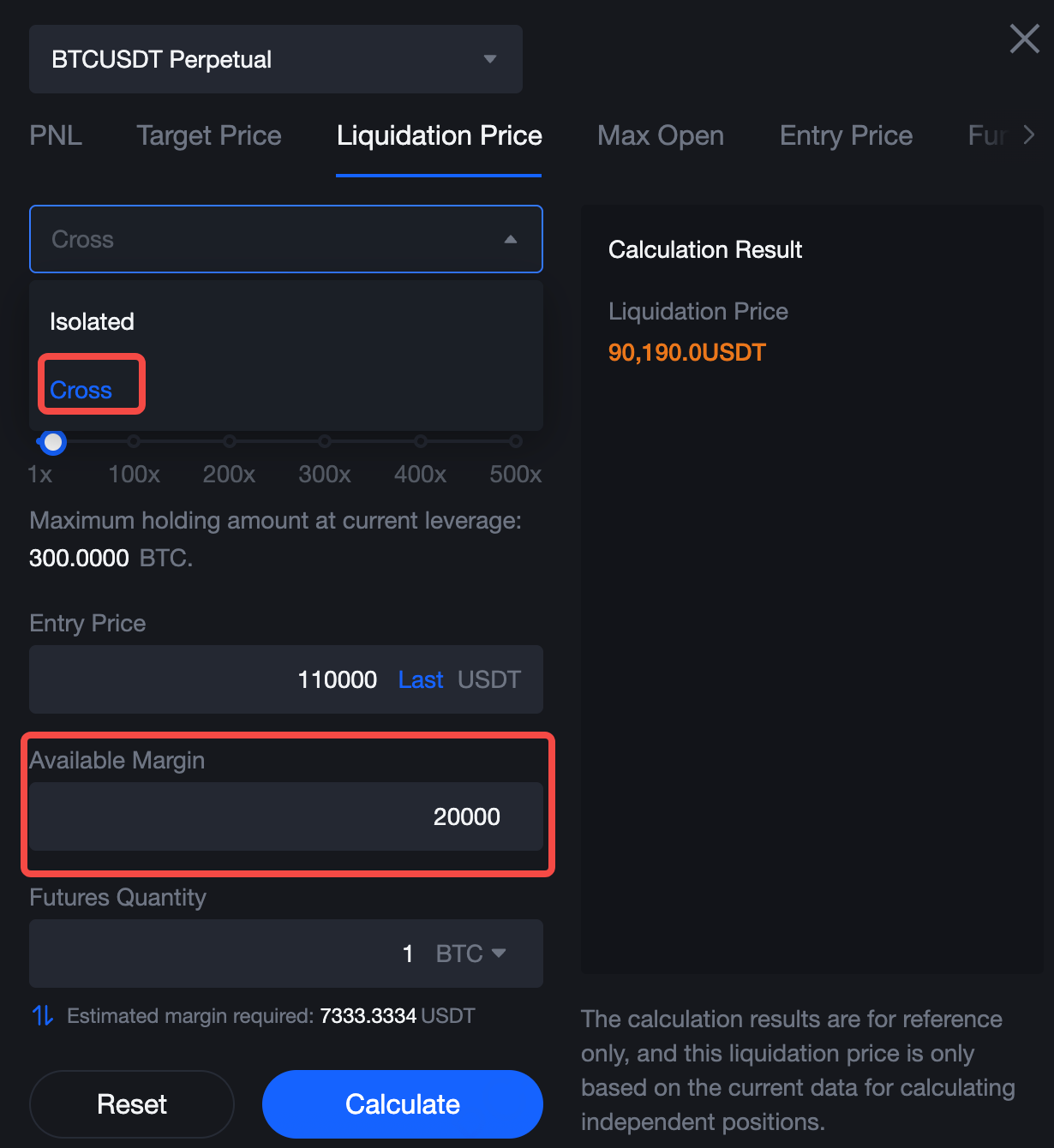

3.3 How to calculate the estimated liquidation price ?

- If you need to use the "forced liquidation price" function, it means you want to know: after opening a position, if a forced liquidation event occurs, what is the reasonable price of the futures at that time?

- Here, you need to fill in 5 categories of information: [ by position/full position ], [long position/bear position], "leverage size", [opening price] and [futures quantity] ;

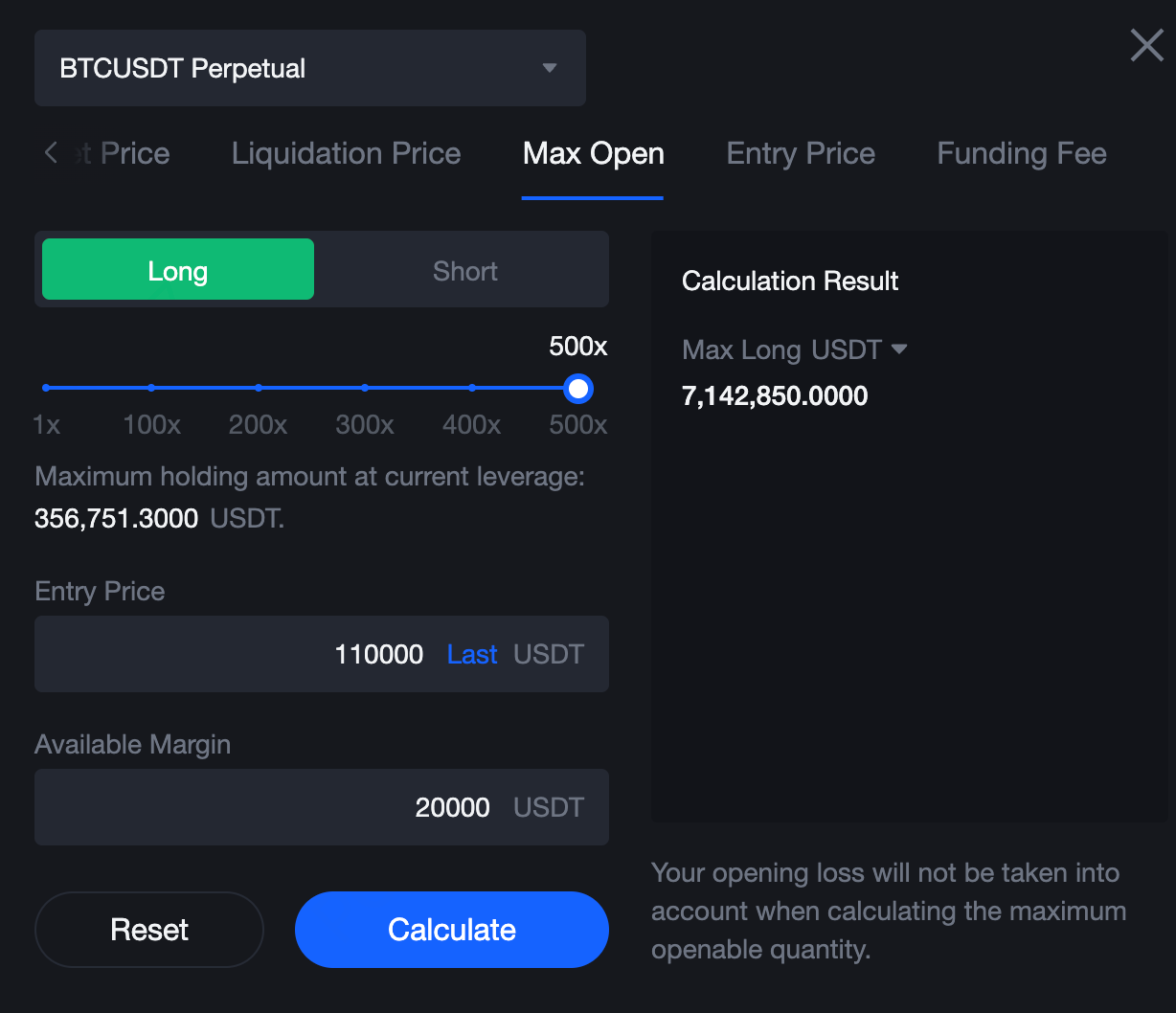

3.4 How to calculate the size of the openable positioning?

- If you need to use the "can open" function, it means that you want to know the position value that you can open under the conditions of your existing available margin amount.

- Here, you need to fill in 4 categories of information: [long position/bear position], "leverage size", [opening price] and [available margin] ;

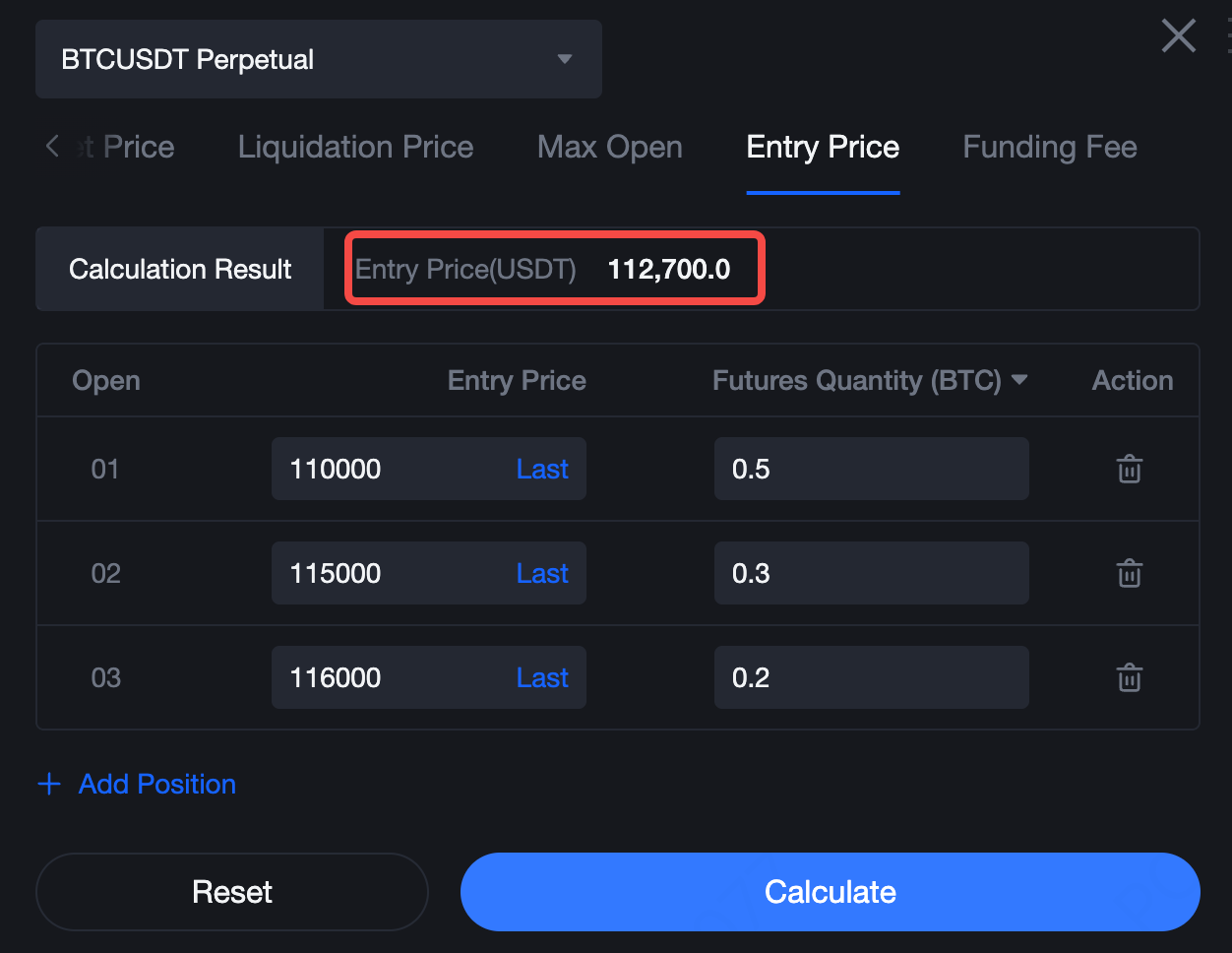

3.5 How to calculate the average position price ?

- If you need to use the "Opening Price" function, it means you want to know: under your existing/new opening conditions, what is the average opening price of your position?

- Here, you need to complete two categories of information: [opening price] and [position quantity] ;

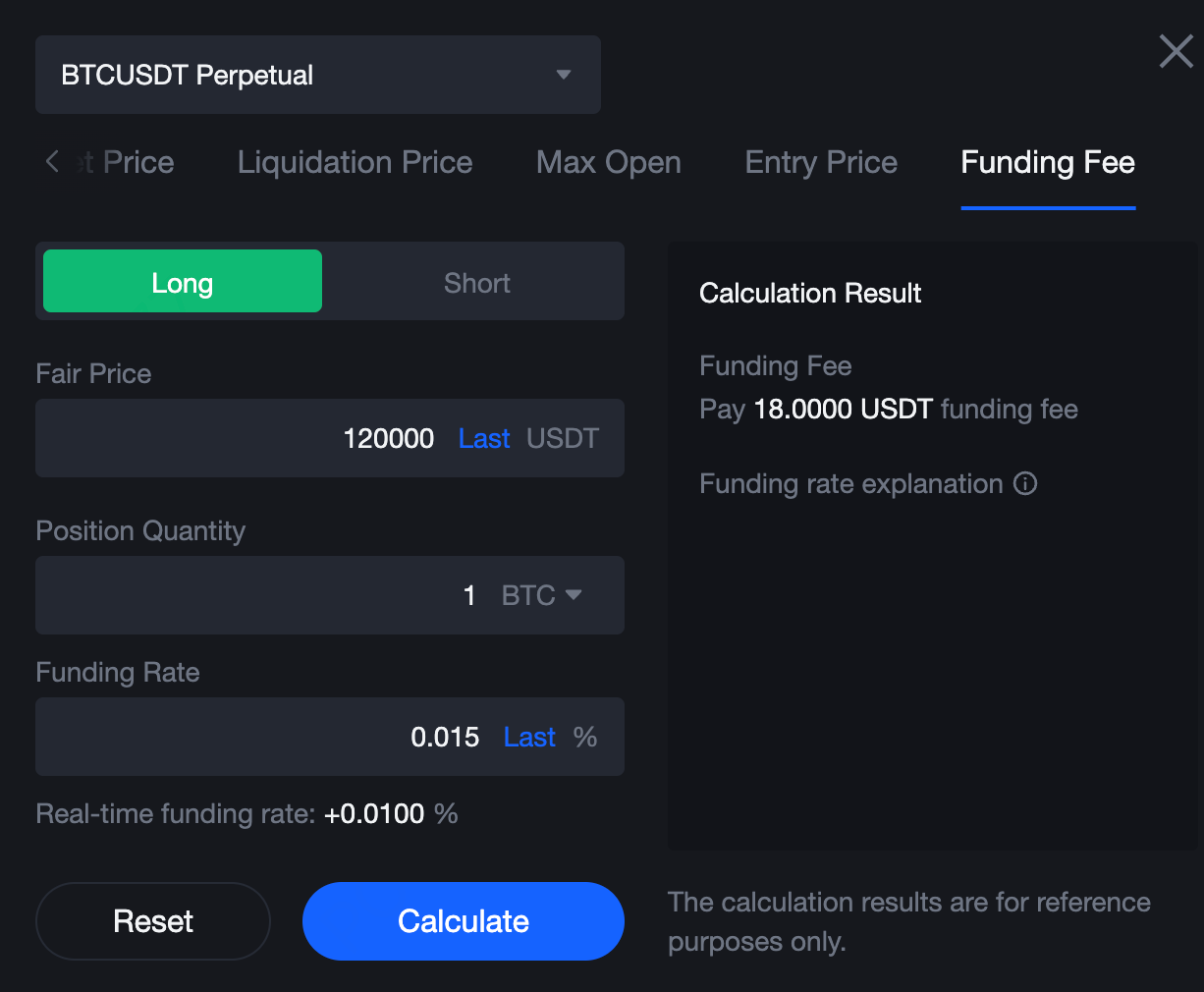

3.6 How is funding calculated ?

- If you need to use the "Funding Fee" function, it means you want to know: what is the funding rate for this futures in the current market, and whether the long or short side pays the fee to the other party.

- Here, you need to fill in 4 categories of information: [long position/bear position], [reasonable price], [position quantity] and [funding rate] ;

4 . Operation Guide

4.1 MEXC web terminal

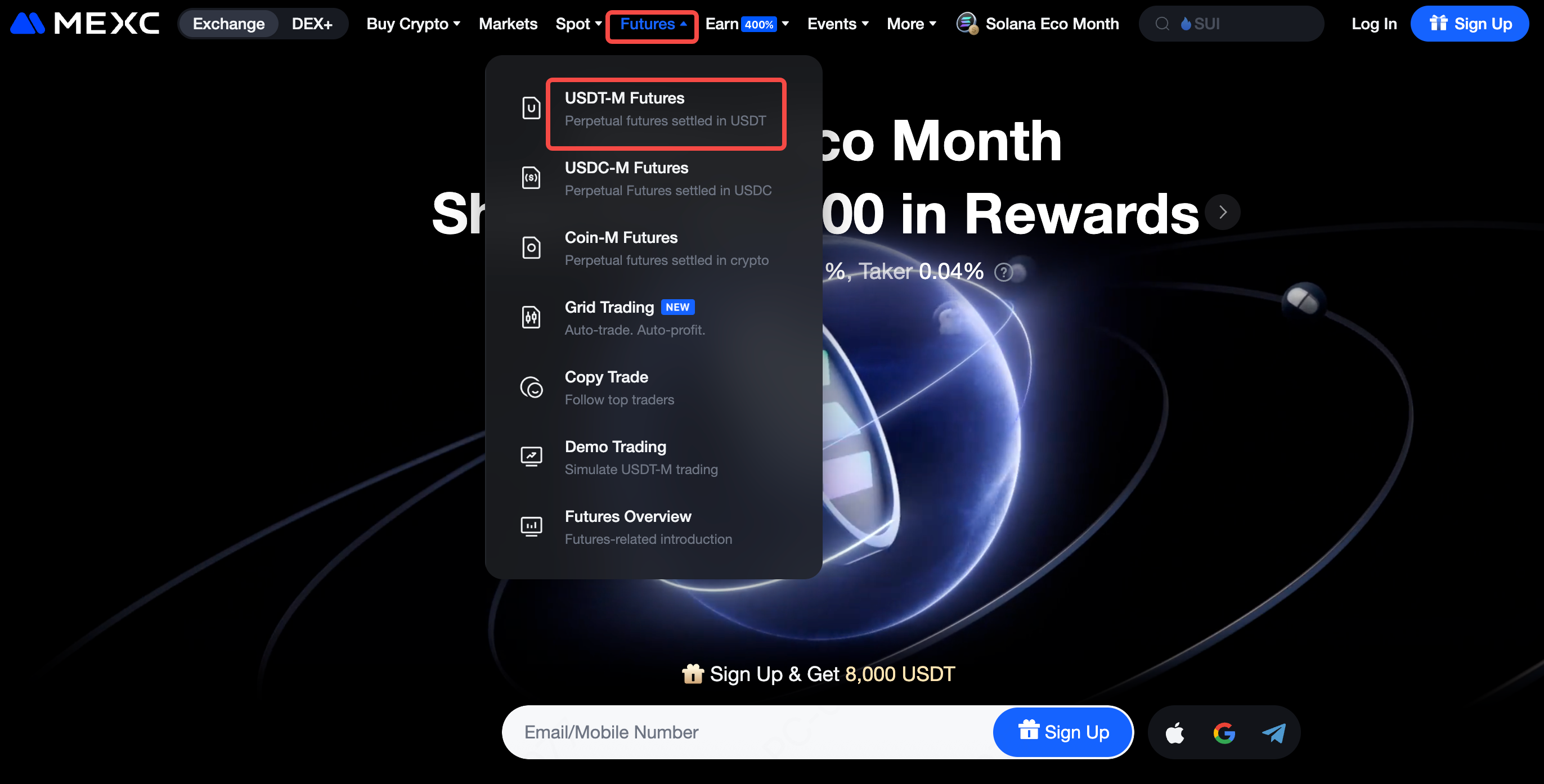

4.1.1 enter USDT-based perpetual futures from the official website of MEXC.

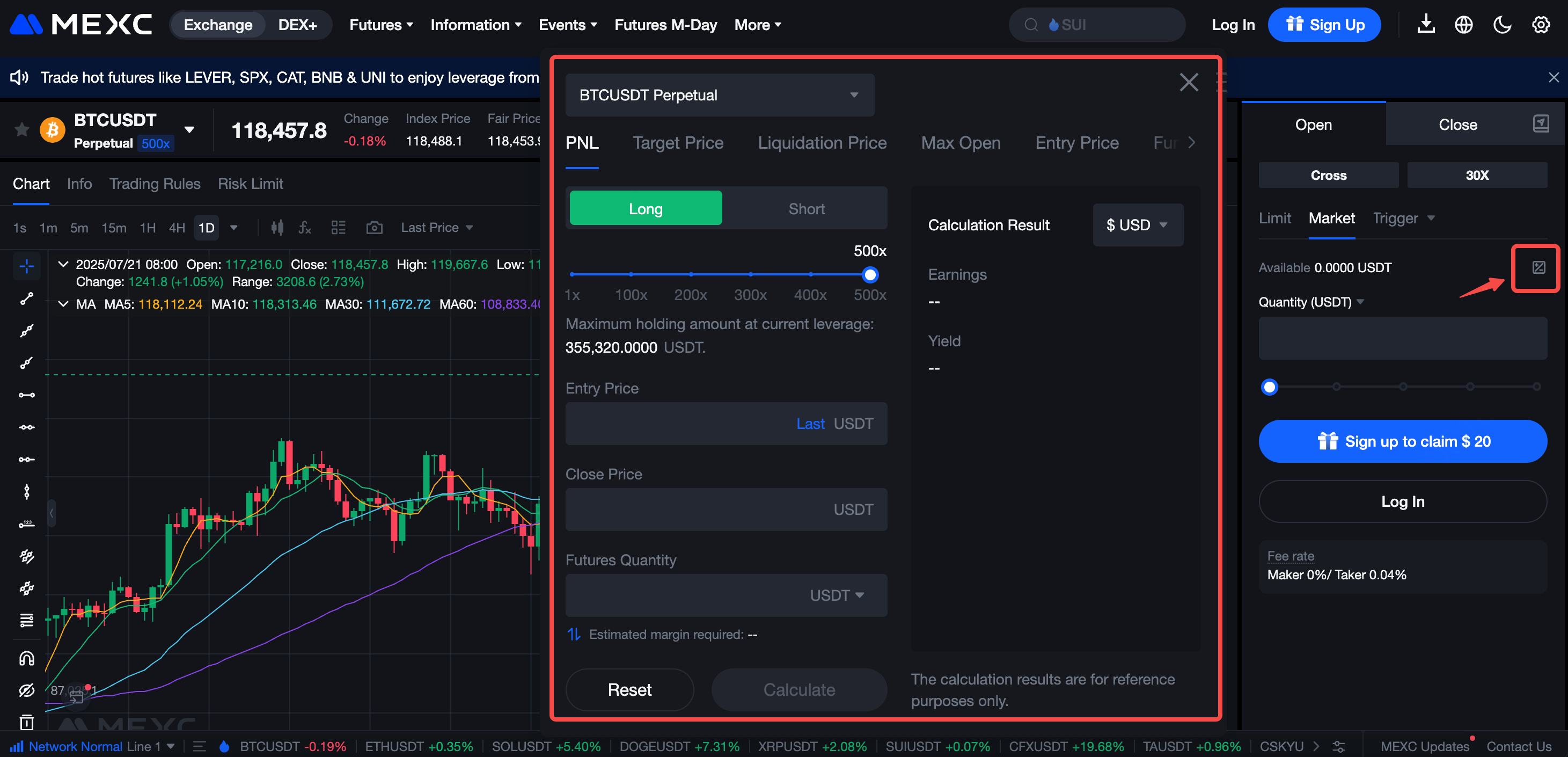

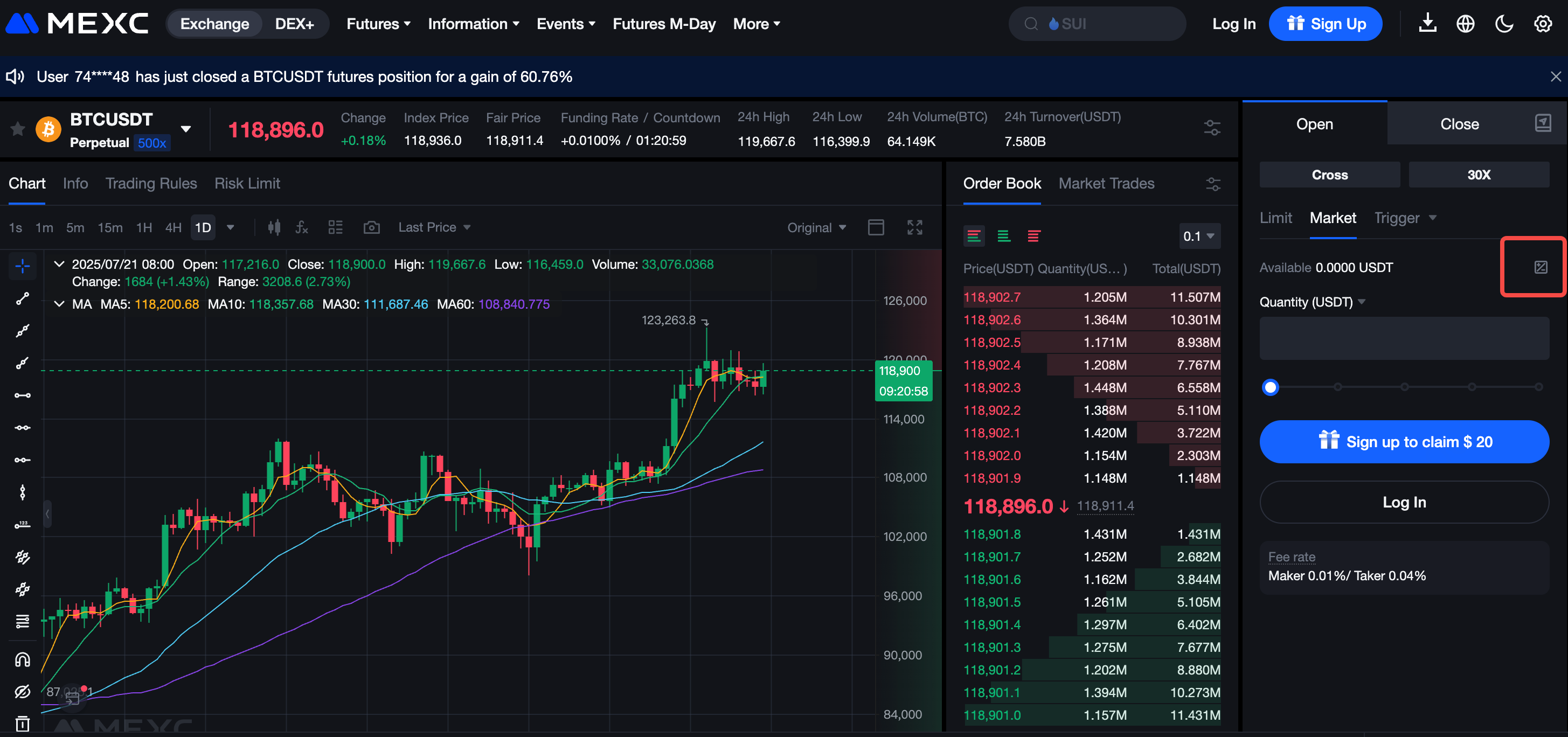

4.1.2 follow the instructions and find the Futures Calculator in the top right corner of the Futures trading page.

4.1.3 click on the six types of information in turn, according to the "Overview" content of this article: enter the corresponding information to calculate these six types of data

4.2 MEXC APP terminal

4.2.1 enter the futures interface from the MEXC App homepage

4.2.2 follow the instructions and find the Futures Calculator in the top right corner of the Futures trading page.

4.2.3 click on the six types of information in turn, according to the "Overview" content of this article: enter the corresponding information to calculate these six types of data

5 . Summary

Recommended reading:

- Why choose MEXC futures trading? Learn more about the advantages and features of MEXC futures trading to help you seize the opportunity in the futures field.

- How to participate in M-Day? Master the specific methods and skills to participate in M-Day, and don't miss the futures experience gold airdrop with 70,000 USDT every day.

- Futures Trading Operation Guide (App End) Learn more about the operation process of futures trading on the App end, so that you can easily get started and play futures trading.

Popular Articles

Trade US Indices (NAS100, SP500, US30) with USDT on MEXC: Max 20x Leverage

The gap between Wall Street and Web3 just closed.MEXC is thrilled to announce the listing of USDT-Margined Perpetual Futures for the world's three most important financial indices: NAS100 (Nasdaq), SP

Why Smart Money Trades Copper (XCU) Perps on MEXC

When investors think of Copper, they often think of physical bars or slow-moving ETFs. That is how the "Old World" trades.But for the modern crypto trader on MEXC, the launch of COPPER (XCU) USDT Perp

Staking Rewards Crunch,Why ETH Yields Can Fall Even When Activity Looks “Fine”

Ethereum staking rewards come from a mix of protocol issuance (new ETH minted) and variable fee-driven components (priority fees and MEV). Over the past two years, the composition of that mix has shif

NFT Market Radar: Utility Narratives Re-enter the Conversation (Late Jan 2026)

Scope note (what this piece is—and isn’t)This “radar” summarizes what three recent articles reported about NFT-adjacent tokens and utility-themed use cases around mid-to-late January 2026. It does not

Hot Crypto Updates

View More

BEEG Outlook 2026: Sui's First "Productive" Meme Coin Redefining Meme Economy Through Creative Studio

BEEG is more than a meme coin—it's Sui's "visual factory." Discover how BEEG transforms from consumptive asset to productive infrastructure through branding services and creative studio, and why MEXC

114514 vs Bitcoin/Altcoins: Correlation Trading Guide

What is Market Correlation in Cryptocurrency? Market correlation in cryptocurrency refers to the statistical measure of how two or more digital assets move in relation to each other. Understanding

114514 (114514) Spot Trading Platform Comparison: Why MEXC Leads the Market

Choosing the right 114514 (114514) spot trading platform can significantly impact your trading success. MEXC stands out among cryptocurrency exchanges with superior features, competitive fees, and

MEXC vs KuCoin: Which Crypto Exchange Should You Choose in 2026?

Meta Description Comprehensive MEXC vs KuCoin comparison: trading fees, coin selection, security, and user experience analyzed. Discover why MEXC is becoming traders' top choice in 2026 with zero

Trending News

View More

XRP Price to $100? Burned Supply and Bank-Grade Design Are Changing the Math

A long-running argument around XRP is resurfacing, this time focused less on speculation and more on mechanics. Crypto analyst 24HrsCrypto recently highlighted

Trump Family-Backed Crypto Platform Partners With Pakistan To 'Explore' Stablecoin Payments

Pakistan’s government said Wednesday it’s partnering with World Liberty Financial (CRYPTO: WLFI), a decentralized platform afread more

US Dollar holds gains ahead of US data, Fedspeak

The post US Dollar holds gains ahead of US data, Fedspeak appeared on BitcoinEthereumNews.com. Here is what you need to know on Thursday, January 15: The US Dollar

Whale Activity Surges in Chainlink as Second ETF Hits the Market

The post Whale Activity Surges in Chainlink as Second ETF Hits the Market appeared on BitcoinEthereumNews.com. Crypto whales are increasing their exposure to Chainlink

Related Articles

Setting Take-Profit and Stop-Loss for Futures Trading

In the cryptocurrency markets, price movements can be extremely volatile, and profits or losses can occur in an instant. For Futures traders, take-profit and stop-loss orders are not only essential to

How to Trade Futures on MEXC App: Complete Beginner's Guide

MEXC Futures trading offers MEXCers an advanced way to trade cryptocurrencies. Unlike Spot trading, Futures trading has its own unique logic and order-opening mechanisms. This article is designed to h

Spot Trading vs. Futures Trading: A Beginner's Guide to Determining Which is Right for You

As the cryptocurrency market continues to mature, the diversification of trading tools has become a key factor in building robust investment strategies. Among global mainstream crypto exchanges, MEXC

Crypto Futures Trading for Beginners: Complete Guide & Strategies

In this article, you will use MEXC Learn to explore the fundamentals of futures trading. This simple guide will help you easily understand the derivatives market and learn about the Futures trading pr