Different Types of Spot Orders

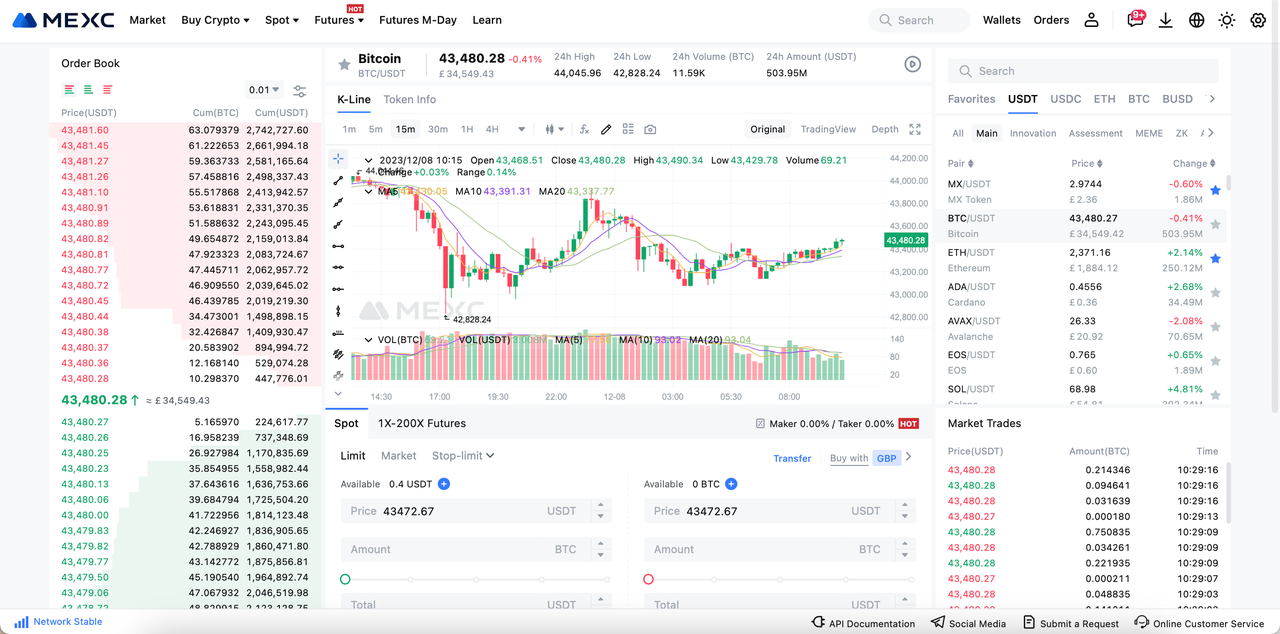

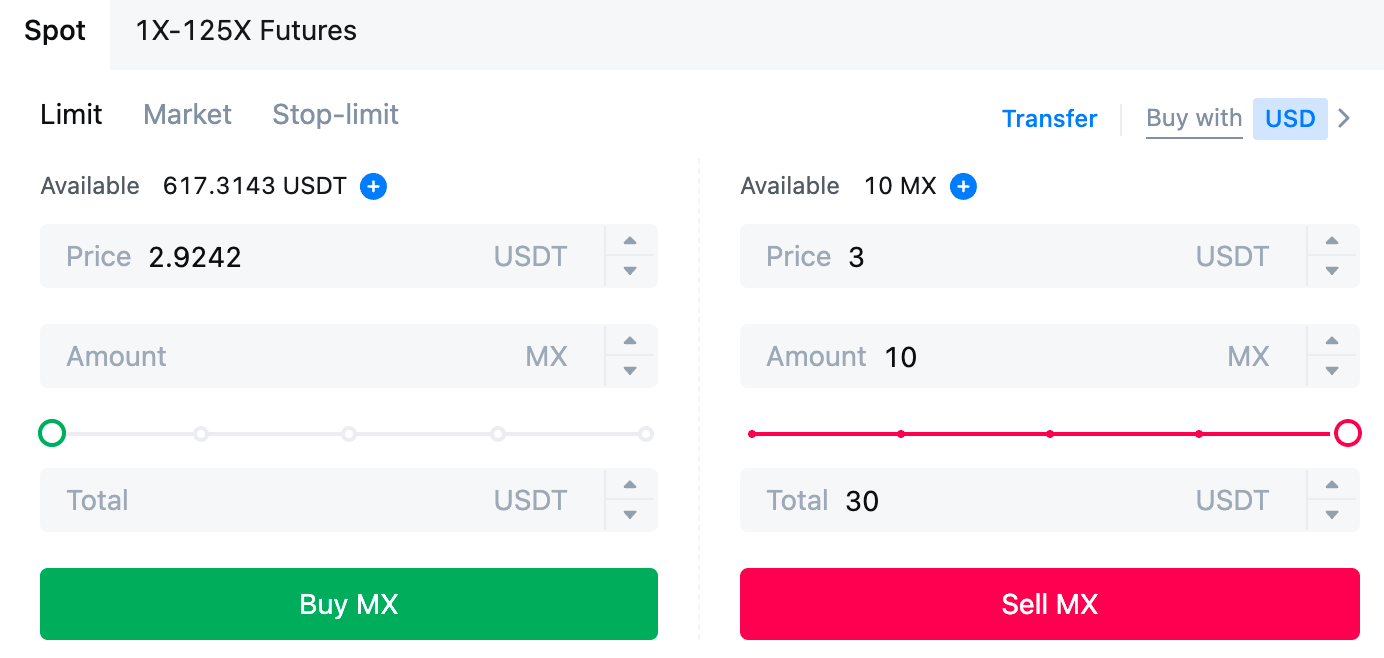

1. Limit Order

2. Market Order

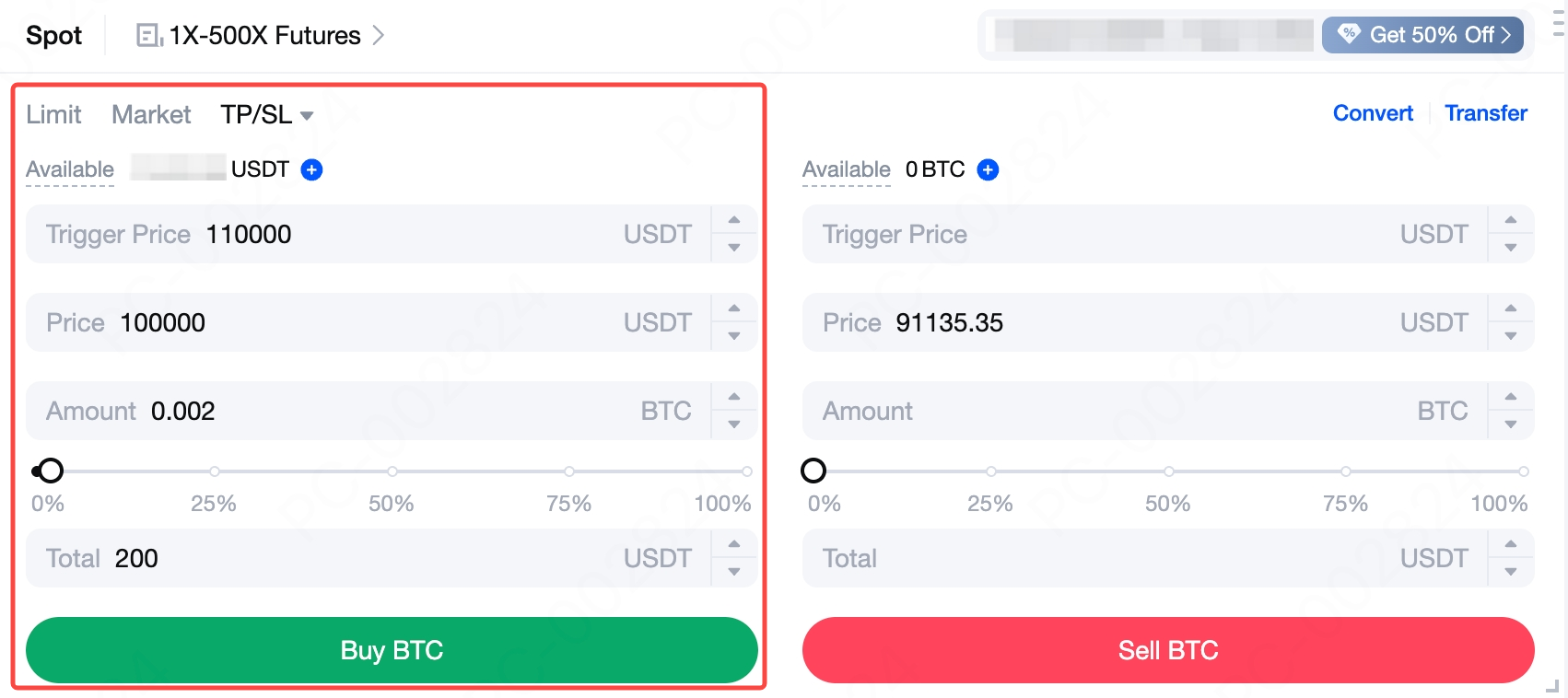

3. Take-Profit / Stop-Loss (TP/SL) Orders

- Limit TP/SL: You set both a trigger price and a limit price. When the market price reaches the trigger price, the system places a limit order at your preset price.

- Market TP/SL: You only need to set a trigger price. When the market price reaches the trigger price, the system submits a market order and executes at the best available price.

Example 1 (Stop-Limit + Stop-Loss)

You hold BTC and set a trigger price of 110,000 USDT with a limit sell price of 100,000 USDT. When the market price falls to 110,000 USDT, the system automatically places a limit sell order at 100,000 USDT, attempting to execute the stop-loss at that price.

Example 2 (Market Take-Profit)

You hold ETH and set a trigger price of 5,000 USDT. When the market price rises to 5,000 USDT, the system submits a market sell order and executes at the best available price to lock in profits.

To learn more about TP/SL orders, refer to: What Is a Take-Profit/Stop-Loss Order?

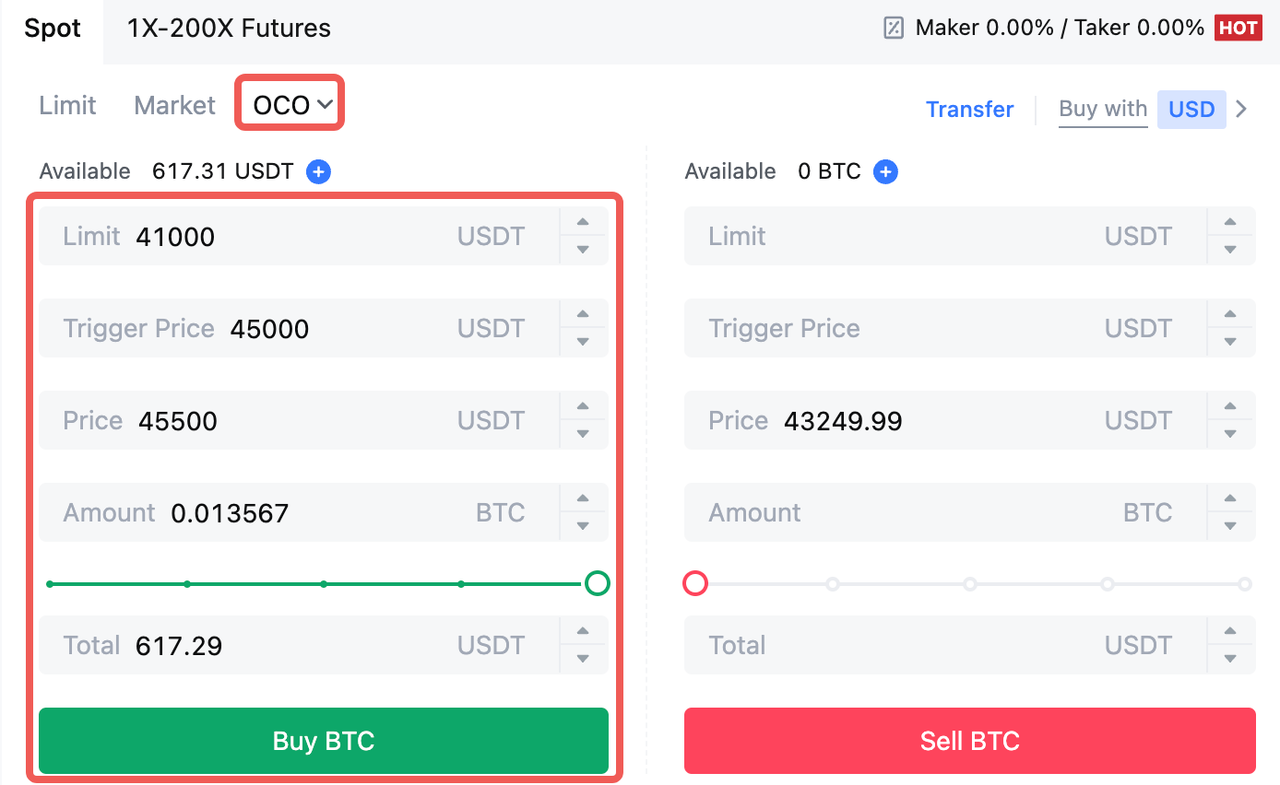

4. One-Cancels-the-Other (OCO) Order

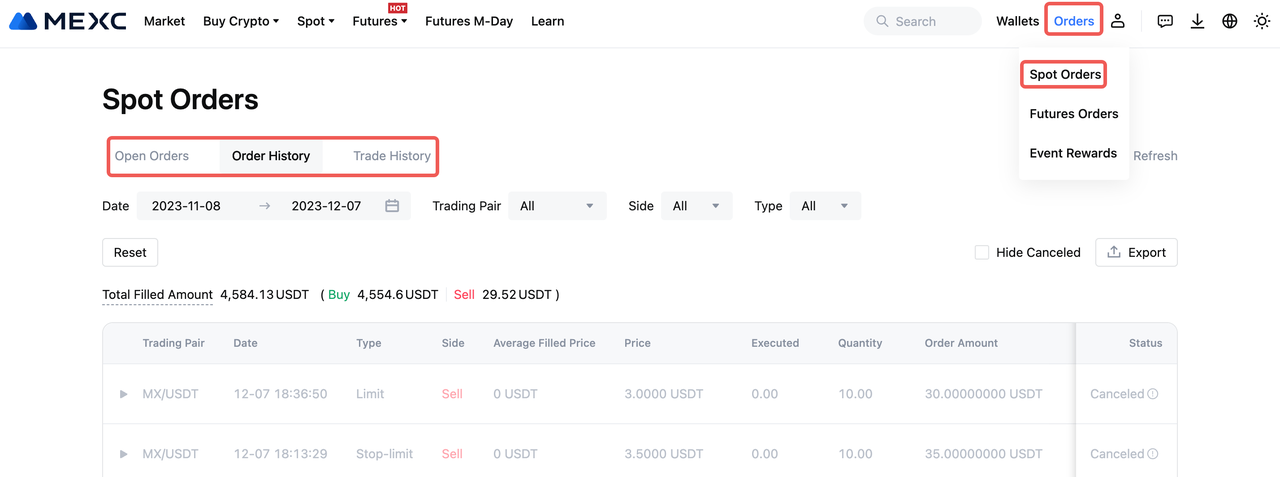

5. How To Check Order History

Popular Articles

Why is Crypto Down? It’s Not "FUD"—It’s the Hard Asset Rotation & Pre-CNY Liquidity Void

If you are looking for a specific news headline to explain today's red candles, stop looking. There isn't one.Retail traders are currently scouring Twitter for "FUD" (Fear, Uncertainty, Doubt) to blam

Palladium (XPD) Live on MEXC: Institutional Guide to Trading the 100x Leverage "Super-Metal"

In the quiet corners of the commodities desk, traders have a nickname for Palladium: "The Widowmaker."It earned this moniker for a reason. Unlike Gold, which moves with the grace of a central banker,

What is Moltbook? Analyzing the Viral Tech Trend Through the Lens of the "Attention Economy"

In the fast-moving world of technology, trends usually follow a predictable pattern. But Moltbook is different.Over the last 48 hours, "Moltbook" has become the dominant keyword across X (Twitter), Re

How Much Bitcoin Is Left to Mine? Complete Supply Guide

Bitcoin's fixed supply of 21 million coins makes it fundamentally different from traditional currencies that governments can print without limit.As of January 2026, the crypto community is approaching

Hot Crypto Updates

View More

OVERTAKE (TAKE) Futures Trading: Risks and Rewards

Introduction to OVERTAKE (TAKE) Futures Trading OVERTAKE (TAKE) futures contracts allow traders to buy or sell TAKE at a predetermined price on a future date without owning the actual tokens. Unlike

A Complete Guide to the OVERTAKE (TAKE) Transaction Process

Introduction to OVERTAKE (TAKE) Transactions Understanding the basics of OVERTAKE (TAKE) transactions Importance of transaction knowledge for investors and users Overview of OVERTAKE (TAKE)

OVERTAKE (TAKE) Price History: Patterns Every Trader Should Know

What is Historical Price Analysis and Why It Matters for OVERTAKE (TAKE) Investors Historical price analysis in cryptocurrency markets is a fundamental research methodology that examines past price

OVERTAKE (TAKE) Volatility Guide: How to Profit from Price Swings

Understanding OVERTAKE (TAKE) Volatility and Its Importance Price volatility in cryptocurrency refers to the rapid and significant changes in token prices over short periods. This is a defining

Trending News

View More

From Casual to Competitive: How Players Transition Successfully

Every competitive player starts as a casual one. The transition from playing for fun to playing with intent is not defined by rank alone. It is defined by mindset

Mike Novogratz’s Galaxy Digital Secures $100M for New Cryptocurrency Fund

TLDR Galaxy Digital is launching a $100 million hedge fund in Q1 2026 that can take both long and short positions in digital assets The fund will invest up to 30

Reclaim Your Weekends: How to Enjoy West Hartford Instead of Scrubbing Floors

Friday afternoon arrives with a palpable sense of relief. You close your laptop, commute home, and take a deep breath, ready to embrace the weekend. But for many

NZD/USD rises above 0.5850 as risk aversion eases

The post NZD/USD rises above 0.5850 as risk aversion eases appeared on BitcoinEthereumNews.com. NZD/USD extends its winning streak for the fifth consecutive session

Related Articles

Spot Trading vs. Futures Trading: A Beginner's Guide to Determining Which is Right for You

As the cryptocurrency market continues to mature, the diversification of trading tools has become a key factor in building robust investment strategies. Among global mainstream crypto exchanges, MEXC

MEXC Spot Trading Fees: Maker & Taker Rates Calculator

Key Takeaways MEXC charges 0% maker fees and 0.05% taker fees for spot trading, making it highly cost-effective for liquidity providers. MX token holders with 500+ tokens for 24 hours receive a 50

MEXC Loans is Now Live!

MEXC Loans is a cryptocurrency lending solution introduced by MEXC. MEXC Loans allows users to collateralize one of their cryptocurrency assets to borrow another that they can then use for spot tradin

Spot Market Trading Rules

In cryptocurrency spot trading, beyond price analysis and strategy selection, understanding and following the trading platform's market rules is equally crucial. For MEXC users, each trading pair not