Crypto Market Liquidations Soar to $1.33B, BTC, ETH, XRP, DOGE See Strong Volatility

Crypto market liquidations have soared to $1.33 billion once again, with yet another selling pressure as Bitcoin BTC $103 831 24h volatility: 3.2% Market cap: $2.07 T Vol. 24h: $83.02 B and altcoins face deeper correction. While BTC price has now dropped to $104,500, Ethereum ETH $3 487 24h volatility: 6.0% Market cap: $421.85 B Vol. 24h: $50.88 B is leading the altcoins’ fall with another 5% crash for the second consecutive day to $3,500. It’s been a weak start to November 2025, historically believed to be the strongest month for digital assets.

Crypto Market Crash Triggers Another Major Liquidation Event

A total of $1.33 billion in leveraged positions across the crypto market have been wiped out in the last 24 hours. According to the CoinGlass data, the long liquidations amount to nearly 90%, which is $1.2 billion.

The latest Bitcoin price drop to $104,500 comes with Bitcoin OG whales and institutions doing profit booking. Crypto market analyst Ardi stated that with BTC price dropping to around $104,000 levels, it is currently testing its 50-week simple moving average (SMA) for the first time in seven months.

According to the analyst, a strong rebound from this level is critical. Failure to hold could trigger a major psychological sell-off. This could further lead to additional crypto market liquidations.

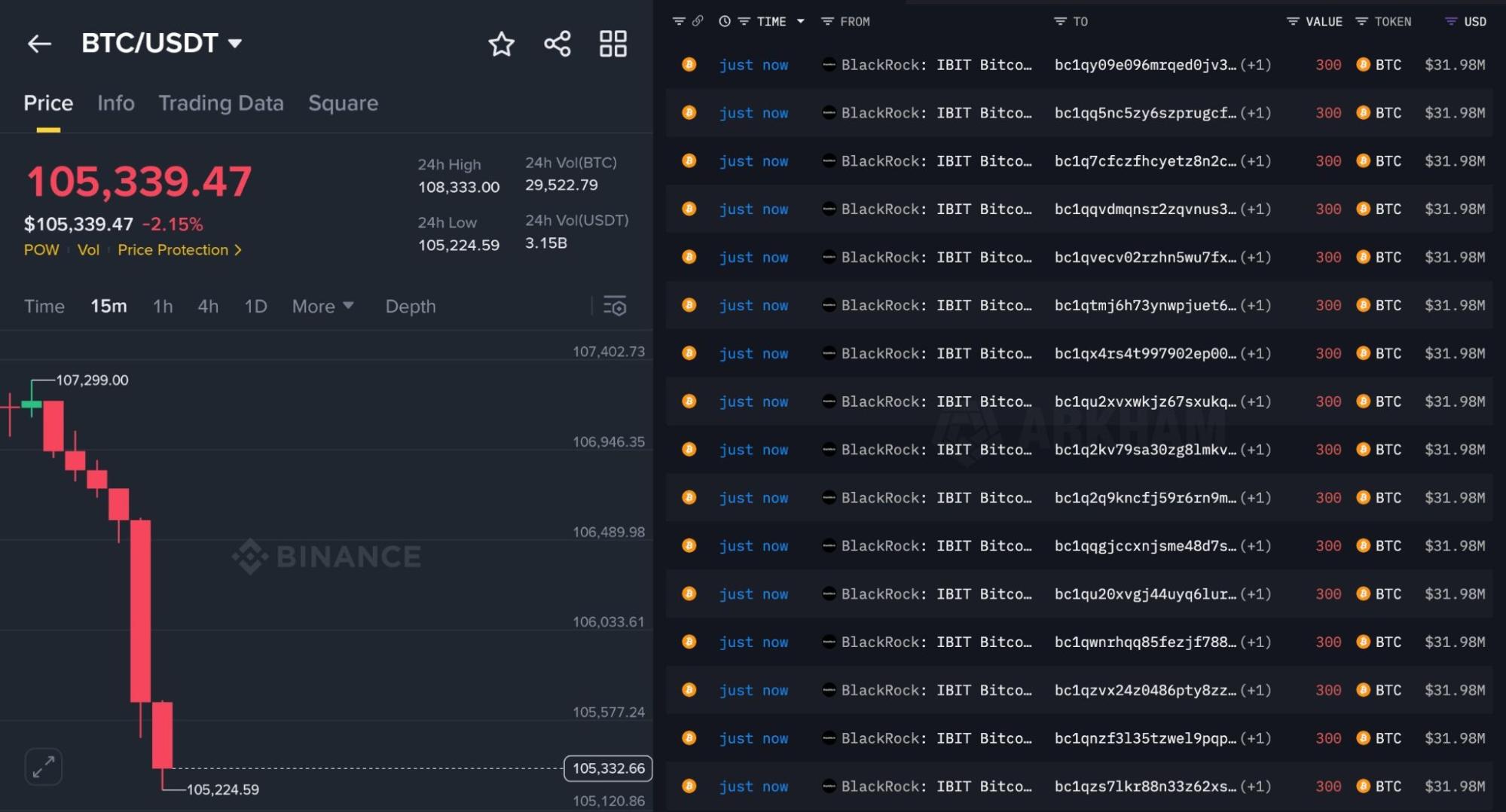

On the other hand, BlackRock’s iShares Bitcoin Trust (IBIT) has been continuously offloading their holdings. As per the on-chain data, the world’s largest asset manager has started dumping BTC yet again.

BlackRock on Bitcoin dumping spree | Source: 0xNobler

BlackRock has approximately unloaded 24,000 BTC valued at $2.75 billion. Crypto market data indicates that the asset manager continues to sell additional holdings in smaller batches each hour. Despite all the FUD (Fear, Unrest and Doubt), Michael Saylor’s Strategy has continued with their BTC purchases.

Altcoins Crash Deepens as Investors Deal with October Shock

The latest correction across the altcoins space is even more pronounced, with Ethereum price dropping another 5.6% today to $3,500. With this, the largest altcoin has extended its weekly losses to 15%.

Other top altcoins are also facing the wrath of bears. XRP XRP $2.25 24h volatility: 6.5% Market cap: $135.98 B Vol. 24h: $6.94 B price is down 6.3% today, BNB BNB $949.7 24h volatility: 7.1% Market cap: $131.07 B Vol. 24h: $4.12 B price is down 7.38%, Solana SOL $159.6 24h volatility: 9.0% Market cap: $88.20 B Vol. 24h: $10.04 B price tanked by 10.22%, and others have corrected anywhere between 5-10%.

According to Bloomberg, the crypto market continues to feel the aftereffects of October’s massive liquidation event, which wiped out billions in leveraged positions. Although BTC showed intermediary signs of rebound, Bloomberg noted that is not being driven by new fear or macroeconomic headwinds. Instead, traders remain cautious after the severe October wipeout.

The publication added that the event “repelled new demand,” as confidence remains subdued and buyers have yet to fully return despite broader strength in global risk assets. Analysts suggest the current phase reflects a recovery in sentiment rather than fundamental weakness.

nextThe post Crypto Market Liquidations Soar to $1.33B, BTC, ETH, XRP, DOGE See Strong Volatility appeared first on Coinspeaker.

También te puede interesar

BitGo wins BaFIN nod to offer regulated crypto trading in Europe

BitGo’s move creates further competition in a burgeoning European crypto market that is expected to generate $26 billion revenue this year, according to one estimate. BitGo, a digital asset infrastructure company with more than $100 billion in assets under custody, has received an extension of its license from Germany’s Federal Financial Supervisory Authority (BaFin), enabling it to offer crypto services to European investors. The company said its local subsidiary, BitGo Europe, can now provide custody, staking, transfer, and trading services. Institutional clients will also have access to an over-the-counter (OTC) trading desk and multiple liquidity venues.The extension builds on BitGo’s previous Markets-in-Crypto-Assets (MiCA) license, also issued by BaFIN, and adds trading to the existing custody, transfer and staking services. BitGo acquired its initial MiCA license in May 2025, which allowed it to offer certain services to traditional institutions and crypto native companies in the European Union.Read more

XRP price sees bearish divergence despite DEX volume surge