Smarter Web Company raises £17.5M to expand Bitcoin holdings

Smarter Web Company has raised £17.5 million in fresh equity to accelerate its aggressive Bitcoin accumulation strategy.

Smarter Web Company, a London-listed Bitcoin treasury company, has raised £17.5 million through an equity offering to institutional investors, continuing its aggressive Bitcoin (BTC) treasury strategy. The company sold 5.9 million new shares at £2.95 each in an accelerated bookbuild managed by Tennyson Securities and Peterhouse Capital Ltd.

The raise follows the company’s latest BTC purchase on July 16, where it acquired 325 BTC for £27.15 million ($36.45 million) at an average price of £83,525 ($112,157) per coin. This comes just days after a previous buy of 275 BTC at an average of $108,182.

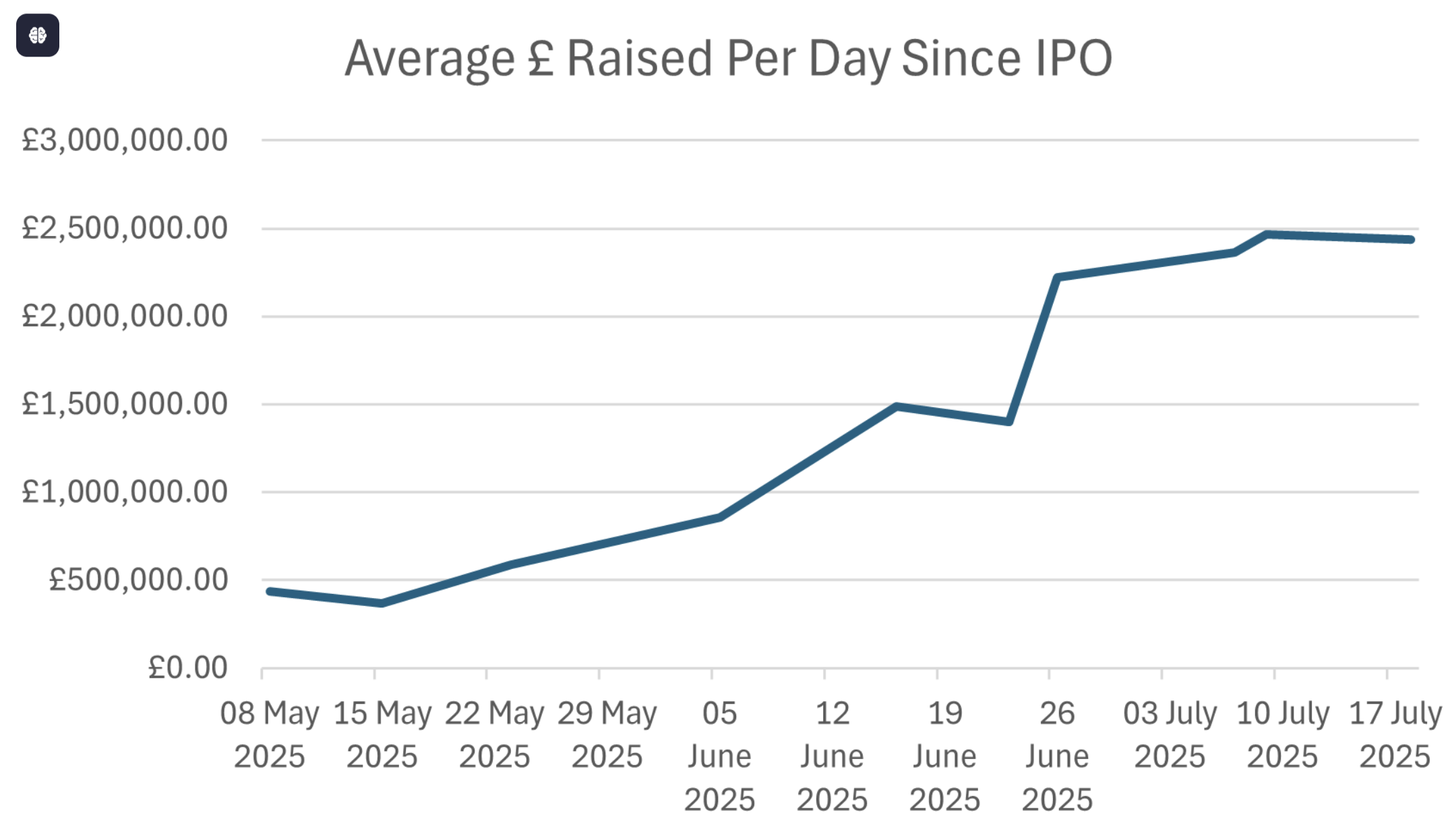

Smarter Web Company has been aggressively raising funds through institutional bookbuilding and qualified investor subscriptions. As investor @henrybomby pointed out, the company has raised £2,435,422 per day since its IPO, with much of the capital allocated to Bitcoin purchases as part of its “10-Year Plan,” which centers on keeping an active BTC treasury as a key part of its financial strategy.

Smarter Web Company adopted a Bitcoin treasury strategy just in April this year, yet it has already accumulated 1,600 BTC, enough to rank among the top 25 institutional holders globally.

You May Also Like

Trump: An important agreement will be signed at the White House at 2:30 a.m. Beijing time tomorrow

Bitcoin whale’s $9.6B transfer, GENIUS Act spark correction concerns