Ripple Price Forecast: XRP holds $3 level as focus shifts to SEC ending Ripple lawsuit

- XRP delicately holds above $3.00 as positive sentiment remains largely suppressed in the broader crypto market.

- The XRP community is focusing on the SEC, which is expected to update the appellate court by August 15.

- The slight recovery in XRP futures Open Interest and funding rate indicates gradual but steady speculative demand.

Ripple (XRP) holds at the edge of a tall cliff, with support at $3.00 on Tuesday. The cross-border money remittance token adopted for Ripple's payment platform printed a steady recovery on Sunday and Monday, but resistance at $3.10 limited price movement.

If support at $3.00 remains intact in upcoming sessions, investor confidence could improve, boosting the chances of XRP steadying the uptrend toward its record high of $3.66.

Can the SEC resolve the legal standoff with Ripple?

The United States (US) Securities & Exchange Commission (SEC) lawsuit against Ripple is approaching its final resolution. However, some caveats must first be cleared to end the five-year court battle.

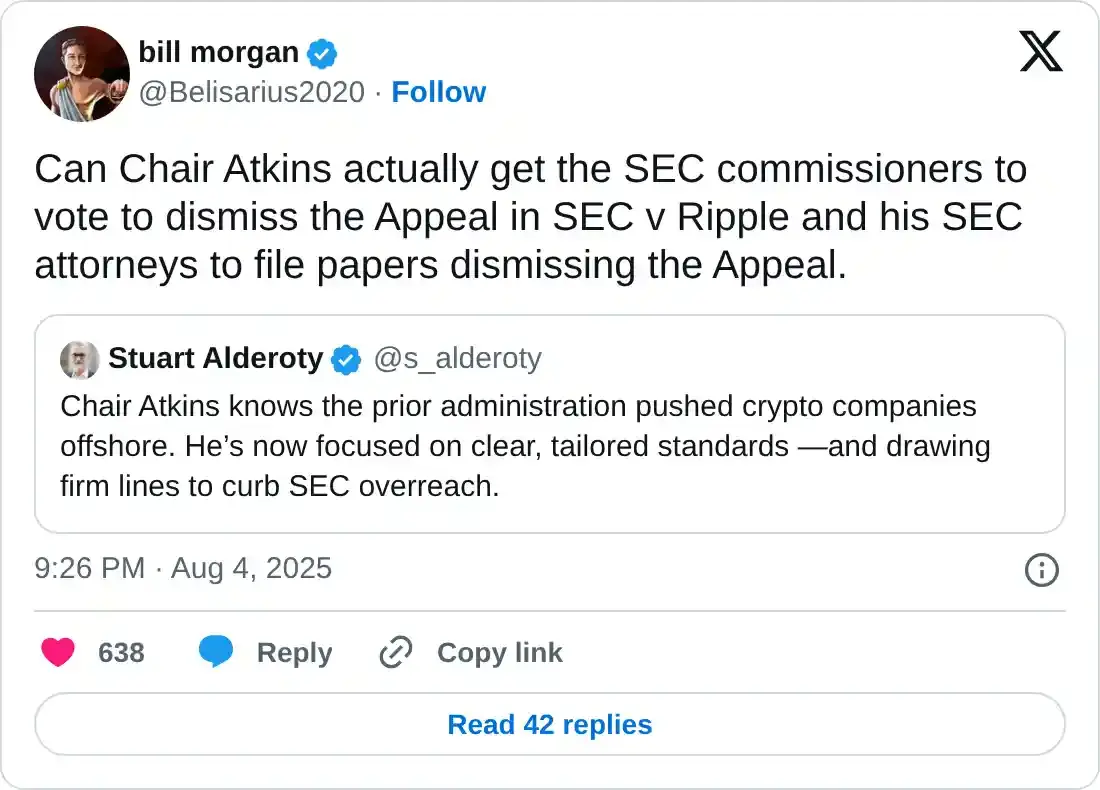

Ripple recently took a bold step by withdrawing its appeal, but the SEC's appeal remains, leaving the case in temporary limbo. Legal expert Bill Morgan argues that the SEC has no set time within which it is required to withdraw its appeal. Nevertheless, the SEC is expected to submit a status report to the Court of Appeals by August 15. Key developments could emerge over the next week, with the XRP community and legal observers closely watching the deadline.

The SEC sued Ripple in 2020, alleging that the company sold unregistered securities in violation of US securities laws. A landmark ruling in 2023 found that the programmatic sale of XRP on third-party platforms like crypto exchanges did not constitute unregistered securities, but direct sales to institutions did.

In recent months, Ripple and the SEC have explored settlement paths, especially after the blockchain startup was penalized $125 million, currently in an interest-earning escrow account.

A $50 million settlement was signed by both parties this year. However, the court rejected the joint motion seeking to end the lawsuit, citing an incomplete legal process. The August 15 deadline could provide insight into the direction of the lawsuit.

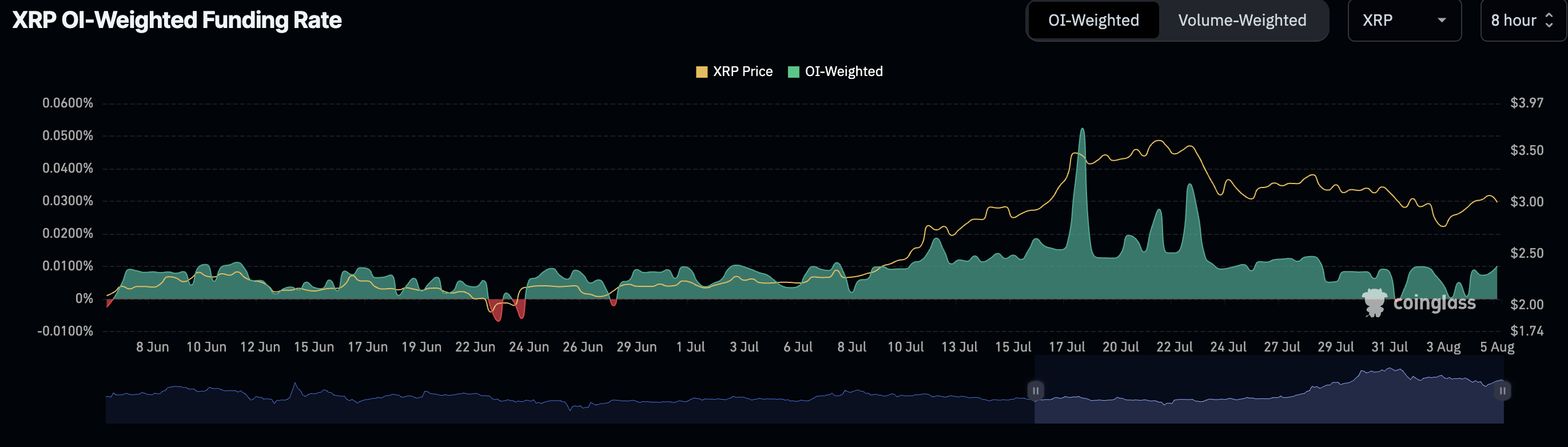

Meanwhile, interest in XRP is improving following the sell-off last week. According to CoinGlass data, the XRP Futures weighted funding rate has inched higher, holding at 0.0101 on Tuesday after dropping to 0.0004% on Sunday. A steady increase in funding rates indicates that traders are increasingly seeking exposure to long positions, anticipating a breakout in the XRP price.

XRP Futures Weighted Funding Rate | Source| CoinGlass

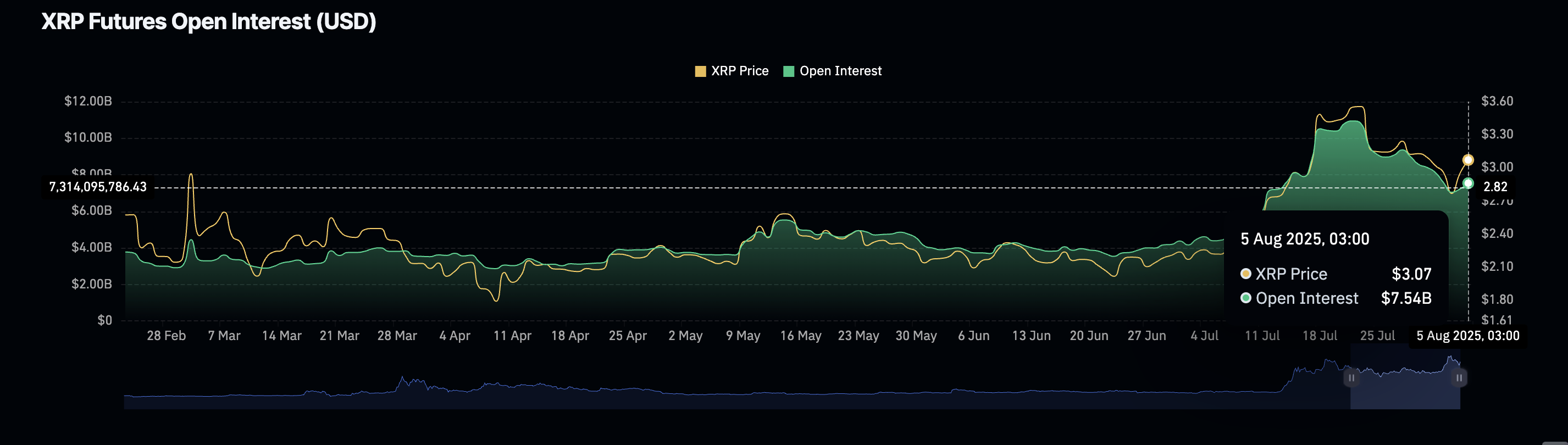

A similar recovery is reflected by the futures Open Interest (OI), which after plummeting to $7.05 billion on Sunday has rebounded to average at $7.54 billion on Monday. Amidst the run-up to the record high, the OI peaked at $10.94 billion on July 22, underpinning the strong investor conviction in the uptrend.

XRP Futures Open Interest | Source: CoinGlass

Technical outlook: XRP offers bearish signals

XRP price shows signs of extending the decline below support at $3.00, underpinned by a sell signal from the Moving Average Convergence Divergence (MACD) indicator. Traders will likely continue to reduce exposure as long as the sell signal, triggered on July 25, holds. The red histogram bars extending below the mean line underscore the bearish outlook.

A daily close on either side of the $3.00 support could provide insight into the direction the XRP price would take in the short term. On the upside, key milestones include the resistance around $3.33, which was tested on July 28 and the all-time high of $3.66.

Below the immediate support, the 50-day Exponential Moving Average (EMA) at $2.80 and the 100-day EMA at $2.59 stand as potential support levels if the decline accelerates.

XRP/USDT daily chart

The SuperTrend indicator offers another sell signal on the daily chart after flipping above the price of XRP. This trend-following tool also functions as dynamic support or resistance. If the SuperTrend line holds above the XRP price, the path of least resistance will remain downward.

Ripple FAQs

Ripple is a payments company that specializes in cross-border remittance. The company does this by leveraging blockchain technology. RippleNet is a network used for payments transfer created by Ripple Labs Inc. and is open to financial institutions worldwide. The company also leverages the XRP token.

XRP is the native token of the decentralized blockchain XRPLedger. The token is used by Ripple Labs to facilitate transactions on the XRPLedger, helping financial institutions transfer value in a borderless manner. XRP therefore facilitates trustless and instant payments on the XRPLedger chain, helping financial firms save on the cost of transacting worldwide.

XRPLedger is based on a distributed ledger technology and the blockchain using XRP to power transactions. The ledger is different from other blockchains as it has a built-in inflammatory protocol that helps fight spam and distributed denial-of-service (DDOS) attacks. The XRPL is maintained by a peer-to-peer network known as the global XRP Ledger community.

XRP uses the interledger standard. This is a blockchain protocol that aids payments across different networks. For instance, XRP’s blockchain can connect the ledgers of two or more banks. This effectively removes intermediaries and the need for centralization in the system. XRP acts as the native token of the XRPLedger blockchain engineered by Jed McCaleb, Arthur Britto and David Schwartz.

You May Also Like

Lancashire Police Turn Crypto Confiscation into £500K Anti-Crime Budget After Landmark Wallet Freeze

Meme Daily: A chart showing the most popular memes of the past 24 hours (August 5, 2025)