Dow Jones, S&P 500 rise on heels of Trump’s trade and AI plans

U.S. stocks rallied Wednesday, July 23, with the Dow Jones surging 370 points, as investors cheered a trade deal with Japan and eyed progress toward an EU agreement.

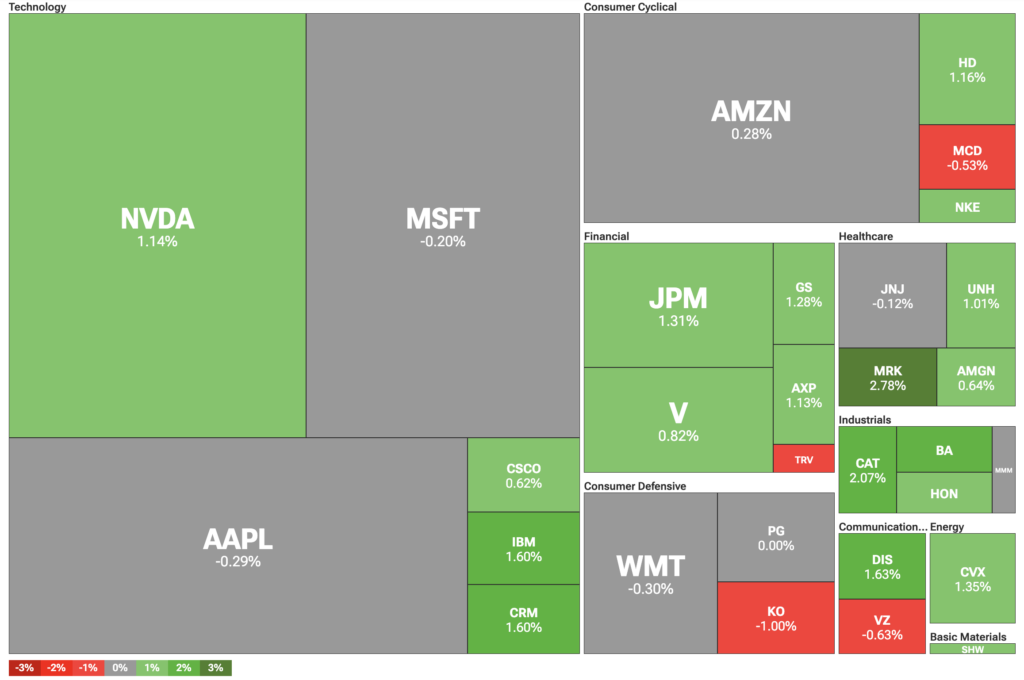

In addition to the Dow Jones’ 0.84% gain, the S&P 500 was up 0.44% at last check on Wednesday. Meanwhile, the tech-heavy Nasdaq gained a modest 0.14%.

Markets rallied on news that, after months of talks, the U.S. and Japan agreed on a trade deal. The new deal will impose a 15% tariff on goods imported from Japan to the U.S., lower than the 25% that President Donald Trump threatened earlier. Tariffs will be reciprocal, and Japan will open up its market to U.S. goods, including cars, trucks, and rice.

At the same time, Reuters reported that the U.S. and the EU are approaching a similar deal, also with a similar 15% rate. Both the U.S. and the EU would eliminate tariffs on certain products, including medical devices, aircraft, and spirits.

This news follows a series of mutual threats between the two trading blocs. Earlier, the EU threatened a €100 billion no-deal plan, targeting specific goods such as aircraft and whiskey. This was a response to Trump’s threats of flat 30% tariffs on EU goods.

Trump unveils AI plan, breaking with Biden’s policies

Trump also unveiled an AI “action plan”, detailing the administration’s approach to the artificial intelligence sector. The plan broke with former President Joe Biden’s policy of limiting exports of advanced AI chips, and ensuring that AI should not display bias.

Instead, Trump’s policy places restrictions on AI models with “ideological biases” specifically built-in by its developers. The change could impact Elon Musk’s Grok, which frequently comes under fire for controversial and racist responses, as well as allegations of direct tampering with its results.

You May Also Like

Kalshi taps Grok as AI wave reaches betting markets

Strategy expands preferred stock offering to $2b as Bitcoin thesis deepens