MEXC Advanced Futures Trading Strategies: Take Profit to Lock in Gains

1. What is Take-Profit in MEXC Futures Trading?

2. MEXC Futures Take-Profit Methods

2.1 Fixed Amount Take-Profit

2.2 Percentage Take-Profit

2.3 Take-Profit by Technical Indicator

2.4 Take-Profit in Stages

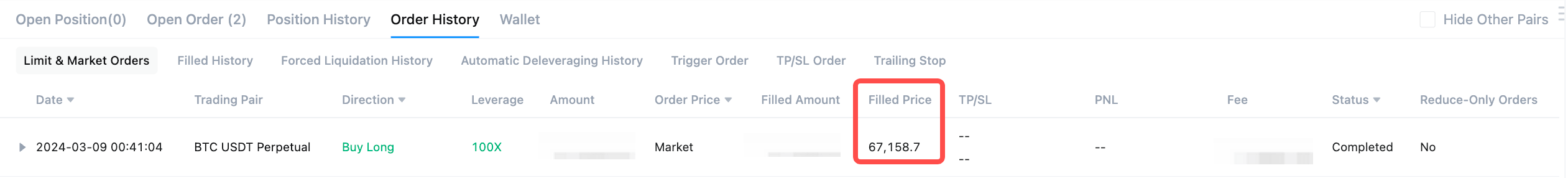

3. User Guide (MEXC Main Platform)

3.1 Flash Close

3.2 Close Long/Close Short

3.3 Close All

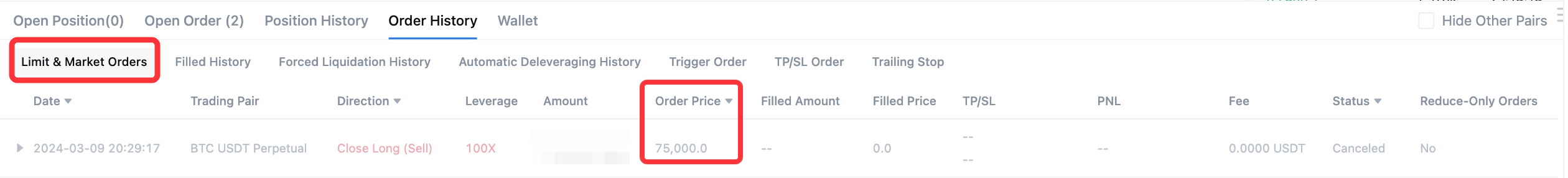

3.4 Limit

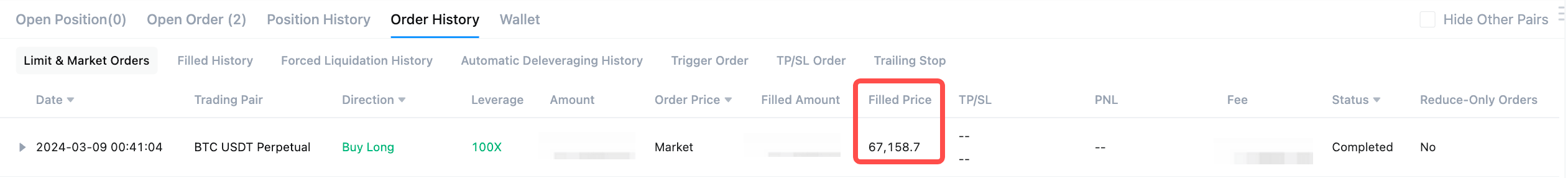

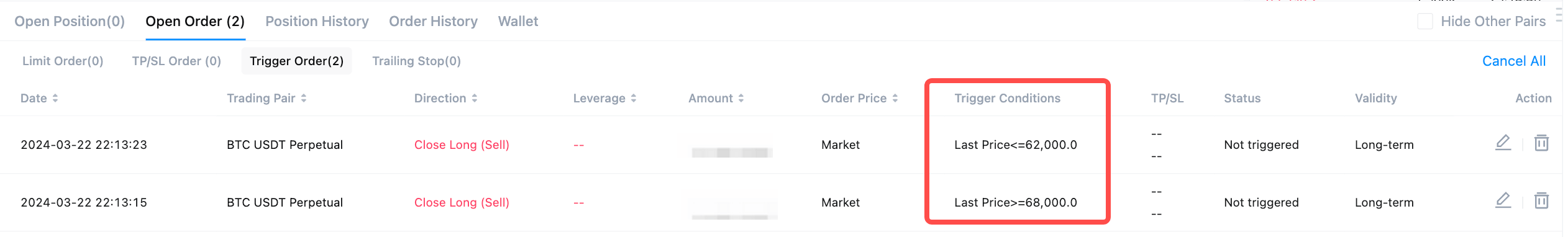

3.5 Trigger Order

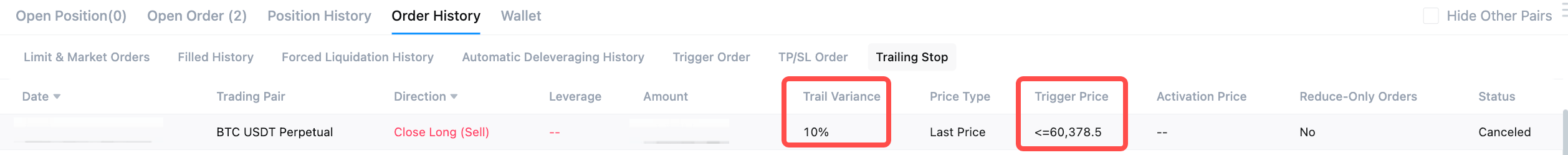

3.6 Trailing Stop Order

3.7 Post Only

3.8 TP/SL (Take Profit /Stop Loss)

4. Why Take Profit Matters in Futures Trading

4.1 Turn Unrealized Gains into Realized Profits

4.2 Overcome Emotion and Enforce Trading Discipline

5. Conclusion

Recommended Reading:

- Why Choose MEXC Futures? Gain an in-depth understanding of the advantages and features of MEXC Futures trading to get ahead in the market.

- How to Trade Futures on MEXC App: Complete Beginner's Guide Learn the Futures trading process on the MEXC App, making it easy to get started and master the essentials.

Popüler Makaleler

Balancing Security and Accuracy: Dynamic Logic of Risk Control Systems

As crypto markets evolve, so do the tactics used by fraudsters and market manipulators. To keep users safe and preserve market integrity, crypto exchanges must constantly enhance their risk control an

How to Verify My Residential Address on MEXC

Providing proof of address (POA) is part of MEXC's KYC verification process. After registering a MEXC account, you must upload a POA document to complete identity verification and ensure compliance wi

Dogecoin All-Time High: When It Happened and What Drove the Surge

Key TakeawaysDogecoin’s all-time high (ATH) occurred on May 8, 2021, when the price reached approximately $0.74.The surge was primarily driven by a combination of Elon Musk’s repeated tweets and endor

Dogecoin Marketcap Explained: What It Means and How It Shapes DOGE’s Value

Key TakeawaysMarket capitalization (market cap) measures the total dollar value of Dogecoin (DOGE), calculated as current price × circulating supply.As of December 2025, Dogecoin’s market cap stands a

İlgili Makaleler

Dogecoin Marketcap Explained: What It Means and How It Shapes DOGE’s Value

Key TakeawaysMarket capitalization (market cap) measures the total dollar value of Dogecoin (DOGE), calculated as current price × circulating supply.As of December 2025, Dogecoin’s market cap stands a

What Are Prediction Futures?

Cryptocurrency futures trading attracts countless investors with its high leverage and the ability to profit in both rising and falling markets. However, its complex mechanisms such as margin, leverag

Calculation of Futures Yield and Trading Fees

When trading futures on MEXC or other major exchanges, your trading PNL is based on three components:Trading Fees: The cost incurred during the transaction.Funding Fees: Periodic settlements based on

MEXC Fees Explained: Complete Trading, Futures & Withdrawal Fees Guide

Whether you are an experienced cryptocurrency trader or just getting started, understanding trading fees is essential to navigating the market and improving your trading experience. MEXC, a leading gl