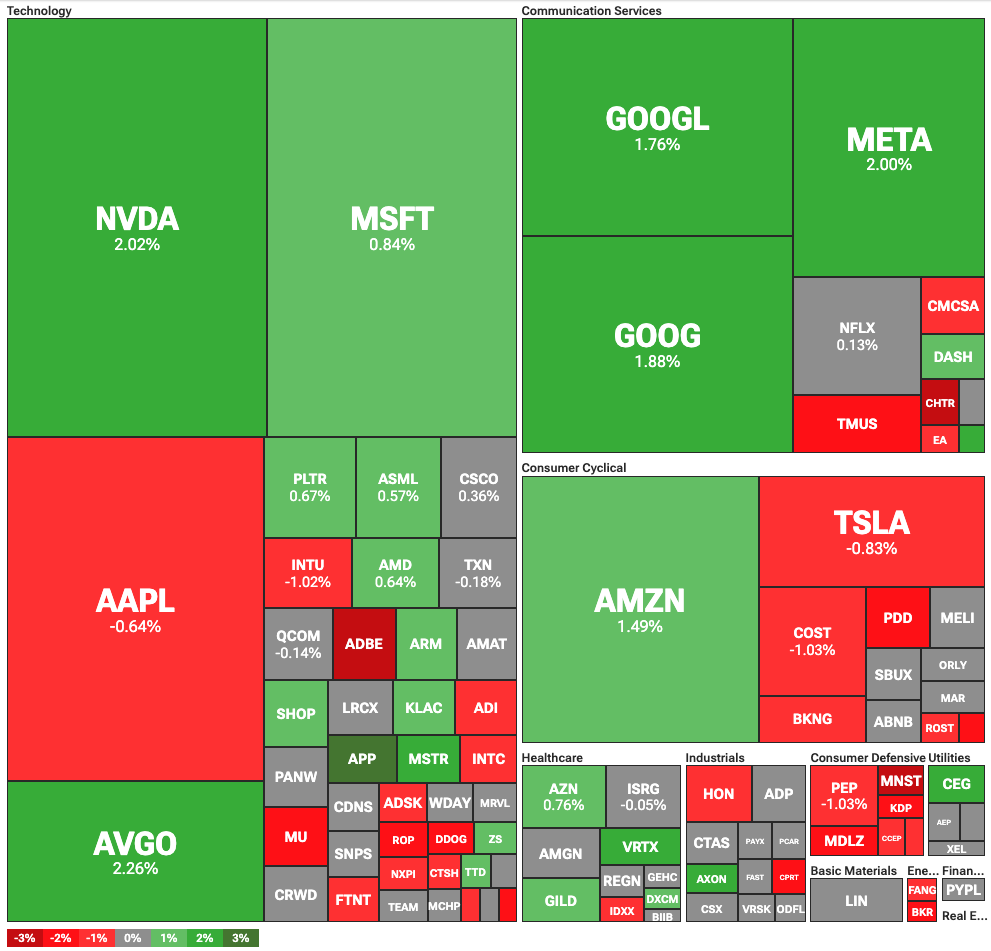

Nasdaq leads the stock market as Nvidia wins race to $4T in valuation

Nasdaq leads stock market gains as Nvidia becomes the first ever company to reach a $4 trillion valuation.

Major U.S. stock indices rose on Wednesday, July 9, as tech stocks offset macroeconomic uncertainty stemming from new tariff threats. The Dow Jones Industrial Average climbed 136.07 points, or 0.31%, while the S&P 500 added 0.36%. The tech-heavy Nasdaq Composite led the gains with a 0.65% increase.

Nvidia was among the top-performing large-cap stocks, rising 2% during the session. The rally propelled the chipmaker past Microsoft and Apple, making it the first company in history to reach a $4 trillion market capitalization. The surge is driven by Nvidia’s central role in providing the hardware that powers advanced artificial intelligence models.

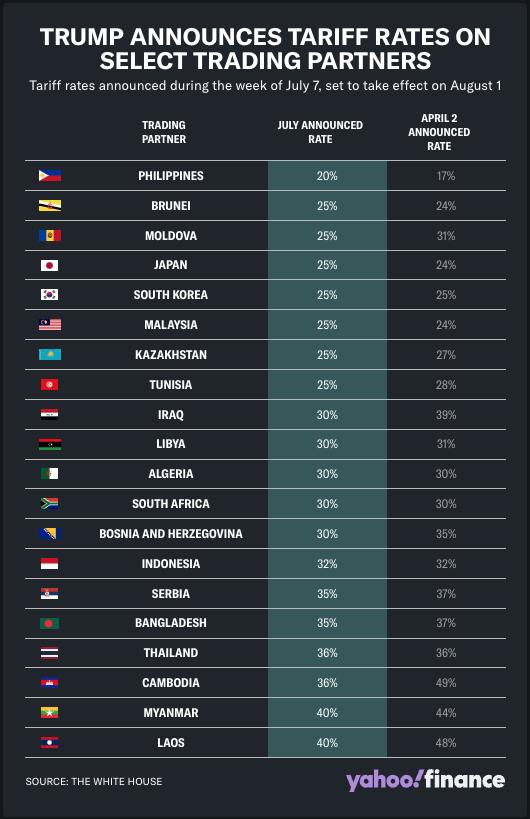

Still, the broader tech rally was tempered by growing concern over U.S. trade policy. President Donald Trump issued a new wave of tariff threats against several U.S. trade partners, including the Philippines, Iraq, Moldova, and Algeria. The proposed tariffs range from 20% to 30%.

Trump issued tariff threats to 20 countries this week

These four nations are among 20 countries that received tariff warnings in the week beginning July 7. The tariffs are scheduled to take effect on August 1, unless bilateral trade agreements are reached beforehand.

Previously, Trump had extended the original tariff enforcement deadline from July 9 to August 1. Markets are now weighing whether these aggressive trade measures are a negotiating tactic or a signal of a broader shift in the administration’s trade policy. If implemented, the tariffs could have significant short-term impacts on global growth and potentially fuel inflation.

You May Also Like

South Korea plans to include crypto trading companies in the risky enterprise category

pump.fun: PUMP will launch its first token offering on July 12, with 15% used for ICO public sale