zkBTC bridge mainnet goes live, unlocking Bitcoin cross-chain liquidity

Lightec’s zkBTC bridge goes live on mainnet, marking a new phase for Bitcoin as it enters the cross-chain liquidity era.

The zkBTC Bridge has officially launched on mainnet, marking a major milestone for the Lightec team after more than two years of development. The announcement follows the successful conclusion of the testnet phase, which ended on July 1,. during which users could earn points by participating in testnet interactions. The testnet, in turn, built on earlier community testing efforts, including the Beta V3 “Odyssey” campaign launched in December last year, in which users earned zkBTC points convertible into airdrops.

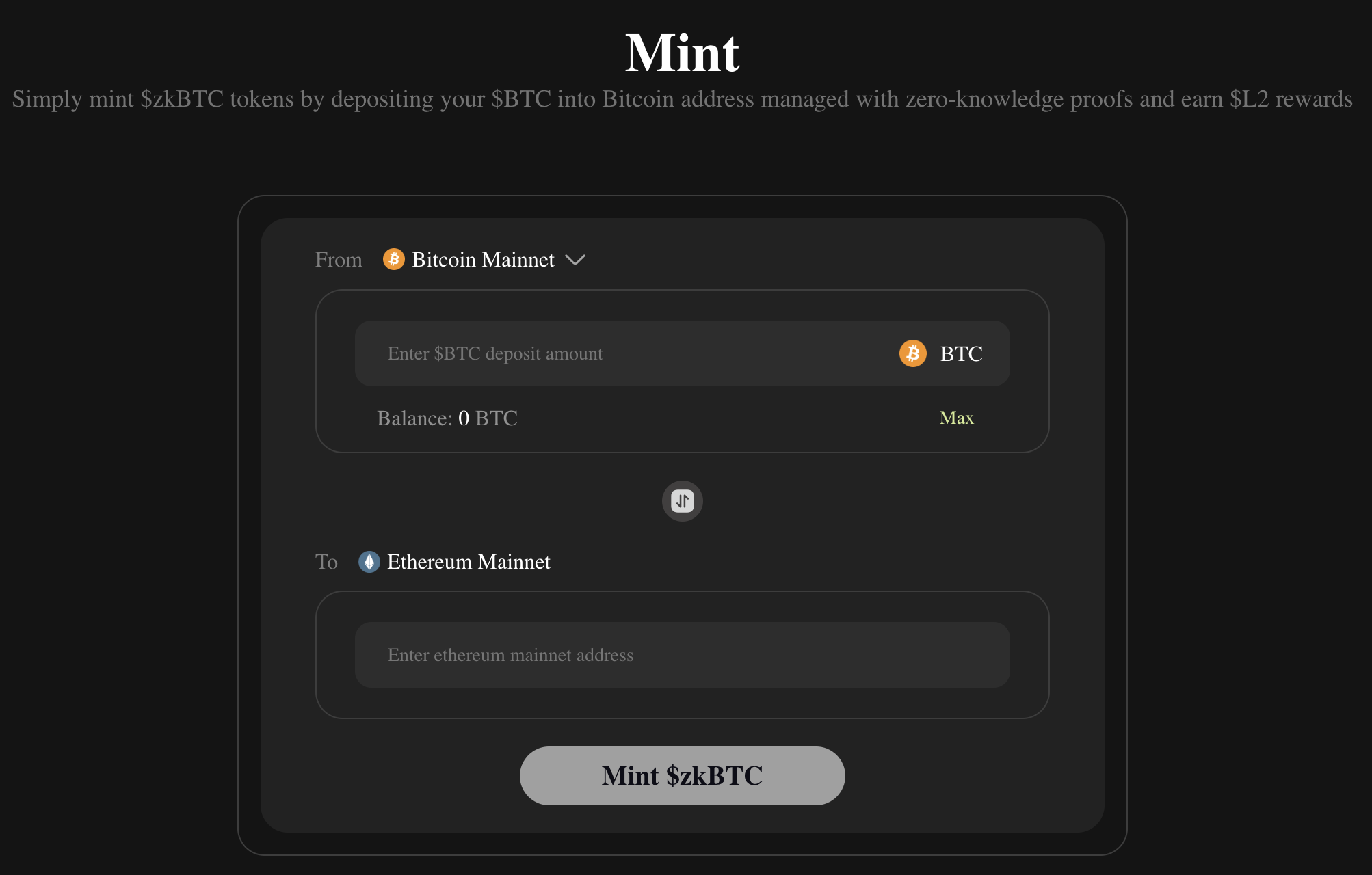

Now live, the zkBTC Bridge enables Bitcoin (BTC) holders to unlock DeFi yields by bridging BTC to Ethereum (ETH) securely and without intermediaries.

Additionally, the team announced it’s currently developing ZenKeeper, a new protocol that eliminates off-chain verification in BTC asset issuance using zero-knowledge proofs. Work also continues on OPZKP, a Bitcoin-native Layer 2 protocol leveraging ZKPs and the OP_ZKP opcode to boost scalability and security across the ecosystem.

The zkBTC Bridge is the first fully zero-knowledge proof-based bridge between Bitcoin and Ethereum. It allows users to deposit BTC into a ZKP-managed address. Once confirmed on the Bitcoin network, an off-chain proof is generated and verified by an Ethereum smart contract, which then mints zkBTC, a 1:1 Bitcoin-pegged ERC-20 token. The same process works in reverse for redemptions, allowing users to convert zkBTC back to BTC at any time.

Built to be fully decentralized and secure, the bridge relies on trusted multisig custody, minimal fees, and a user-friendly interface. It integrates with DeFi protocols and is backed by partnerships across leading crypto infrastructure providers.

You May Also Like

Tron founder Justin Sun to join Blue Origin’s next spaceflight

Publicly traded BTCS acquires 26,666 in ETH, holds $242m in treasury