USDT supply hits $156.1b all-time high, 90% on Tron and Ethereum

Tether’s USDT reached an all-time high in supply at $156.1 billion, with most of the stablecoin circulating on Tron and Ethereum.

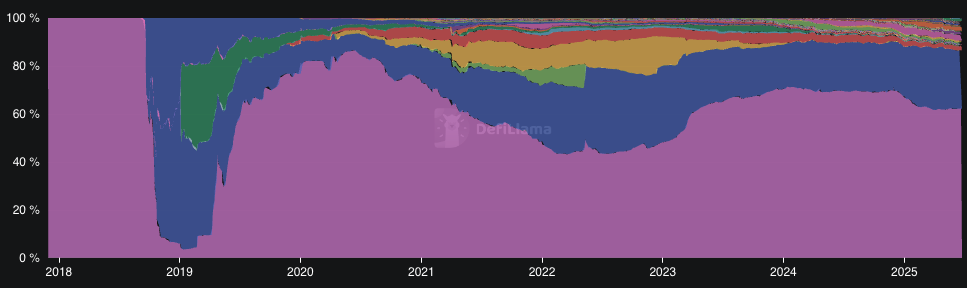

Despite renewed hype around Circle, Tether continues to dominate the stablecoin market. On Tuesday, June 24, USDT’s outstanding supply hit an all-time high of $156.1 billion. Notably, 90% of that supply is concentrated on just two networks: Ethereum and Tron.

Over half of USDT stablecoins, or 50.47%, are now on Tron (TRX), while almost 40% are on Ethereum (ETH). Less than 10% of USDT supply is distributed across other blockchains, including BNB Chain, Solana, Cosmos, Avalanche, and others.

Circle’s USDC has gained more traction on many of these smaller chains. For instance, Solana hosts nearly $7.5 billion worth of USDC compared to just $2.3 billion of USDT. Still, despite USDC’s growing popularity, USDT’s dominance has remained largely stable.

Currently, USDT accounts for 62.10% of stablecoin supply across all chains, while USDC holds around 24%. However, USDT saw a dip in dominance near the end of 2024, coinciding with the implementation of the European Union’s MiCA stablecoin regulations.

What’s the future for USDT?

Instead of trying to comply with MiCA regulation, Tether chose to withdraw from the market completely. It had discontinued its EURT stablecoin, as well as faced delisting on several major exchanges. Still, Tether’s leadership would not relent, declining to enact full reserve transparency.

Still, the passage of the U.S. GENIUS Act could pose new problems for Tether, where it controls a dominant market share. However, experts are not convinced that the GENIUS Act would force the Tether out of the U.S. market.

For now, Tether’s strategic focus remains on Asia, where it continues to be a preferred option for crypto payments—particularly on the Tron network.

You May Also Like

Beyond Bitcoin: Why Crypto Infrastructure Will Survive the Next Crash

FOMC and Canadian ETF Debut Fail To Pump XRP Price: What Catalyst Does XRP Need?