The US government will start buying Bitcoin for its strategic reserve when there is “enough pressure externally,” says crypto entrepreneur Mike Alfred. The US government is unlikely to start accumulating Bitcoin for its strategic reserve until other nations make the first move, says crypto entrepreneur Mike Alfred.Alfred said in a podcast published on Tuesday that the US government will start putting Bitcoin (BTC) into its reserve created earlier this year “when there is enough pressure externally.” “Once the US government recognizes that others are taking action before them, that’ll probably catalyze additional action in the future,” he said, adding that the timeline for the US government’s action is up in the air.Read more The US government will start buying Bitcoin for its strategic reserve when there is “enough pressure externally,” says crypto entrepreneur Mike Alfred. The US government is unlikely to start accumulating Bitcoin for its strategic reserve until other nations make the first move, says crypto entrepreneur Mike Alfred.Alfred said in a podcast published on Tuesday that the US government will start putting Bitcoin (BTC) into its reserve created earlier this year “when there is enough pressure externally.” “Once the US government recognizes that others are taking action before them, that’ll probably catalyze additional action in the future,” he said, adding that the timeline for the US government’s action is up in the air.Read more

US won’t start Bitcoin reserve until other countries do: Mike Alfred

The US government will start buying Bitcoin for its strategic reserve when there is “enough pressure externally,” says crypto entrepreneur Mike Alfred.

The US government is unlikely to start accumulating Bitcoin for its strategic reserve until other nations make the first move, says crypto entrepreneur Mike Alfred.

Alfred said in a podcast published on Tuesday that the US government will start putting Bitcoin (BTC) into its reserve created earlier this year “when there is enough pressure externally.”

“Once the US government recognizes that others are taking action before them, that’ll probably catalyze additional action in the future,” he said, adding that the timeline for the US government’s action is up in the air.

Read more

Disclaimer: The articles reposted on this site are sourced from public platforms and are provided for informational purposes only. They do not necessarily reflect the views of MEXC. All rights remain with the original authors. If you believe any content infringes on third-party rights, please contact service@support.mexc.com for removal. MEXC makes no guarantees regarding the accuracy, completeness, or timeliness of the content and is not responsible for any actions taken based on the information provided. The content does not constitute financial, legal, or other professional advice, nor should it be considered a recommendation or endorsement by MEXC.

You May Also Like

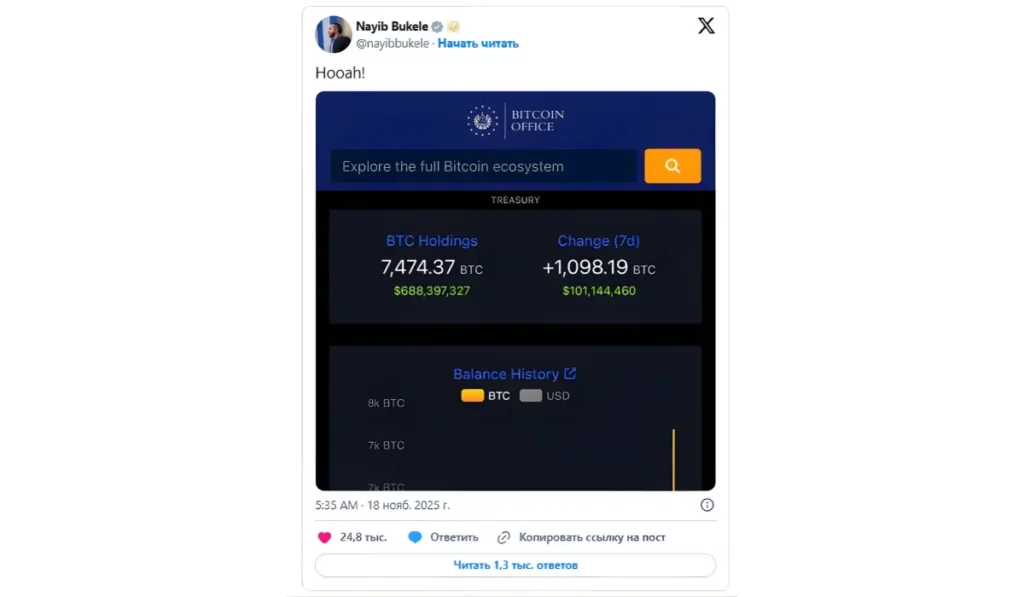

El Salvador “Buys The Dip”, Adds 1098 BTC To Growing National Bitcoin Treasury

Key Takeaways El Salvador is steadfast in maintaining its bitcoin accumulation strategy. Amid a decline that saw the apex crypto’s price drop below the $90,000 mark for the first time since April 2025, the Central American nation added 1098 BTC, worth nearly $100 million, to its coffers over the past week. On Tuesday, President Nayib... The post El Salvador “Buys The Dip”, Adds 1098 BTC To Growing National Bitcoin Treasury appeared first on BiteMyCoin.

Share

Bitemycoin2025/11/19 13:25

What China Banning Nvidia Chips Means for the AI Race

After years of U.S. sanctions, China moves to ban Nvidia, betting Huawei and homegrown chips are enough to win the AI wars.

Share

Coinstats2025/09/18 04:05

FedWatch Predicts Small Fed Rate Cut in December

The post FedWatch Predicts Small Fed Rate Cut in December appeared on BitcoinEthereumNews.com. Key Points: FedWatch data suggests possible Fed rate cut in December. Unchanged rates probability slightly higher at 51.1%. Market reactions include major crypto liquidations. BlockBeats News reports on CME’s “FedWatch” data indicating a 48.9% chance of a 25 basis point Fed rate cut in December, with 51.1% probability of rates staying unchanged. Crypto markets closely watch potential Fed moves, impacting asset volatility. $7.9 billion in liquidations reflect market reactions to macroeconomic signals. FedWatch Predicts Small Fed Rate Cut in December The CME’s FedWatch tool captures current market expectations regarding the U.S. Federal Reserve’s interest rate stance. As of mid-November, there is a nearly even split between expectations for a cut and for no change, hinting at market uncertainty. Such monetary policy speculations often precede notable shifts in financial markets, including cryptocurrencies. Leading digital assets like Bitcoin and Ethereum could witness significant price reactions depending on any Fed announcement. Market reactions remain cautious amid this uncertainty. The crypto community is focused on potential ripple effects across asset prices, highlighted by the recent major liquidation events tied to speculative positioning. Bitcoin and Ethereum: Coping with Potential Policy Shifts Did you know? In similar past cycles, crypto markets have experienced sharp volatility surges ahead of FOMC meetings, reflecting trader positioning in anticipation of outcomes. Bitcoin (BTC) currently trades at $91,457.44, with a market cap of $1.82 trillion and a dominance of 58.32%, according to CoinMarketCap as of November 19, 2025. Over the past 24 hours, BTC saw a trading volume of $86.42 billion, marking a decrease of 19.55%, with its price rising by 1.97%. However, a seven-day decline of 11.31% continues to reflect broader market nervousness. Bitcoin(BTC), daily chart, screenshot on CoinMarketCap at 04:48 UTC on November 19, 2025. Source: CoinMarketCap Analytical insights indicate the potential for financial market upheaval if the Federal…

Share

BitcoinEthereumNews2025/11/19 12:56