US Treasury Buys Back $142M in Debt — Here’s What It Means for Crypto

The US Treasury conducted a debt buyback operation targeting Treasury Inflation-Protected Securities worth up to $500 million, settling on November 13, 2025, as part of ongoing efforts to manage the nation’s ballooning debt crisis.

The move comes amid mounting warnings from financial heavyweights, such as Ray Dalio, about America’s fiscal trajectory, with the government now spending 40% more than it takes in, while crypto advocates position digital assets as potential relief mechanisms.

The buyback targeted TIPS maturing between February 2040 and February 2055, with primary dealers submitting offers through the Federal Reserve Bank of New York’s FedTrade system.

Source: JEC

Source: JEC

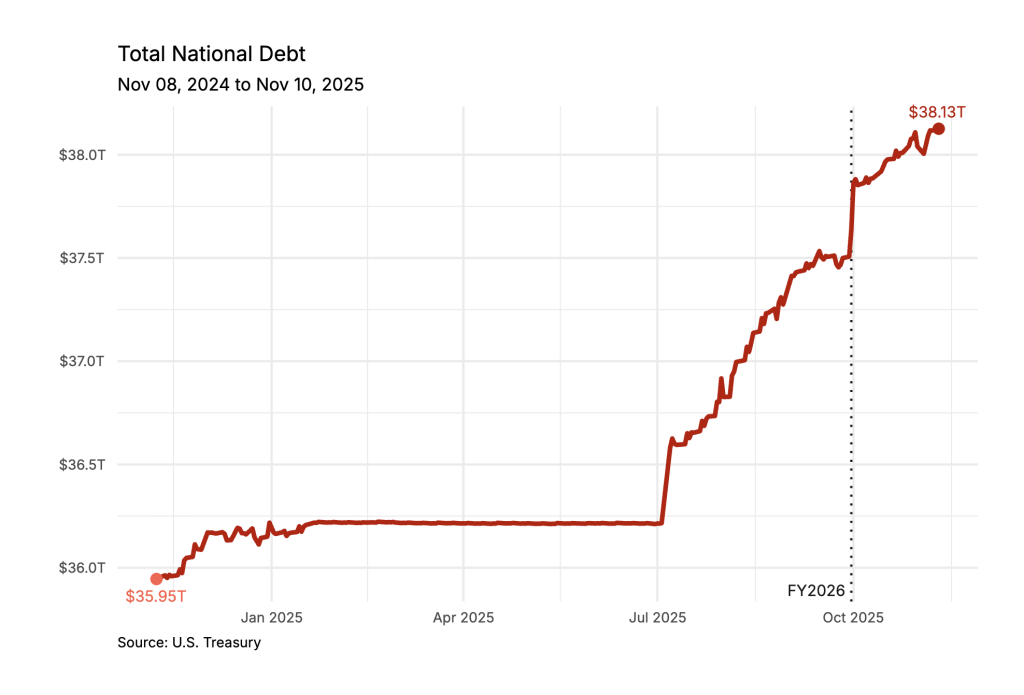

The operation is positioned as a debt management strategy, as total US debt approaches $40 trillion, a threshold that has elicited intense debate about sustainable fiscal policy and alternative financial systems.

Dalio Warns of ‘Economic Heart Attack’ Within Three Years

Ray Dalio escalated his debt crisis warnings, stating the US faces “an economic heart attack” unless the federal deficit drops from roughly 6% to 3% of GDP within three years.

The Bridgewater founder outlined a self-reinforcing cycle in which excessive debt during downturns leads countries to print money, devalue their currency, raise inflation, and ultimately spawn political extremism as living standards collapse.

“We are operating with a $7 trillion spending and a $5 trillion dollar intake, we’re spending 40% more than we’re taking in, and this is a chronic problem,” Dalio explained in a recent Fox Business interview.

He compared accumulating debt service payments to “plaque in the arteries, squeezing away buying power,” warning that the government must sell $12 trillion in debt, including $9 trillion in maturing obligations, $1 trillion in interest payments, and $2 trillion in new borrowing.

Dalio’s November 5 analysis also highlighted additional concerns about Federal Reserve policy, suggesting QE measures while cutting interest rates into an emerging bubble represents “stimulating into a bubble” rather than the historical pattern of “stimulus into a depression.”

With AI stocks already showing bubble characteristics, unemployment near lows, and inflation above target, he questioned whether current monetary easing veers toward debt monetization.

Consumer Debt Reaches Breaking Point

American households face unprecedented financial stress as student loan delinquencies exploded to 14.3% in Q3 2025, the highest level ever recorded, while auto loan delinquencies hit 3% and credit card delinquencies reached 7.1%.

The Kobeissi Letter reported consumers are “drowning in debt” despite relatively low unemployment rates.

The crisis intensified following the expiration of student loan relief programs, with serious delinquencies jumping 13.5 percentage points year-over-year as missed payments reappeared on credit reports.

Mortgage delinquencies climbed to 1.3% transitioning into serious delinquency, the highest in eight years, while vehicle repossessions surged past 1.7 million last year against a record $1.7 trillion in outstanding auto loans.

Financial analysts warn that the wealth gap has reached extremes, with the top 10% of earners accounting for 49.2% of total US spending in Q2 2025, the highest since data collection began in 1989.

The pending resumption of wage garnishment for student loan defaults threatens to divert billions from consumer spending, as nearly 2 million borrowers could see up to 15% of their paychecks seized.

Economists Clash Over Debt Consequences

While Dalio’s warnings dominate headlines, economist Steve Keen challenges the mainstream debt narrative, arguing that governments that control their own currency face fundamentally different constraints than households or companies.

Keen emphasized that banks create money when they lend, making credit an addition to aggregate demand rather than mere transfers between savers and borrowers.

President Trump intensified policy debates by announcing a “tariff dividend” of at least $2,000 per American, potentially distributing over $400 billion to roughly 220 million adults earning below certain income thresholds.

The announcement drew immediate comparisons to 2021 stimulus checks that preceded inflation surging near 10%, with critics questioning massive handouts while stocks hover near record highs and total US debt climbs toward $40 trillion.

What Does America’s Debt Crisis Mean for Crypto?

Trump positioned crypto as fiscal relief, stating that it “takes a lot of pressure off the dollar,” while Senator Cynthia Lummis is advancing Strategic Bitcoin Reserve legislation, seeing it as the “only solution” to offset the National Debt.

The administration views crypto as a viable hedge against mounting national debt.

However, market observers remain divided, with some speculating that increased stablecoin focus could divert attention from Bitcoin accumulation strategies despite overall positive regulatory sentiment toward digital assets as debt alternatives.

You May Also Like

Institutional Interest in Bitcoin Grows as Long-Term Holders Sell Gradually

Satoshi-Era Mt. Gox’s 1,000 Bitcoin Wallet Suddenly Reactivated