The US SEC has begun to take action. Can the crypto treasury narrative continue?

On September 24, the U.S. Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (Finra) jointly announced that they would investigate more than 200 listed companies that had announced plans for crypto treasury, on the grounds that these companies generally experienced "abnormal stock price fluctuations" on the eve of the release of related news.

Since MicroStrategy pioneered the addition of Bitcoin to its balance sheet, "crypto treasuries" have become a sensational "financial alchemy" in the US stock market. Newcomers like Bitmine and SharpLink have seen their share prices skyrocket dozens of times due to similar operations. According to data released by Architect Partners, since 2025, 212 new companies have announced plans to raise approximately $102 billion to purchase mainstream crypto assets such as BTC and ETH.

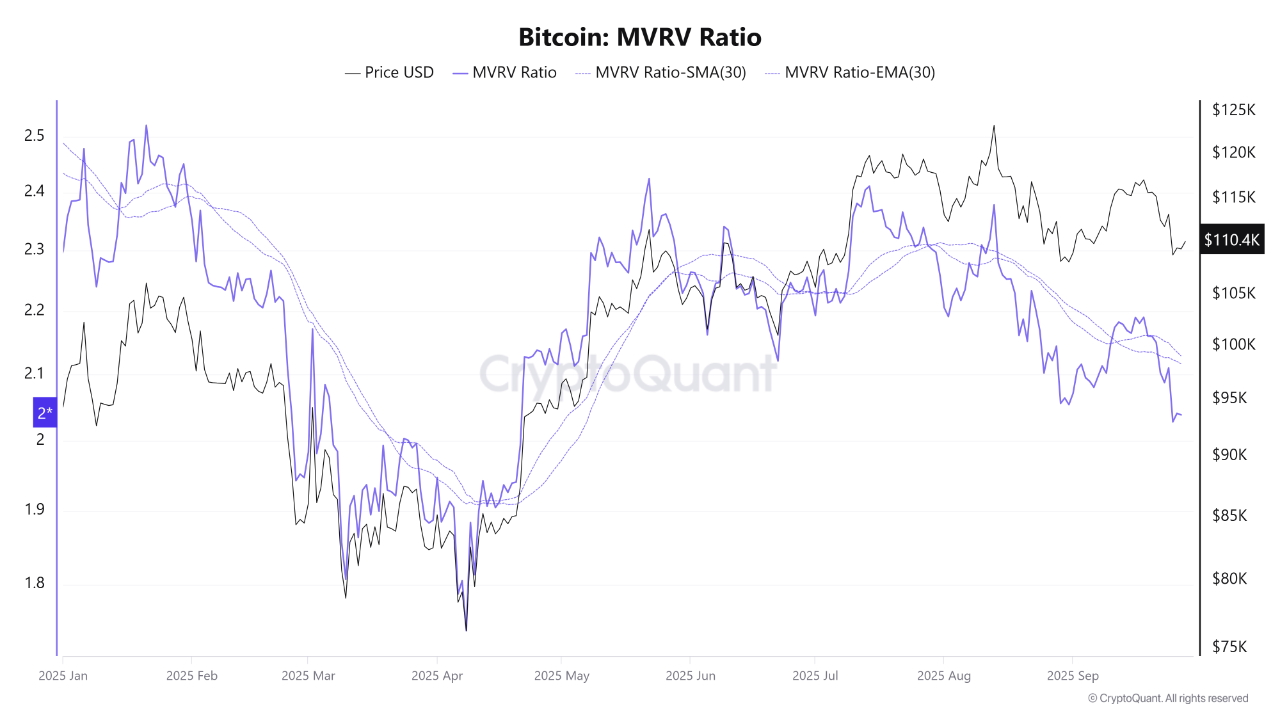

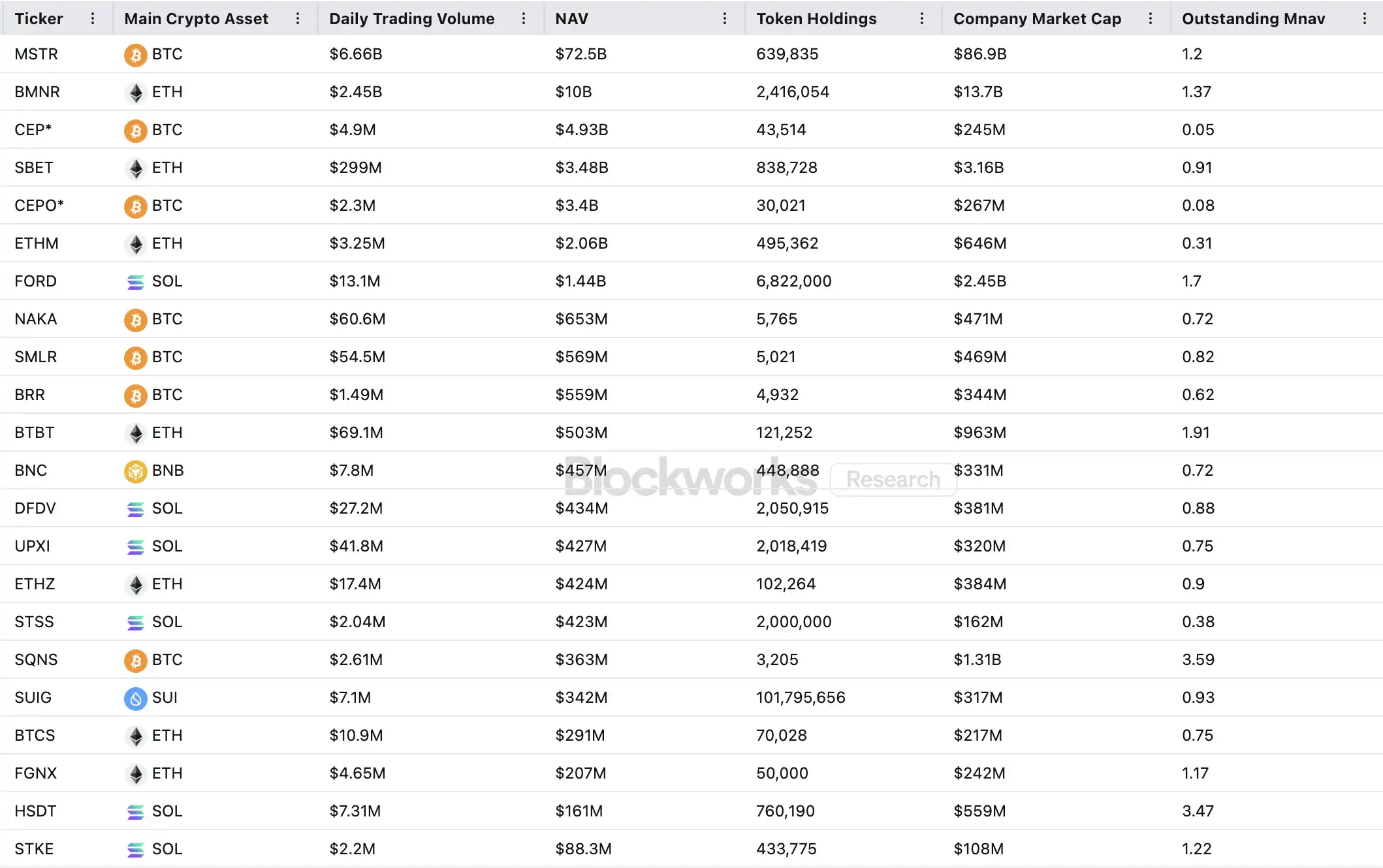

However, while this capital frenzy has driven up prices, it has also sparked widespread skepticism. MSTR's mNAV (market capitalization to net asset value) plummeted from 1.6 to 1.2 within a month, while two-thirds of the top 20 crypto treasury companies have mNAVs below 1. Concerns about asset bubbles and insider trading are surging, and this new asset allocation trend is currently facing unprecedented regulatory challenges.

How the Flywheel of Crypto Treasury Companies Works

Caiku's financing flywheel is built on the mNAV mechanism, a reflexive flywheel logic that gives Caiku a seemingly unlimited supply of funds during a bull market. mNAV refers to the market-to-net-asset value ratio, calculated as the multiple of a company's market capitalization (P) relative to its net asset value per share (NAV). In the context of Caiku Strategy, NAV refers to the value of the digital assets it holds.

When the stock price (P) exceeds the net asset value per share (NAV) (i.e., mNAV > 1), the company can continue to raise funds and reinvest the proceeds in digital assets. Each additional issuance and purchase increases the per-share holdings and book value, further strengthening the market's confidence in the company's narrative and driving the stock price higher. Thus, a closed-loop positive feedback loop begins to turn: mNAV rises → additional issuance → purchase of digital assets → increased per-share holdings → increased market confidence → further stock price increases. It is precisely because of this mechanism that MicroStrategy has been able to continuously raise funds to purchase Bitcoin over the past few years without significantly diluting its shares.

Once the stock price and liquidity are pushed high enough, the company unlocks a whole host of institutional capital entry mechanisms: issuing financing instruments such as debt, convertible bonds, and preferred stock, converting the market narrative into assets on its books, which in turn drives up the stock price, creating a flywheel. The essence of this game lies in the complex resonance between stock price, narrative, and capital structure.

However, mNAV is a double-edged sword. A premium can represent a high level of market confidence, or it can simply be speculation. Once mNAV converges to or falls below 1, the market shifts from a "thickening" logic to a "dilution" logic. If the token price itself falls at this point, the flywheel shifts from a positive rotation to a negative feedback loop, resulting in a double blow to market capitalization and confidence. Furthermore, treasury strategy companies' financing relies on the premium flywheel of mNAV. If mNAV remains at a discount for a long time, the space for additional issuance will be blocked. Small and medium-sized shell companies that are already stagnant or on the verge of delisting will see their businesses completely overturned, and the established flywheel effect will collapse instantly. In theory, when mNAV < 1, the more reasonable option for a company is to sell its holdings and repurchase shares to restore balance. However, this should not be generalized. Discounted companies can also represent undervaluation.

During the 2022 bear market, even when MicroStrategy's mNAV briefly dipped below 1, the company chose not to sell its coins for repurchases, but instead insisted on retaining all its Bitcoin through debt restructuring. This "holding on" strategy stems from Saylor's belief in BTC, viewing it as a core collateral asset that he "will never sell." However, this approach is not replicable by all treasury companies. Most altcoin treasury stocks lack stable core businesses, and their transformation into "coin buying companies" is merely a means of survival, not a foundation of conviction. If market conditions deteriorate, they are more likely to sell to cut losses or realize profits, potentially triggering a stampede.

Does insider trading exist?

SharpLink Gaming was one of the first companies to cause market volatility during this "crypto treasury boom." On May 27th, the company announced it would increase its holdings of Ethereum by up to $425 million as a reserve asset. On the day of the announcement, its share price soared to $52. However, strangely, as early as May 22nd, trading volume had already increased significantly, with the share price jumping from $2.70 to $7, even before the company released an announcement or disclosed any information to the SEC.

This phenomenon of "stock price moving before the announcement" is not an isolated case. MEI Pharma announced the launch of a $100 million Litecoin treasury strategy on July 18th, but its stock price rose for four consecutive days before the announcement, nearly doubling from $2.7 to $4.4. The company did not submit a major update or issue a press release, and a spokesperson declined to comment.

Similar situations have also occurred at companies such as Mill City Ventures, Kindly MD, Empery Digital, Fundamental Global, and 180 Life Sciences Corp., all of which experienced varying degrees of abnormal trading fluctuations before announcing their crypto treasury plans. The possibility of information leaks and pre-emptive trading has alerted regulators.

Will the DAT narrative collapse?

Arthur Hayes, an advisor to Upexi, a Solana microstrategist, noted that crypto treasuries have become a new narrative in traditional corporate finance. He believes this trend will continue across multiple mainstream asset classes. However, we must clearly understand that on each chain, only one or two companies will ultimately emerge as winners.

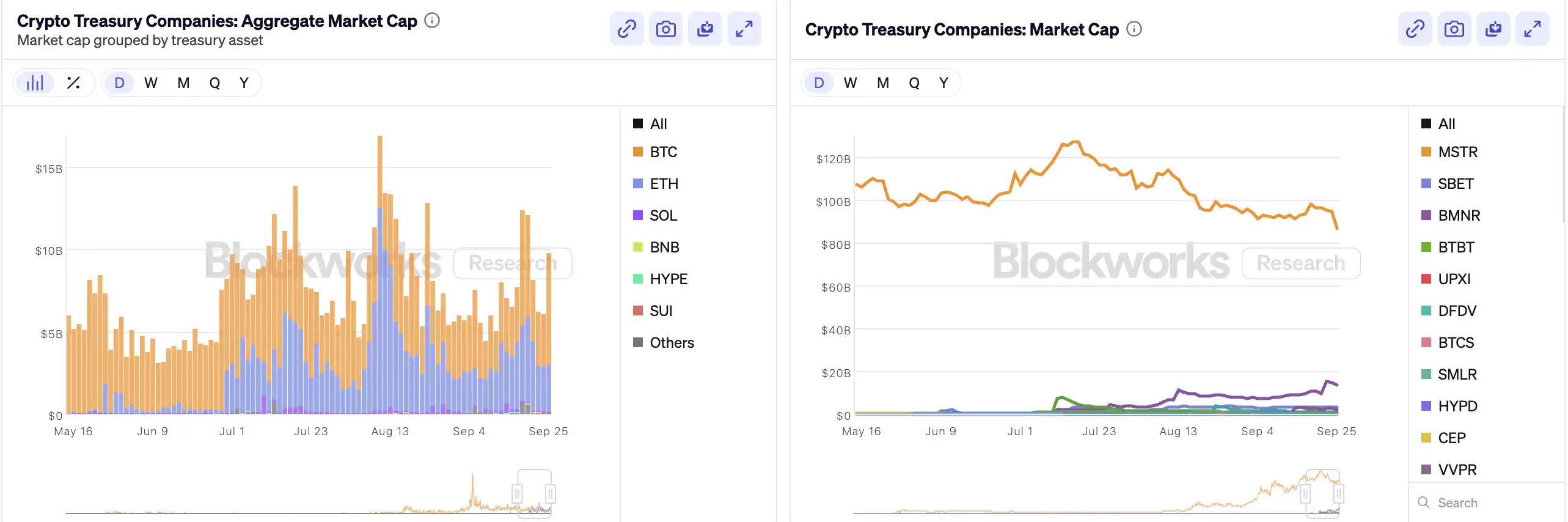

At the same time, a head-to-head competition is accelerating. Although over 200 companies have announced crypto treasury strategies by 2025, covering multiple chains such as BTC, ETH, SOL, BNB, and TRX, funding and valuations are rapidly concentrating on a very small number of companies and assets. BTC and ETH treasuries account for the majority of DAT companies. In each asset class, only one or two companies can truly stand out: MicroStrategy in the BTC sector, Bitmine in the ETH sector, and perhaps Upexi in the SOL sector. The remaining projects struggle to compete at scale.

As Michael Saylor has demonstrated, there are numerous institutional fund managers seeking exposure to Bitcoin. They can't buy BTC directly or hold ETFs, but they can buy MSTR stock. If you can package a company holding crypto assets into their "compliant basket," these funds will be willing to pay $2, $3, or even $10 for an asset that's only worth $1 on paper. This isn't irrational; it's institutional arbitrage.

In the latter half of the cycle, the market will continue to see newer issuers, who will resort to more aggressive corporate finance instruments to pursue greater stock price elasticity. These practices will backfire when prices decline. Arthur Hayes predicts that this cycle will see a major DAT failure similar to the FTX debacle. When this happens, these companies will crash, and their stocks or bonds could experience significant discounts, causing significant market volatility.

Regulators have also noted this structural risk. In early September, Nasdaq proposed strengthening its scrutiny of DATs; today, the SEC and FINRA jointly launched an investigation into insider trading. These regulatory measures are intended to reduce insider trading opportunities, raise the threshold for issuance and raise the difficulty of financing, and thus reduce the room for manipulation by new DATs. For the market, this means that "pseudo-leaders" will be eliminated at an accelerated pace, while true leaders will continue to survive and even grow through narratives.

Summarize

The narrative of crypto-treasury remains, but rising barriers to entry, tightening regulations, and a bubble-clearing process will all proceed simultaneously. Investors must understand the logic and arbitrage paths behind the financial structure, while remaining vigilant to the risks accumulating behind the narrative. Ultimately, this "on-chain alchemy" cannot be played out indefinitely; winners reign supreme, while losers exit.

You May Also Like

Why It Could Outperform Pepe Coin And Tron With Over $7m Already Raised

Today’s Wordle #1552 Hints And Answer For Thursday, September 18th