Solana Price Prediction, And What’s The Best Crypto Investment To Make In 2025

SPONSORED POST*

What’s the best crypto investment? It’s the first question every newcomer asks, and on that search, Solana (SOL) is one of the first names you’ll meet. In this piece, we cut through the noise with a clean, catalyst-driven Solana price prediction for 2026, then translate it into real ROI so you can judge if SOL still fits your strategy. We’ll keep it simple: where Solana can realistically go, what that means for your returns, and, if the math isn’t enough, where smarter capital is looking next.

Here’s the plan: we start with a straight-shot Solana price prediction (key levels, drivers, and risks), stack it against your goals, and ask the only question that matters for the best crypto investment, is the upside big enough to change a portfolio? If not, we’ll follow the big wallets into the corners of the market with more room to run, and show you why that’s where the 100× stories usually begin.

Solana (SOL) Price Prediction: Strong Momentum Could Carry SOL Toward $600

When the talk turns to proven large-caps, Solana (SOL) is one of the first names that comes to mind, so here’s the quick Solana price prediction for 2026: a base case at $260–$350 (retesting or slightly topping the early-2025 ~$293 ATH), a bull case at $450–$600 if spot-ETF access broadens, Firedancer hits mainnet, and on-chain activity accelerates, and a bear case near $150 on risk-off or regulatory/tech setbacks. With SOL hovering in the mid-$240s and still below its peak, steady institutional interest and upcoming network upgrades keep the setup constructive for the next cycle.

Based on this framework, the best-case Solana price prediction tops out near $600, a very optimistic stretch. From today’s $245, that’s only about a 2.45× move; $10,000 at today’s price would be roughly $24,486 at $600, solid, but not the kind of ROI that truly reshapes a portfolio. For context, Solana was a good buy around $0.50: $0.50 → $245 = 490× (a $10,000 stake ≈ $4.9M), $0.50 → $293 (ATH) = 586x. Those life-changing multiples came from being early; from here, SOL is a strong large-cap hold, not a 100× ticket.

Source: CoinMarketCap

That’s why many investors diversify into assets with far more room to grow alongside SOL, aiming to capture bigger upside. Next, we’ll show how to make the best crypto investment, and where those potential 100× shots are most likely to come from.

How To Make The Best Crypto Investment

The answer is simple: Start by educating yourself, learn the market, the cycles, and what actually moves price, then track the big wallets. The same wallets that turned early Shiba Inu investments into millions are the first to spot the next wave (and they often know before headlines hit).

When those wallets accumulate, that’s your signal: act early, before listings and deep liquidity reprice the story.

Right now, those wallets are leaning into Pepeto (PEPETO), quietly, early, and hard. If you want the best shot at asymmetric returns, the playbook is simple: master the basics, watch where proven winners deploy capital, and position before the crowd. Windows like this don’t stay open; once the rush starts, the easy multiple is gone.

Why Big Wallets Are Currently Investing In Pepeto?

At this point, many of you are wondering, why this exact meme coin, why is it that special and can it really deliver those 100x we are all looking for? Well, easy to understand, when you see that Pepeto takes what made old legends like Dogecoin and Pepe explode, energy and speed, and adds what was missing: Technology and Optimization. You can see it in the tools: PepetoSwap and a cross-chain bridgebuilt to fix real trader pain, faster routing, lower slippage, simpler liquidity, smooth moves across chains.

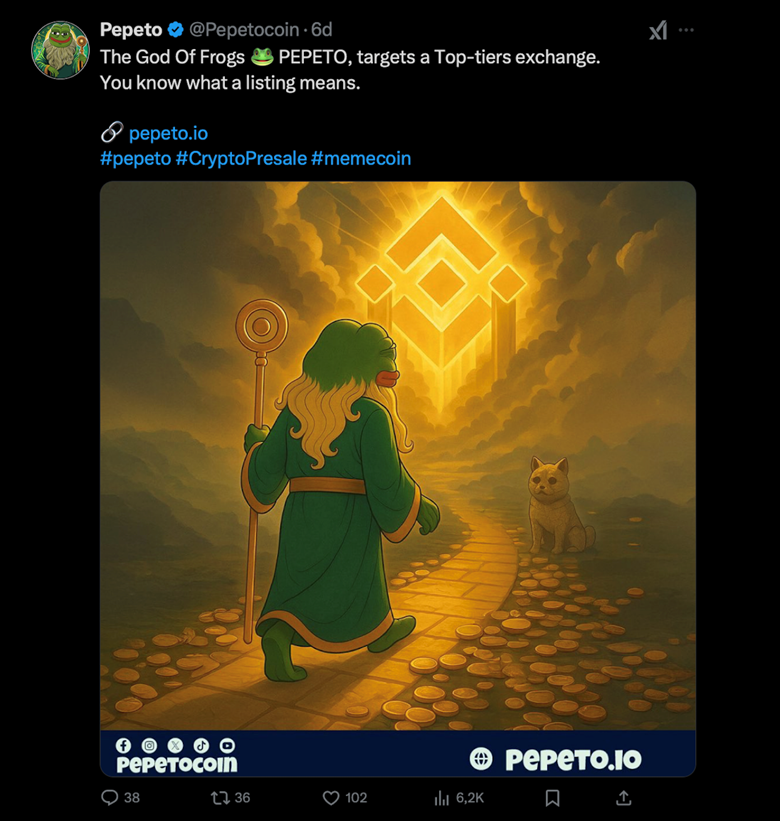

The team also hinted in a recent social post that they’re aiming for a top-tier exchange listing.

The goal is clear: host all memecoins. Already 850+ projects have applied to list, strong demand even before launch, so these are tools traders will actually use. And because every swap touches the PEPETO token, real activity can turn into steady buy-pressure over time.

Think of it as a memecoin engine with rails: culture sparks it, tools keep it rolling. The presale has already crossed $6.78M with a staking APY around 226%, and a current presale price of $0.000000154 that rises each stage. That means the earlier you buy, the lower your entry, and by launch, your stack is already marked higher. It’s utility plus purpose, culture plus tools, designed to run farther than hype alone.

No other meme coin is packing this much practical value right now. Missing this presale at this early stage could be a lifetime regret, especially for smaller investors who’ve waited years for a coin with real utility and the 100× ( $10,000 would turn into 1 MILLION DOLLAR ) potential many analysts are predicting.

Final takeaway

Even if our Solana price prediction plays out and SOL tags the bull-case $600 in 2026, a solid 2–3× from current levels, that’s still not the kind of upside that rewrites a portfolio, and leadership rotates.

If there’s one name set to outshine every other presale in 2025, and deliver outsized returns, it’s Pepeto, the project people will brag they spotted first. With $6.78M+ already raised and the lowest Pepeto price you’ll ever see again live today ($0.000000154, rising each stage), this is the kind of window that rarely opens twice. Don’t miss it, start at the official website now: https://pepeto.io .

Disclaimer : To buy PEPETO Tokens, make sure to use the official website: https://pepeto.io/ As the listing gets closer, some are attempting to take advantage on the hype by using the name to mislead investors with fake platforms. Stay cautious and verify the source.

For More Info About Pepeto, Visit:

Website: https://pepeto.io/

X (Twitter): https://x.com/Pepetocoin

Telegram Channel: https://t.me/pepeto_channel

Instagram: https://www.instagram.com/pepetocoin/

*This article was paid for. Cryptonomist did not write the article or test the platform.

You May Also Like

Russia’s Central Bank Prepares Crackdown on Crypto in New 2026–2028 Strategy

According to Market Analysts This $0.012 AI Token Could Be the Best Investment of the Decade — Ozak AI’s 41,000% Potential Outshines Ethereum’s Early Growth