Memecoin battle: Pepeto vs. DOGE vs. SHIB price forecast for Q3 2025

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

Pepeto gains momentum in Q3 2025 as a utility-focused memecoin, going head-to-head with DOGE and SHIB through staking, bridge tech, and a dedicated exchange

Table of Contents

- DOGE and SHIB stay popular but face instability

- Pepeto positions itself as a utility-first memecoin

- Why Pepeto could leap ahead of DOGE and SHIB in Q3

- About Pepeto

The competition among memecoins is heating up as Q3 2025 begins. While established names like Dogecoin and Shiba Inu continue to capture trader attention, a new challenger, Pepeto, is building momentum with a different approach.

Unlike other tokens that rely solely on social hype, Pepeto is designed as an integrated ecosystem, merging real technology with structured tokenomics. Instead of simply capitalizing on internet trends, it focuses on delivering ongoing utility and confidence to long-term holders.

As DOGE and SHIB depend mainly on market speculation and their loyal communities, Pepeto seeks to reset expectations for what a memecoin can achieve.

DOGE and SHIB stay popular but face instability

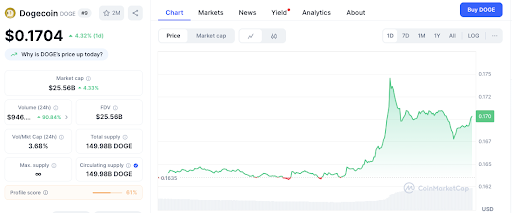

Dogecoin has recently moved higher, trading at $0.1689 after climbing 3.91% in one day. It attempted to break through $0.175, met resistance, and has now settled near the $0.1650 support range.

Trading volume spiked 82.68%, underscoring strong buyer interest. If momentum holds, the next level to watch is $0.180, which may act as psychological resistance.

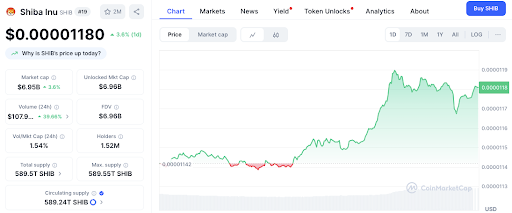

Shiba Inu is also benefiting from renewed optimism. Its price has risen to $0.00001177, up 3.53% over 24 hours. SHIB recently broke out of a consolidation phase, reaching $0.00001190 before retracing slightly. It remains supported around $0.00001150, with elevated trading suggesting a potential second leg upward.

Though both DOGE and SHIB have posted gains, their price action still hinges on short-term speculation rather than the clear frameworks driving Pepeto’s strategy.

Pepeto positions itself as a utility-first memecoin

Starting with a presale price of $0.000000139, Pepeto has already attracted over $5.52 million in early funding. Unlike typical meme coins that trade on hype alone, Pepeto incorporates a thoughtful utility component.

Central to the project is a staking model offering an annual yield of 270%, motivating holders to lock up tokens for sustained returns. This approach helps maintain stability and minimizes sudden sell-offs.

Beyond staking, Pepeto’s standout features include a dedicated memecoin exchange and a blockchain bridge for seamless cross-chain transactions and swaps.

Why Pepeto could leap ahead of DOGE and SHIB in Q3

Pepeto sets itself apart with a clear, phase-based roadmap that guides every stage of development. Its launch strategy includes smart contract audits, staking features, AMAs, and large-scale listings across multiple exchanges.

Phase three will see the debut of its exchange and bridge platform, unlocking real-time trading and liquidity transfers. Phase four will roll out staking services alongside a global marketing effort.

Compared to DOGE and SHIB both largely fueled by community sentiment, Pepeto offers measurable value. Allocating 30% of tokens for staking, 30% for presale buyers, and maintaining reserves for liquidity and promotion shows intentional planning. With over 31 trillion PEPETO tokens staked already, the project has proven early backing and trust.

About Pepeto

Pepeto is an innovative cryptocurrency project combining memecoin culture with a robust, utility-focused ecosystem. It provides a zero-fee exchange, a cross-chain bridge for frictionless swaps, and staking rewards to fuel the next wave of meme coins.

To learn more about Pepeto, visit its website and socials.

Disclosure: This content is provided by a third party. crypto.news does not endorse any product mentioned on this page. Users must do their own research before taking any actions related to the company.

You May Also Like

Nasdaq-listed GameSquare Secures $8M to Initiate $100M ETH Treasury

OpenSea acquires Rally Wallet to expand mobile and token trading capabilities