Iran Unleashes Missile Blitz on Israel—Dow Tanks Over 800 Points

On Friday, around 2 p.m. Eastern time, reports show that Iran has begun counterstrikes firing “hundreds” of ballistic missiles toward Israel.

Wall Street Sinks as Israel-Iran Conflict Erupts in Missile Onslaught

CNN reported that the Israeli military said it identified incoming missiles launched from Iran, and the news station heard the explosions in Tel Aviv and Jerusalem.

The retaliation follows the airstrikes against Iran by Israeli forces on Thursday evening. Social media reports note that due to the over 100 ballistic missiles shot, “Israel’s air defenses were overwhelmed, failing to stop them all.”

“The attack is ongoing. Dozens of additional missiles were launched toward the State of Israel,” the IDF reported this afternoon according to CNN’s report on Friday.

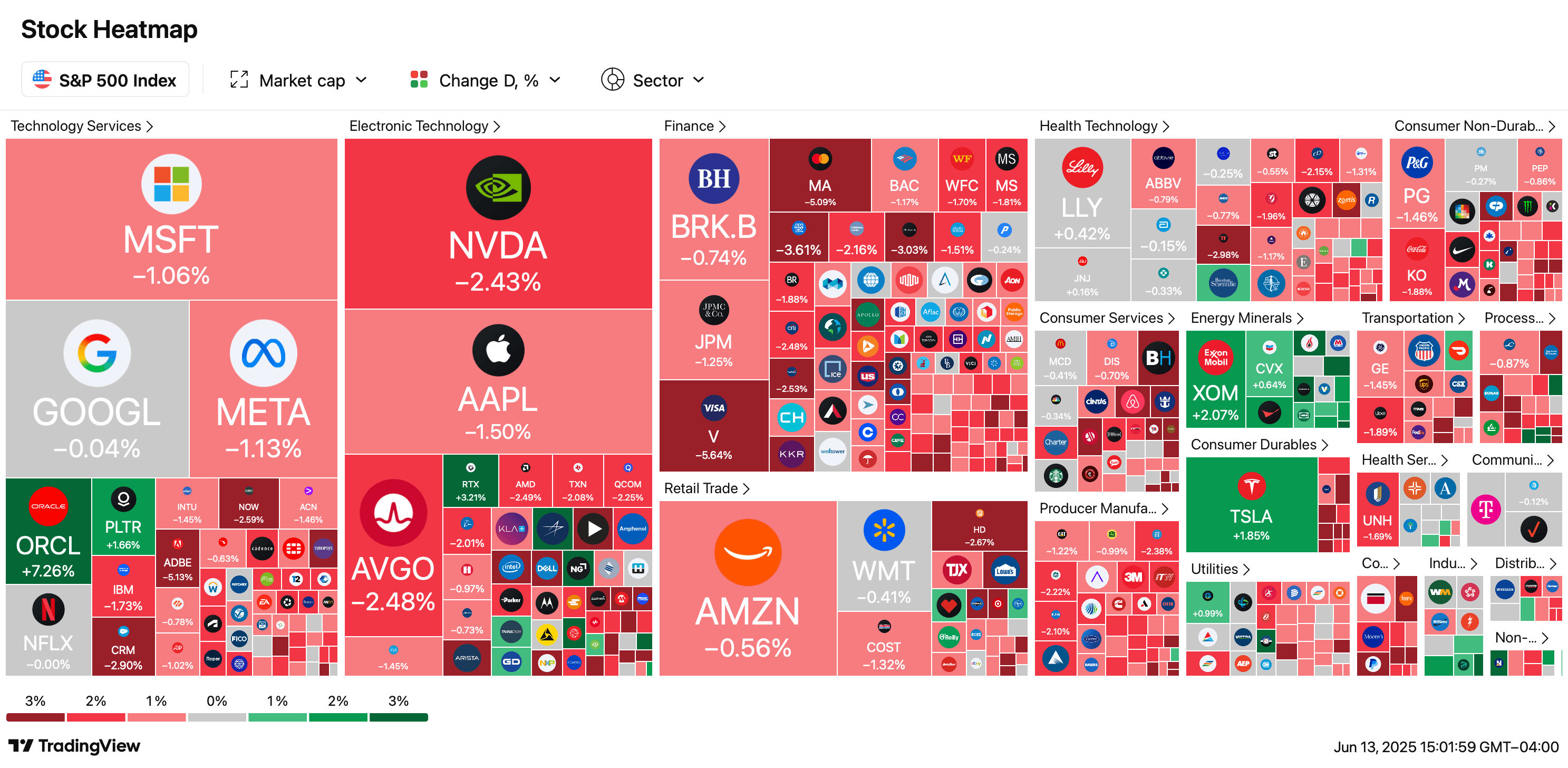

Amid the conflict, U.S. stock markets slipped across the board, with all major indexes posting significant losses. The Dow Jones Industrial Average led the drop, falling 1.99% to 42,111.41. The Nasdaq Composite declined 1.39%, coasting along at 19,389.62, while the S&P 500 shed 1.24%, at 5,970.00 by 3 p.m. ET.

The NYSE Composite also held lower, down 1.11% at 19,974.46. Each index shows a steep afternoon sell-off, contributing to a red day on Wall Street. Additionally, yields on 10-year U.S. Treasuries edged higher, joined by a similar uptick in 30-year notes and long-duration sovereign bonds abroad.

Although bitcoin ( BTC) briefly dipped beneath the $105,000 threshold, it clawed its way back into that range within an hour after the ballistic missile strike.

You May Also Like

Vietnam legalizes crypto under new digital technology law

Consensys founder: ETH has been discussed frequently recently due to the improvement of the US regulatory environment