Crypto Exec Warns MEV Hinders Institutional DeFi Growth and Harms Retail Users

Certainly! Here’s a refined and rewritten version of the article, with a brief introduction, key takeaways, and preserved HTML structure tailored for a reputable publication on crypto markets and blockchain.

—

Maximal Extractable Value (MEV) continues to pose significant barriers to mainstream adoption of decentralized finance (DeFi), particularly by institutional players. Experts argue that privacy-preserving transaction processing could be key to mitigating MEV’s harmful effects, reducing front-running, and fostering a more accessible and equitable crypto ecosystem for retail users.

- MEV enables miners and validators to reorder transactions for profit, hindering DeFi growth and retail participation.

- Implementing privacy-focused transaction mechanisms could eliminate front-running and sandwich attacks.

- Institutional involvement in DeFi is limited due to transparency risks, impacting overall market liquidity and stability.

- Addressing MEV is crucial to fostering fair, decentralized, and resilient crypto markets.

Maximal Extractable Value (MEV), the practice where miners or validators reorder transactions to maximize profits, continues to obstruct broader adoption of decentralized finance (DeFi). According to industry expert Aditya Palepu, CEO of DEX Labs, this phenomenon hampers both institutional participation and retail user experience, creating a barrier for DeFi’s mainstream growth.

Palepu explains that all electronically traded markets face similar issues stemming from information asymmetry, which allows for exploitative tactics like front-running. The solution, he suggests, involves processing transactions within trusted execution environments—technology that keeps order flow data hidden until execution, thus preventing market manipulation.

A simplified visual of the MEV supply chain. Source: European Securities and Markets AuthorityThis type of privacy preservation effectively eliminates front-running strategies, including sandwich attacks, which manipulate prices by placing trades immediately before and after user transactions for profit. As a result, markets become fairer and less susceptible to manipulative practices.

The ongoing debate within the crypto industry centers around the potential centralization risks, increased costs, and the broader implications of MEV on market stability and scalability. Industry stakeholders are exploring solutions such as batched threshold encryption to make DeFi more equitable and secure.

Institutional reluctance hampers the growth of DeFi for retail investors

One of the primary reasons institutions shy away from DeFi is the lack of transaction privacy. As Palepu notes, transparency in blockchain transactions exposes institutions to front-running, market manipulation, and increased risks, discouraging their active participation.

“When institutions cannot participate effectively, it negatively impacts retail users and the broader market,” he emphasizes. Institutional involvement is vital for developing the robust trading infrastructure necessary for healthy financial markets that underpin DeFi ecosystems.

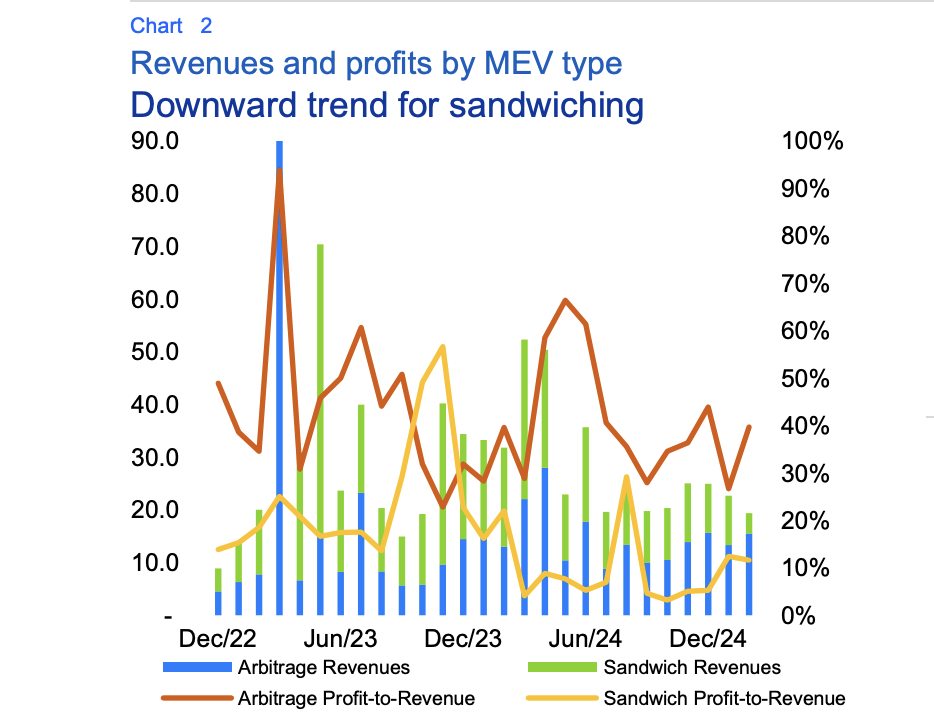

Revenues generated through various MEV techniques. Source: European Securities and Markets Authority

Revenues generated through various MEV techniques. Source: European Securities and Markets Authority

Without institutional participation, liquidity can decline, market volatility may spike, and the potential for price manipulation increases, creating risks for retail investors. Additionally, high transaction costs and reduced market diversity can hinder DeFi’s potential to become a fully-fledged alternative to traditional finance.

Addressing MEV concerns and enhancing transaction privacy are seen as foundational steps toward a fairer and more sustainable crypto ecosystem, encouraging greater institutional confidence and retail engagement, and ultimately fostering more resilient blockchain markets.

—

This article was originally published as Crypto Exec Warns MEV Hinders Institutional DeFi Growth and Harms Retail Users on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

Kalshi Jumps to 62% Market Share While Polymarket Eyes $10B Valuation

Low Cap ICOs to Watch This November 2025: Bitcoin Hyper, Pepenode, and Maxi Doge