Crypto.com Wants a National Trust Bank License – What Would a Federal License Really Change?

Crypto.com has officially filed an application with the U.S. Office of the Comptroller of the Currency (OCC) for a National Trust Bank Charter, a move that could place the company among a small group of crypto firms seeking federal recognition in banking.

The filing marks a major step in the exchange’s long-term effort to expand its regulated financial services footprint in the United States.

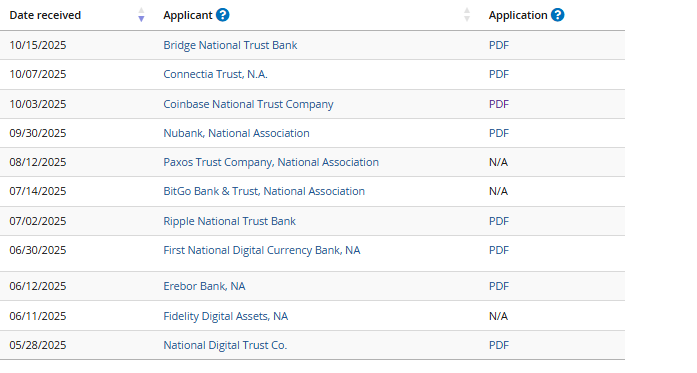

Crypto.com Joins a Growing List of Firms Pursuing a Federal Charter

In its announcement, Crypto.com said the charter would allow it to advance its custody and staking technology while offering services across multiple blockchains, including its native Cronos network.

The company emphasized that a federal license would position it as a trusted custody destination for digital asset treasuries, exchange-traded funds (ETFs), and institutional investors, all under the oversight of a U.S. federal regulator.

“Building the Crypto.com product and service portfolio through regulated and secure offerings has been our focus since day one,” said Kris Marszalek, the firm’s co-founder and CEO.

Marszalek described the new filing as a natural progression in Crypto.com’s mission to build secure, compliant, and institutionally friendly crypto infrastructure.

Crypto.com now joins an elite list of firms, including Coinbase, Circle, Paxos, Stripe, Ripple, Sony, and others that have submitted similar applications.

Source: OCC

Source: OCC

Anchorage Digital Bank is the only firm to hold a federal trust charter. The firm secured its license in 2021 but faced compliance challenges that led to a temporary cease-and-desist order in 2022, later lifted this August.

Why Are Crypto Companies Racing to Secure National Bank Charters?

The OCC, which operates as an independent bureau within the U.S. Treasury, is the only agency authorized to issue national bank charters.

These licenses allow companies to operate banking and fiduciary services across all 50 states under one legal framework.

For digital asset firms, a federal charter is seen as a gateway to legitimacy, providing access to Federal Reserve payment systems, including Fedwire, and preempting complex state-by-state regulation.

A National Trust Bank Charter, unlike a traditional banking license, allows firms to engage in fiduciary activities, such as asset custody and investment management, but prohibits them from accepting demand deposits or issuing general-purpose loans.

This structure keeps them outside the Bank Holding Company Act, avoiding Federal Reserve oversight while remaining under the OCC’s supervision.

The surge in the number of crypto firms pursuing this license can be attributed to the OCC’s current leadership, which has shown renewed openness to digital asset activity.

Under Comptroller Jonathan Gould, a former blockchain executive confirmed earlier this year, the agency has issued new guidance allowing national banks to buy, sell, and custody crypto for clients, provided they meet strict safety and risk standards.

In recent months, the OCC has granted conditional approval to Erebor Bank, a digital-first institution backed by Peter Thiel and Palmer Luckey, suggesting that regulators are once again willing to test responsible crypto banking models.

Gould has stated publicly that the OCC “does not impose blanket barriers” on banks pursuing digital asset activities, a shift from the regulator’s previously cautious stance following the 2023 collapse of several crypto-friendly banks.

This week, he also rejected fears that stablecoins could trigger sudden banking crises, calling the risk of large deposit runs “overstated.”

Path to Federal Charters Narrows as Banking Groups Urge OCC to Halt Crypto Applications

Still, the path to a federal charter remains far from straightforward. The OCC has received more than 16 applications from fintech and crypto firms seeking national trust status, but only one has been approved to date.

Many have stalled amid lobbying from traditional banking groups, who argue that crypto companies do not yet meet the fiduciary standards expected of national trust banks.

In July, the American Bankers Association (ABA), joined by other banking and credit union associations, sent a letter urging the OCC to pause crypto-related charter approvals.

The group expressed concerns about limited transparency in applications from firms like Ripple and Circle, arguing that many crypto businesses primarily offer custody and staking services rather than traditional fiduciary duties such as estate or trust management.

The letter warned that approving such applications would represent “a fundamental departure” from the OCC’s chartering framework and could weaken the safeguards that underpin the U.S. banking system.

Regulatory caution also stems from broader concerns over anti-money laundering (AML) compliance and risk transparency.

The OCC has maintained that applicants must demonstrate robust governance, capital adequacy, and internal controls before receiving approval.

While the agency has grown more open under Gould’s leadership, approvals remain slow as regulators test new supervisory models for digital asset institutions.

You May Also Like

VivoPower To Load Up On XRP At 65% Discount: Here’s How

UK and US Seal $42 Billion Tech Pact Driving AI and Energy Future