Capital Group Becomes Largest Metaplanet Shareholder with 11.45% Bitcoin Treasury Stake

Capital Group has emerged as the largest shareholder in Japan’s Metaplanet Inc, acquiring an 11.45% stake worth nearly $500 million through its subsidiary Capital Research and Management Company.

The investment positions the $2.6 trillion asset management giant with significant exposure to Bitcoin through Asia’s most aggressive corporate treasury strategy.

Wall Street Giant Bets Big on Bitcoin Treasury Revolution

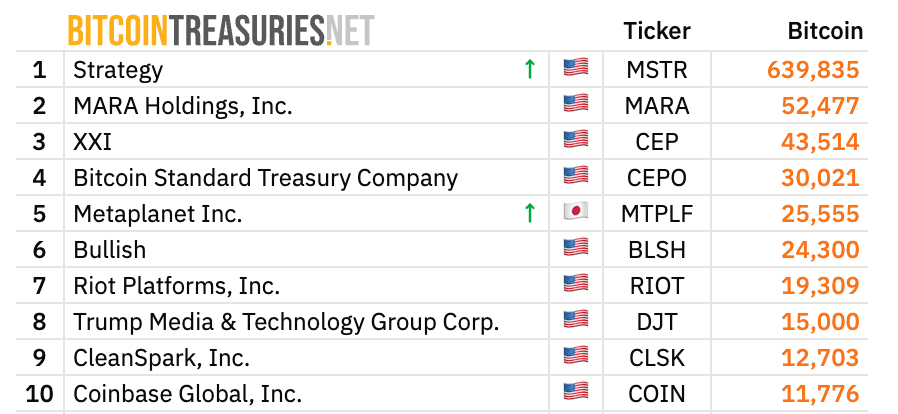

Metaplanet currently holds 25,555 Bitcoin worth $2.71 billion, making it the fifth-largest corporate Bitcoin holder globally behind MicroStrategy’s 639,835 BTC.

Source: Bitcoin Treasuries

Source: Bitcoin Treasuries

The Tokyo-listed company has transformed from a struggling hotel operator into Asia’s premier Bitcoin treasury firm under the leadership of CEO Simon Gerovich.

Capital Group’s ownership increased from 8.31% in August to 11.39% by September 17, surpassing the previous largest shareholder, National Financial Services LLC.

The timing coincides with Metaplanet’s recent $632 million Bitcoin purchase, adding 5,419 coins at an average price of $116,724.

The investment marks Capital Group’s calculated expansion into crypto exposure through equity stakes rather than direct Bitcoin holdings.

The firm previously built positions in MicroStrategy and other Bitcoin-focused companies, growing its crypto-related investments from $1 billion to over $6 billion under portfolio manager Mark Casey.

Capital Group was founded in 1931 and has historically maintained conservative investment approaches while managing American Funds and serving institutional clients worldwide.

Asia’s Bitcoin Treasury Pioneer Faces Scaling Challenges

Metaplanet executed Japan’s most ambitious corporate Bitcoin strategy, increasing holdings from 4,525 BTC in April to over 25,000 BTC as of now, through aggressive capital raising.

The company’s “555 Million Plan” aims to target 210,000 BTC by 2027, representing approximately 1% of the total Bitcoin supply.

Recent financing included a $1.45 billion international share offering, completed earlier this month, which issued 385 million shares to fund additional purchases.

Eric Trump joined the company’s advisory board in March and appeared at shareholder meetings held earlier this month to support the Bitcoin-focused strategy.

The transformation generated extraordinary returns with a 395.1% Bitcoin yield year-to-date, making Metaplanet the best-performing stock among Japan’s 55,000 publicly listed companies in 2024.

Shareholder count surged over 1,000% to 128,000 individuals.

However, operational challenges have recently emerged, as the stock has declined 54% since its June peak, despite Bitcoin gaining 2% during the same period.

Similar to Metaplanet, Strategy’s stock also currently trades near five-month lows, falling to $323 last week, despite only an 8% drop in Bitcoin from its recent peak.

The company’s “flywheel” financing mechanism using moving strike warrants showed signs of strain as premium compression reduced accumulation capacity.

Metaplanet generated ¥1.9 billion in revenue from Bitcoin options trading during Q2 2025, addressing Bitcoin’s yield-free nature through covered call writing and volatility strategies.

The options business contributed ¥816 million in operating profit, accounting for 68% of the total revenue of ¥1.2 billion.

Traditional Finance Embraces Corporate Crypto Treasury Model

Capital Group’s investment validates the corporate Bitcoin treasury model pioneered by MicroStrategy and adopted across Asia.

Over 190 public companies now hold Bitcoin on their balance sheets, totaling more than $115 billion in combined holdings.

The investment firm’s approach involves indirect crypto exposure through equity stakes in Bitcoin-holding companies rather than direct crypto purchases.

Institutional adoption accelerated as governments have also created supportive policies.

For instance, Japan’s proposed tax reforms could reduce corporate crypto capital gains rates from 55% to 20%, encouraging additional treasury adoptions among Tokyo-listed firms.

Due to the increased regulatory appetite, the global corporate Bitcoin movement has grown to 335 entities, which collectively control over $421 billion in holdings.

However, analysts warn that most participants face sustainability challenges during credit cycles, particularly those without yield-generation capabilities.

In fact, recent Coinbase research claims the era of easy money for crypto treasuries has ended, and now, as companies are in a ‘player vs player’ competition.

The research identifies that most of these crypto treasuries have to transition and move beyond simple MicroStrategy copycat strategies toward execution-dependent success.

For Metaplanet, its international profile grew through strategic partnerships and high-profile endorsements.

The company’s transformation from a hospitality to a digital assets business has now become a template for corporate treasury pivots in emerging markets.

At the time of publication, Bitcoin is trading near $111,500, following recent market volatility.

You May Also Like

Shiba Inu (SHIB) May Break Back into the Top 10, But Mutuum Finance (MUTM) at $0.035 is Poised to be the Next Big Crypto

Revolutionary: Perplexity’s $400M AI Search Deal Transforms Snapchat for 940 Million Users