Brazil’s Braza Bank Completed $1B in Stablecoin Payments on the XRP Ledger

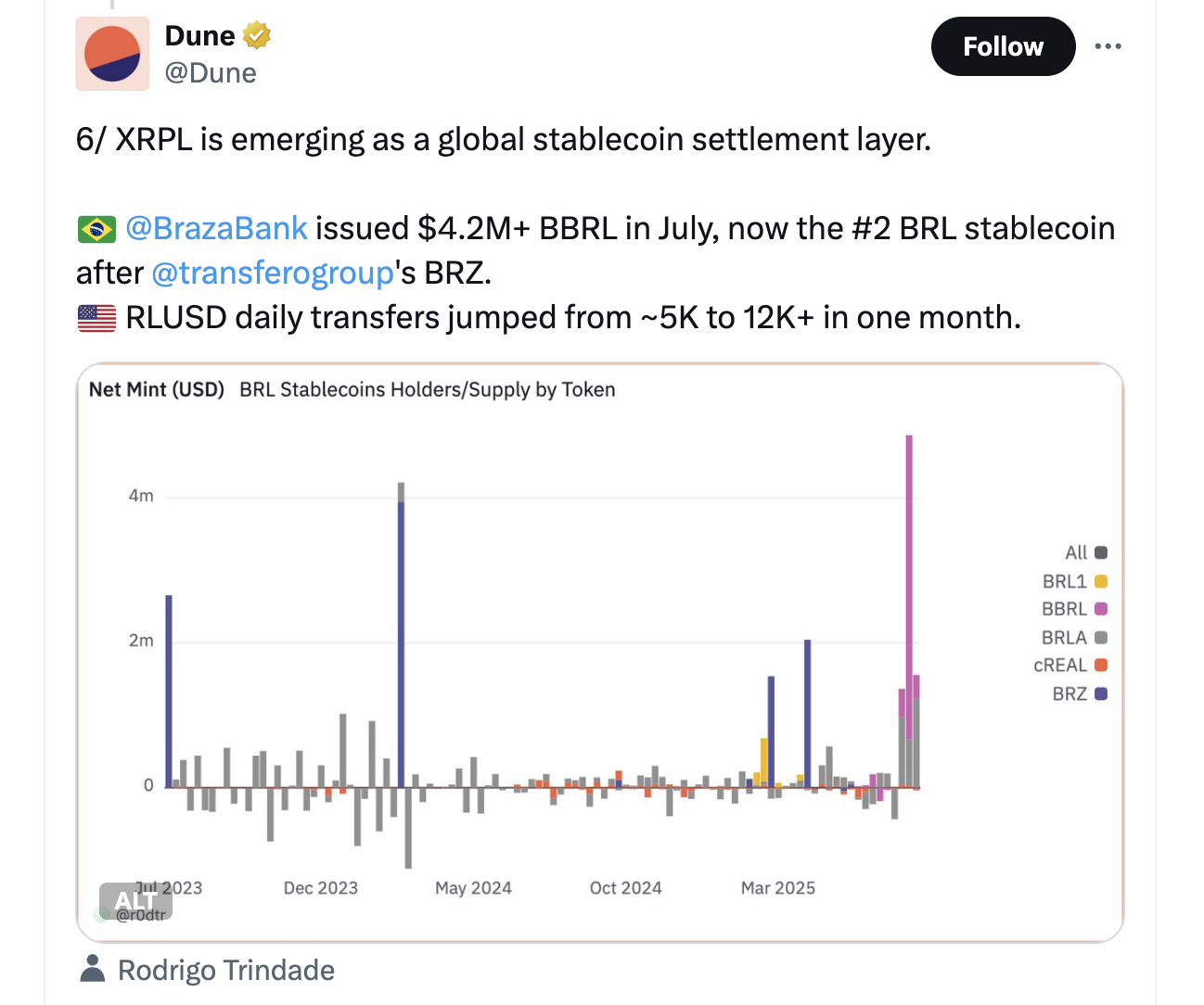

The Brazilian Real stablecoin BBRL, issued by Braza Bank on the XRP Ledger (XRPL), reportedly processed $1 billion in customer payments during Q3 2025. Notably, the achievement was highlighted by Stake City founder Luke Judges on X on Thursday. He noted that the growth shows how XRPL-based assets are addressing real-world challenges for financial institutions. $1B in Stablecoin Payments Using BBRL on XRP Ledger While Judges did not share a source confirming that Braza Bank processed $1 billion in stablecoin payments on XRPL in Q3, the claim largely aligns with figures Ripple reported in an official statement in May. Notably, Ripple’s statement announced Braza Bank’s further stablecoin expansion on XRPL, which included the launch of USDB. In the announcement, Ripple stated that Braza processed $1.079 billion (nearly BRL 6 billion) in a single day this April. BBRL is part of Braza Group’s broader strategy to integrate traditional finance with blockchain infrastructure. The coin launched earlier in 2025. Shortly after, the bank also introduced USDB, a dollar-pegged stablecoin backed by U.S. and Brazilian government bonds. Both stablecoins are on XRPL. It gives Braza a scalable framework to support cross-border transactions, mass payouts, and settlements for businesses. In July, Braza Bank minted over $4.2 million in BBRL. This further confirms increased use of the XRP Ledger for cross-border payments and real-world asset settlements.  $4.2 million BBRL Minted on XRP Ledger Notably, the bank reported a balance sheet of more than $500 million as of 2024 and ranks sixth in Brazil’s interbank market. Euro Stablecoin on the Horizon Meanwhile, Judges also revealed that Braza has a "line of sight" to a euro-denominated stablecoin, which he believes could achieve similar transaction volumes soon. This suggests the bank is preparing to expand its offering beyond the Brazilian Real and U.S. Dollar. Such a move would position Braza to manage BRL, USD, and EUR stablecoins simultaneously on the XRPL. This will establish a robust on-chain infrastructure for global currency flows. Ripple’s Role in Brazil’s Stablecoin Push Ripple executives have emphasized the XRPL’s role in enabling compliant, reliable, and efficient tokenization at scale. According to Ripple’s LATAM Managing Director Silvio Pegado, the ledger’s features are designed to support regulated financial institutions like Braza as they move billions across borders. The partnership forms part of an effort to modernize Brazil’s financial system. Braza is also participating in the Brazilian Central Bank’s DREX project, which explores integrating blockchain with traditional banking infrastructure. Braza Bank’s Outlook for 2025 and Beyond Notably, Braza CEO Marcelo Sacomori has projected that USDB could capture 30% of Brazil’s USD-pegged stablecoin market by 2026. Sacomori believes stablecoins will dominate global foreign exchange within five years, with Braza positioning itself to lead the transition.

$4.2 million BBRL Minted on XRP Ledger Notably, the bank reported a balance sheet of more than $500 million as of 2024 and ranks sixth in Brazil’s interbank market. Euro Stablecoin on the Horizon Meanwhile, Judges also revealed that Braza has a "line of sight" to a euro-denominated stablecoin, which he believes could achieve similar transaction volumes soon. This suggests the bank is preparing to expand its offering beyond the Brazilian Real and U.S. Dollar. Such a move would position Braza to manage BRL, USD, and EUR stablecoins simultaneously on the XRPL. This will establish a robust on-chain infrastructure for global currency flows. Ripple’s Role in Brazil’s Stablecoin Push Ripple executives have emphasized the XRPL’s role in enabling compliant, reliable, and efficient tokenization at scale. According to Ripple’s LATAM Managing Director Silvio Pegado, the ledger’s features are designed to support regulated financial institutions like Braza as they move billions across borders. The partnership forms part of an effort to modernize Brazil’s financial system. Braza is also participating in the Brazilian Central Bank’s DREX project, which explores integrating blockchain with traditional banking infrastructure. Braza Bank’s Outlook for 2025 and Beyond Notably, Braza CEO Marcelo Sacomori has projected that USDB could capture 30% of Brazil’s USD-pegged stablecoin market by 2026. Sacomori believes stablecoins will dominate global foreign exchange within five years, with Braza positioning itself to lead the transition.

You May Also Like

MYX Finance price surges again as funding rate points to a crash

Ethereum’s ERC-8004 Brings AI-Driven Economic Potential