Exclusive interview with Sasha, founder of Notcoin: It’s no longer just a game, it’s a community and culture, and point-to-point games that try to copy usually fail

Author: Weilin, PANews

"Tap to earn" point-earning games are undoubtedly one of the hot trends in the crypto market this year, successfully driving the popularity of Telegram and the TON blockchain network. For example, Hamster Kombat claimed to have attracted more than 300 million players before the airdrop in September. Tracing back to the source of this craze, the tap to earn game Notcoin, which was launched on January 1 this year, is undoubtedly the ancestor of tap to earn games on Telegram. Its token NOT, launched in May, once had a market value of nearly 3 billion US dollars in June.

On November 1, PANews interviewed Sasha Plotvinov, the founder of Notcoin, during the TON Ecosystem Conference The Gateway in Dubai, discussing Notcoin’s founding concept, token price fluctuations, the current status of the TON ecosystem, and how Notcoin can maintain sustained growth in a highly competitive market.

Sasha said that simply copying other people's gameplay is actually difficult to succeed. Notcoin now also plays the role of a game publisher. He believes that by focusing on the community, Notcoin has enough depth to become a culture, in fact a "cult". The key to achieving large-scale adoption of Web3 is first to eliminate all barriers to entry, second to viral mechanisms, and finally, to maintain a real and personalized experience for the product.

Challenges for product managers: Unexpectedly, Notcoin crashed on the second day after launch

Sasha started his career as a product manager, where he learned many valuable lessons. He mentioned that the biggest challenge he encountered early on as a product manager was that not everything he could think of would work as expected after release. Many assumptions actually didn’t work. And that’s okay, this “uncertainty” is an inevitable part of the development process.

He recalled that on January 2, the day after Notcoin was released, the application was down almost all day due to popularity. The team worked from 8 am to 11 pm to try to solve the problem, but failed. The next day, the application still did not work properly. "We were thinking: 'What should we do?' But we also learned a lot. So, you can say that we did expect this goal, but we didn't expect it to happen in this way," said Sasha. "To be honest, we had no experience with high-traffic applications before Notcoin, so we had to learn and deal with it ourselves when everything collapsed."

Looking back at the history of Notcoin, it was first launched in closed beta within Telegram in November 2023. Initially, the game was marketed as a meme coin with no clear purpose, just to become a temporary viral phenomenon. At that time, Notcoin attracted more than 650,000 users in a few weeks. After Notcoin was officially launched on January 1 this year, more than 5 million players joined in the first week alone.

In the first quarter of this year, Notcoin drove the popularity of Telegram and TON. Now Telegram has hundreds of millions of monthly active users, and TON currently has millions of users. In fact, when founding Notcoin, Sasha and his team actually spent a long time thinking about how to establish a certain connection and how to guide some users to another platform.

They tried a lot of different approaches, but at some point they realized that they just needed to remove all the barriers to entry. For Telegram users, entering Web3 does not require complicated processes such as wallets and gas fees. Users can start playing directly. When they have income, they will be more motivated to explore the overall ecosystem of encryption and Web3. Sasha thinks this is some kind of innovation because many Web3 games at the time were too complicated for newcomers.

Sasha and his team decided to make the process as simple as possible. "We understand that people like to mine or earn tokens, so I don't think tapping is the key point here, the key point is more like a mechanism that is suitable for mining. Mining can be done in many ways. We understand that people like to see their balance grow, so why not let them see it? At some point, we will tell them: 'If you want to mint your balance now, you can do so at any time.' I think this is the turning point."

Seeing the powerful social attributes of Telegram, they believe that the TON ecosystem is still a blue ocean

Notcoin has become a powerful Web3 technology application scenario on the TON network. When talking about why he chose to develop on the TON network, Sasha said that this decision stems from the strong social attributes and openness of the Telegram platform itself. Telegram provides a unique ecosystem that allows encrypted applications and mini-games to be directly embedded in the platform.

“The opportunity is very clear. There’s no ‘secret sauce’ or anything like that. We just spent enough time looking at the fundamentals to understand the opportunity here.”

Three years ago, when there were almost no projects on TON, no smart contracts, tokens or NFTs, Sasha saw the opportunity on TON. "You can imagine it as a naked chain with no activity. It is precisely because we started at that time that we have established close relationships with the foundation and other projects. All the teams built on TON are our friends, and obviously, we all started small. We all started in an environment that has never been optimistic until everyone discovers its potential now."

In his opinion, if you want to develop a game now, such as publishing it on the App Store or Google Play Store, you will face many competitors, all vying for the attention of users. This makes it very difficult to stand out there. But on Telegram, it is now easy to launch something that can find product-market fit, and users will like it, use it, and even be willing to pay for something they like. "This is really a blue ocean, and there are almost no competitors here at the moment. It is very advantageous to be the first to enter the game," he said.

About NOT tokens: The issuance is very decentralized and difficult for whales to manipulate

In May this year, NOT was launched on Binance, which attracted widespread attention in the market and pushed up trading volume significantly. But recently, the price of NOT has experienced a pullback. In addition, for the price fluctuations, are there any known supporters or "whales" intervening to stabilize the price?

In response to this question, Sasha said that it is basically difficult for whales to manipulate the price of Notcoin, because Notcoin's issuance is very widespread and decentralized, which means that there are a large number of users, 11.5 million people have received tokens. This means that many users hold very small shares of tokens. To manipulate the price, you must be a super whale, such as someone who holds more than 100 million US dollars, and you must be crazy enough to buy tokens without fully understanding them. "Whales usually prefer VC coins because they can control a lot of things there and understand all the distributions, including lock-up periods, etc. Notcoin has no lock-up period, and all tokens are distributed at the beginning."

Sasha said, “The highest trading volume was about 4.5 billion in 24 hours. How much money is needed to manipulate the price of such a high-risk asset? It’s almost unbelievable.”

Sasha explained that the market reaction to NOT in the summer was neither particularly active nor particularly cold. He believes that this is because many people are hesitant. "Recently France decided to arrest Pavel Durov for some strange reasons. I think for some investors, they see it as a risk. Once he is released, the TON ecosystem is expected to grow because it will reduce the risk for investors and businesses."

The development of Notcoin has not always been smooth sailing. Previously, it was reported that Sasha's team announced in an AMA that NOT's community allocation share was 95%, but later project announcements showed that the community share was 78%. Sasha clarified this. "First of all, when people play games, they earn some Notcoin. On the first day of TGE, we basically distributed 78% of the tokens to these players. The rest was distributed through channels such as Binance Launchpool, OKX Launchpool, and Bybit Launchpool, with a rough proportion of: Binance 4%, OKX 1.5%, and Bybit 1.5%. In addition, we have also launched activities through some wallets, such as Telegram wallets, which are about 1% to 2%. Together with all these incentive competitions, this is part of the listing process."

“You always need to help traders on the exchange explore your product in some way. So, basically, Launchpool is the most efficient way to do that. That’s how we distribute most of the tokens. We also burn some tokens, and we end up keeping about 5% of the tokens for the future years of the project. Allowing us to continue to build and make sure that even if we go into a bear market tomorrow, etc., it still makes sense to continue to build the project for the next few years.”

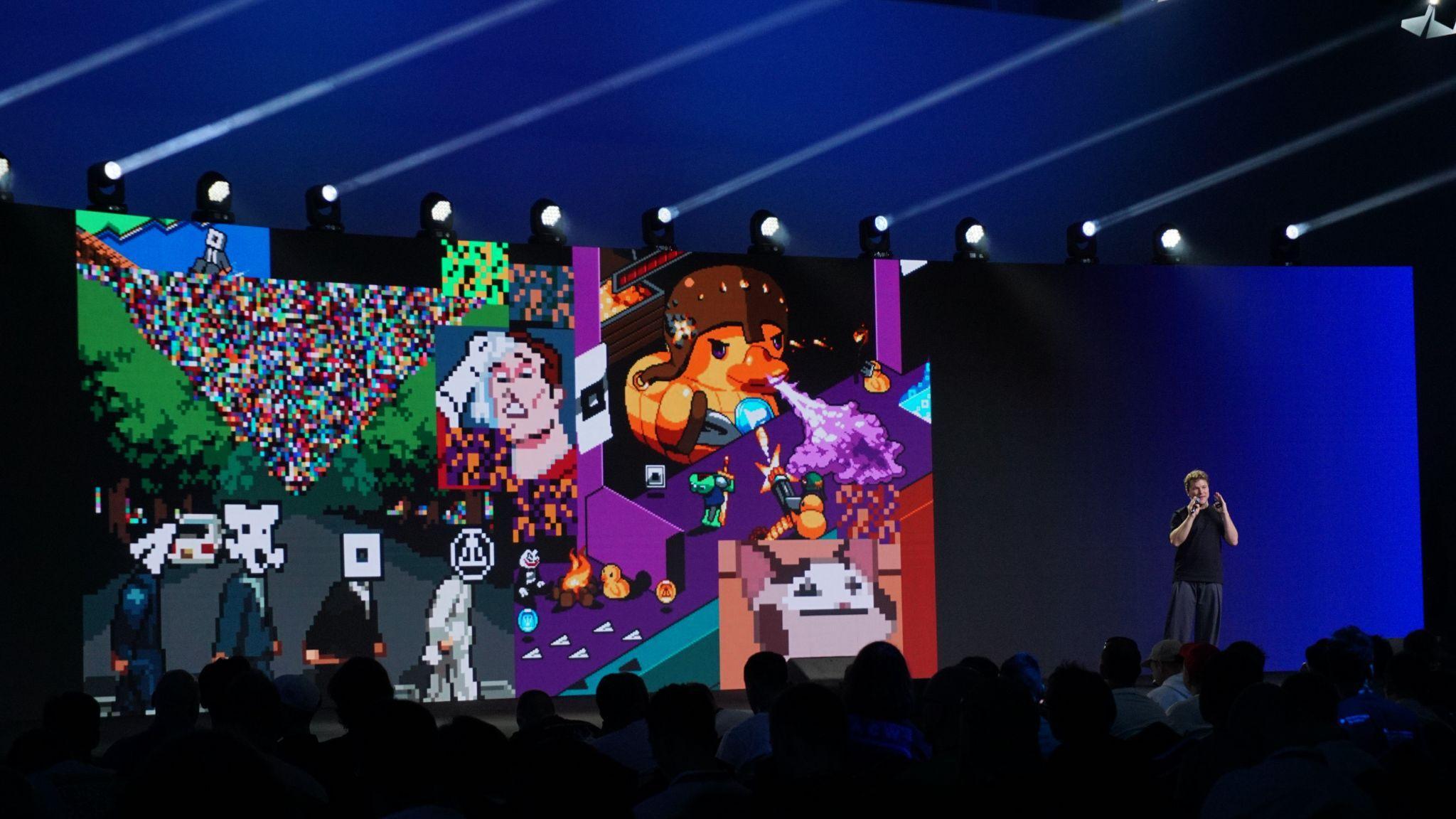

Sasha introduces Not Pixel at TON Ecosystem Conference The Gateway 2024

The future of Notcoin: Becoming a culture

The popularity of some point-to-earn games has faded, and it is becoming difficult for them to retain users, which is another topic of concern in the market recently.

Sasha shared his thoughts on this. "I think that games that try to copy other approaches usually fail because people are smart enough not to play 'another tap to earn' game. People want fun, they want emotional experiences, but they also want some real experiences. If you just copy something, people might think: I've seen that, I don't like it, I don't want it."

Specifically, Notcoin does not have a specific roadmap. Currently, Notcoin has launched Phase 3, with more mini-games launched, such as the pixel earning game Not Pixel, which attracted more than 20 million users in a few weeks.

Sasha emphasized that Notcoin is no longer just a gaming application, it has become a community with depth. By collaborating with multiple gaming projects, Notcoin is able to return more value to its core community members. "What we are doing now is basically putting Notcoin holders and the Notcoin community at the center. This means that every game that is now working with Notcoin is contributing to the core Notcoin community."

Sasha mentioned that, for example, 20% of Not Pixel’s tokens will be distributed to Notcoin holders and the Notcoin community. We hope to make it more attractive from a product perspective, more like a game profile or something like that, where you have your own avatar, custom background, and can play different games. For example, if you play Not Pixel, let’s say you complete your first 100 pixel painting, we will give you some achievement rewards and eventually make you part of a more core community member.”

Notcoin is not only building around the community, but has gradually integrated into the role of a game publisher. "We help other games, only two games at the moment, and we help them build the right content and release them smoothly. We will make sure to introduce them to our community, and we will also provide help from the construction perspective, whether it is code or many other things. But in turn, every game release will contribute to the Notcoin community."

Sasha believes that Notcoin was originally an application, but now Notcoin is no longer just an application, it is a community. "You can think of it as something like 'Bored Ape'. It can be very broad, even including restaurants, burgers and the like. Sometimes, the entire ecosystem can be broad. Notcoin has enough depth to become a culture, in fact a 'cult'. , for some of us. In a good way, when people feel that the values in Notcoin resonate with them.”

The key to mass adoption: removing barriers to use and adopting viral mechanisms

Although Notcoin is currently based on the TON ecosystem, Sasha said that the team does not rule out expanding the project to other blockchains in the future. Talking about the development on TON, Sasha said that users need more time to adapt to and trust cryptocurrencies. Investing funds in cryptocurrencies and so on. "Everything we see now is actually just the beginning of a real impact, because these numbers are just numbers at the moment. But in two or three years, we will see those who really enter Web3, and their entry process begins with Telegram and TON."

Sasha believes that the key elements to achieving large-scale adoption of Web3 are: first, removing all barriers. Second, ensuring that the mechanism is viral. "I don't believe you can build a big application by buying a lot of traffic. Basically, all the really big applications grow naturally and organically. You need to build an application that people want to play or use, and they will have enough motivation to share, invite others, and so on. This involves network effects. So, remove barriers and make sure that your internal mechanism can promote this network effect."

In his opinion, it is also necessary to maintain a real experience. "A lot of apps just try to copy other apps. That's fine, but I think if you can really make something unique, it will work better. Also, I think in general, people like fun things, like memes. It's really good when people experience some emotions, similar to when they feel a sense of belonging or some kind of emotion associated with a specific meme or a specific game or thing. So, if you can make a game that can bring some personalized experience to users, it's a good way to grow. "Real communities are built when people have a shared emotional experience." He mentioned.

At the end of the interview, Sasha made a very positive prediction for the development of the TON ecosystem. He said, "I expect TON to become the largest blockchain, which is not difficult to understand. I thought it would happen next year, maybe even this year. You know, TON now has more than 100 million wallets, and TON is doing very fast here. And the growth curve is still exponential growth."

"Let's wait and see, I'm really looking forward to seeing what happens next." Sasha said at the end of the interview.

You May Also Like

Botanix launches stBTC to deliver Bitcoin-native yield

Unprecedented Surge: Gold Price Hits Astounding New Record High