Solana Is Outperforming Bitcoin and Ethereum: Here’s Why

The post Solana Is Outperforming Bitcoin and Ethereum: Here’s Why appeared first on Coinpedia Fintech News

The cryptocurrency market is experiencing a steady rise today, with total capitalization increasing and Bitcoin holding above $ 111,000. However, the spotlight has shifted to Solana (SOL), which is outperforming both Bitcoin (BTC) and Ethereum (ETH), showcasing strong fundamentals that crypto users should not overlook.

Solana Price Breaks $211 With Retail Support

Solana surged past $211 this week, driven by an 11-week high in retail sentiment. Unlike past rallies dominated by whales, this wave is fueled by smaller traders, bringing healthier market participation. Retail entry often signals sustainable growth, reducing the overreliance on big holders.

Liquidity on the Solana network is strengthening rapidly. Stablecoin supply jumped from $10B in July to $12B in just weeks, giving DeFi activity a strong boost. This surge in on-chain liquidity provides deeper market depth and greater stability for Solana-based protocols.

Solana DeFi TVL Doubles to $11B

Confidence in Solana’s ecosystem is reflected in its total value locked (TVL), which has nearly doubled from $6B to $11B since the last market dip. At the same time, Solana is leading DEX trading volumes, overtaking Ethereum, BNB Chain, and Base over the past 24 hours. This indicates traders are increasingly choosing Solana for faster and cheaper transactions.

Whales Ditch Ethereum For Solana

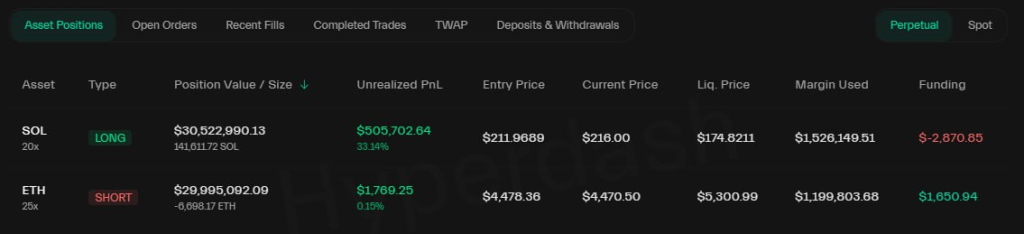

Adding fuel to the rally, on-chain trackers revealed that Whale 0x9e8b, who has already realized over $15M in profits on Hyperliquid, just opened a massive new position:

- Long 141,611 $SOL ($30.7M) with 20x leverage

- Short 6,698 $ETH ($30M) with 25x leverage

This classic rotation trade suggests confidence that Ethereum’s run may be cooling off while Solana still has room to outperform. Such aggressive positioning underscores rising conviction among big players that SOL could be the next market leader.

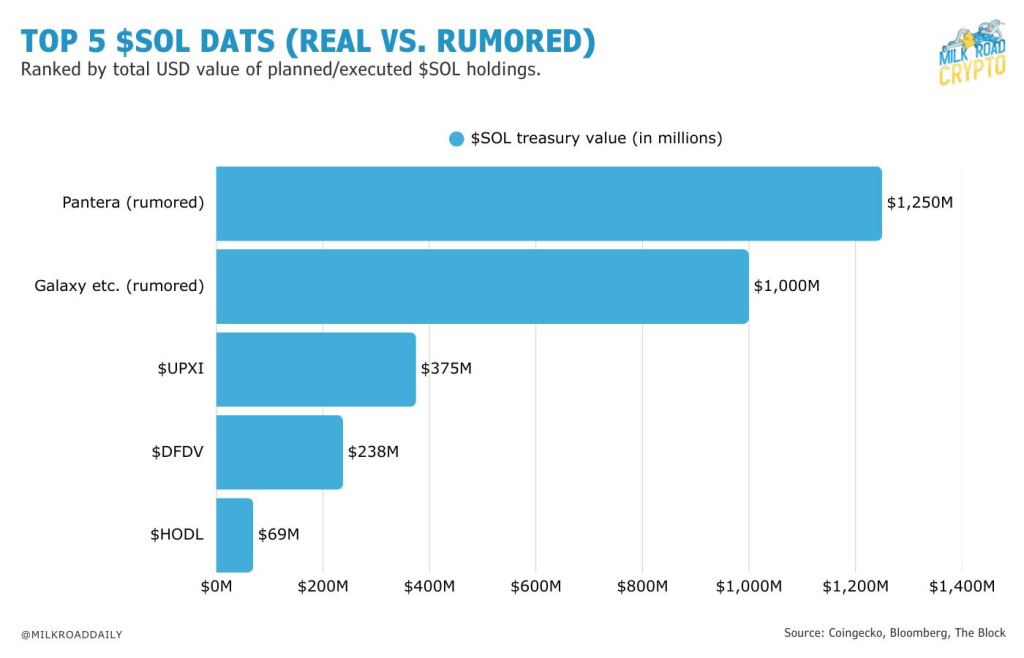

Institutions Eye Solana as Next Big Allocation

Institutional interest is heating up. Pantera Capital and Galaxy Digital are preparing to allocate significant treasury positions into SOL, potentially securing around 2.2% of the total supply, three times larger than the current biggest holder. A supply squeeze of this scale could send prices higher.

Adding fuel, spot SOL ETF speculation is building. If approved, it could unlock institutional inflows similar to Bitcoin and Ethereum ETFs, pushing Solana into mainstream portfolios.

This isn’t just another short-term rally. Rising retail adoption, expanding DeFi liquidity, higher DEX trading activity, and looming institutional inflows suggest structural growth. If ETFs are approved, Solana could evolve from an altcoin outperformer into a core crypto portfolio asset in the next cycle.

While Solana’s price surge is exciting, the real value lies in long-term adoption and utility. He compared Solana, launched in 2020, with Cardano’s longer history since 2015, acknowledging Solana’s fast growth but giving credit to all chains for driving blockchain innovation.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Solana price broke past $211 on strong retail demand, DeFi liquidity growth, and rising institutional interest.

Yes, Pantera and Galaxy plan allocations equal to ~2.2% of total supply, sparking supply squeeze hopes.

With ~10K TPS after the Alpenglow upgrade, Solana processes transactions far faster than Ethereum.

Analysts believe a push toward $250–$300 is likely if ETF approval and inflows align.

You May Also Like

Let insiders trade – Blockworks

‘Mysteriously disappeared’: DOJ Epstein prosecution memo vanishes after press inquiry