Ethereum Sees Contract Boom In 2025, Setting Stage For $5,000 Rally

Although Ethereum (ETH) failed to break the $5,000 mark on August 24 – pulling back from a new all-time high (ATH) of $4,956 – the second-largest cryptocurrency by market cap may soon cross that milestone, driven by booming new contract activity.

Ethereum New Contract Activity Booming – Will Price Follow?

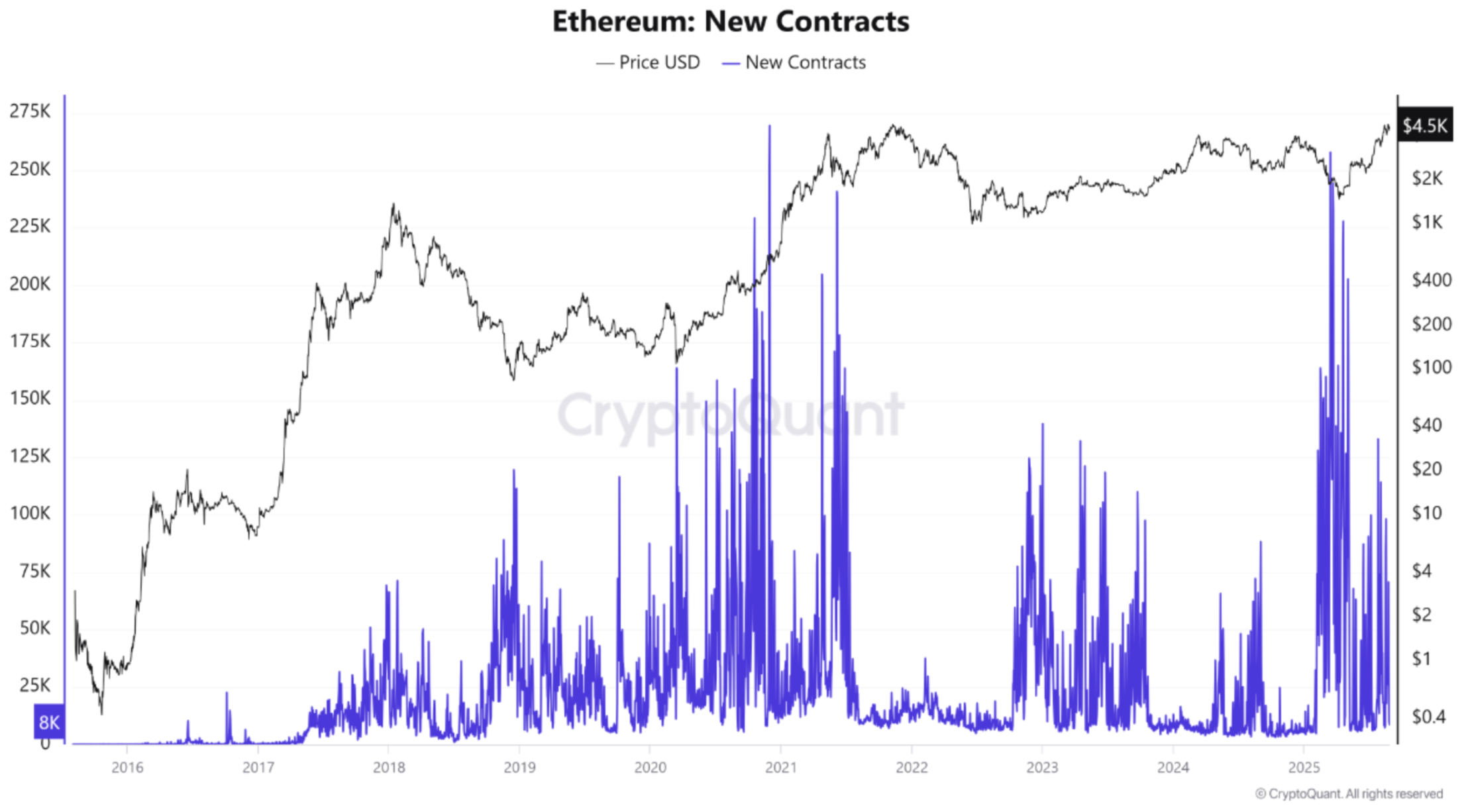

According to a CryptoQuant Quicktake post by contributor PelinayPA, a sharp rebound in Ethereum contracts could be seen in 2024 and 2025. This year specifically, new contracts surged dramatically as ETH price climbed beyond $4,500.

The CryptoQuant contributor highlighted that during the 2016-17 market cycle, new contract activity remained relatively muted. Despite the subdued activity, ETH price entered a strong uptrend.

On the contrary, following the 2018 bull run, ETH entered a price downtrend despite a rise in new contracts. ETH’s price reaction to a growth in new contracts showed that usage growth could not offset the bursting of the speculative bubble surrounding digital assets.

Meanwhile, during the 2020-21 bull market, Ethereum contract creation spiked significantly, in-line with the decentralized finance (DeFi) and non-fungible tokens (NFT) boom. At the time, increased network activity served as a key catalyst in aiding ETH’s rally.

Later – during the 2022 bear market – both contract number and ETH price dropped. The digital asset’s price and network activity was also adversely impacted due to dwindling developer interest and user demand during the market cycle.

The aforementioned examples confirm that over the long-term, growth in contract creation shows rising confidence and adoption within Ethereum’s ecosystem. These factors play out positively for ETH’s price.

That said, sudden surge in contract creation have not always directly resulted into price gains. This was evident from the price corrections observed during 2018 and 2021 cycles.

What Does The Current Outlook Indicate?

In her analysis, PelinayPA remarked that the latest surge in new Ethereum contracts signals renewed network activity, primarily driven by DeFi, NFT, and institutional adoption. If the trend sustains, it could fuel the next ETH bull run.

As far as long-term effects are concerned, the analyst said that consistent growth in new contracts highlights Ethereum’s rapidly expanding real-world use-cases. This gives immense support to ETH’s price. However, hype-driven contract spikes can lead to short-lived price corrections.

Recent predictions point toward further room for growth for Ethereum. For instance, Fundstrat co-founder Tom Lee forecasted that ETH may climb to $5,500 “in the next couple of weeks.”

In the same vein, Standard Chartered’s digital assets research chief, Geoffrey Kendrick, noted that ETH could rise to $7,500 by the end of the year. At press time, ETH trades at $4,582, down 0.2% in the past 24 hours.

You May Also Like

Is Doge Losing Steam As Traders Choose Pepeto For The Best Crypto Investment?

The Definitive Analysis On Whether XRP Can Realistically Reach $5