SharpLink Acquires 56,533 ETH After $360.9M Raise

SharpLink Gaming, Inc. (Nasdaq: SBET), one of the world’s largest corporate holders of Ether, reported a substantial increase in its digital asset reserves.

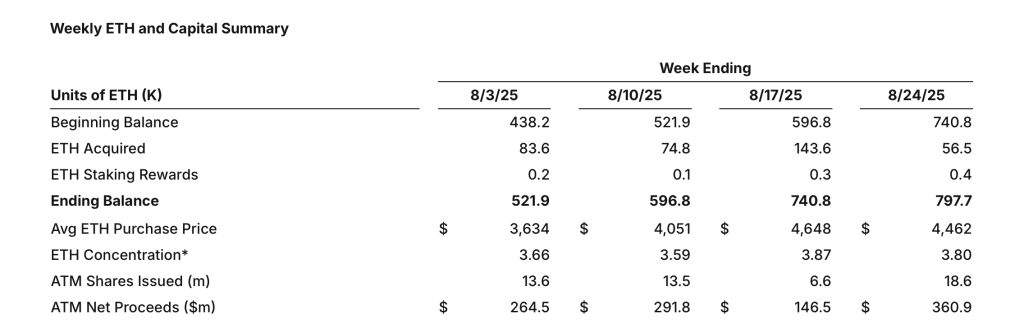

The company announced it has acquired 56,533 ETH at an average price of $4,462, lifting its total holdings to 797,704 ETH, valued at approximately $3.7 billion.

The expansion shows SharpLink’s ongoing commitment to Ethereum adoption and its long-term treasury strategy, launched earlier this summer.

“Our regimented execution of SharpLink’s ETH treasury strategy continues to demonstrate the strength of our vision and the commitment of our team,” said Co-Chief Executive Officer Joseph Chalom.

“With nearly 800,000 ETH now in reserve and strong liquidity available for further acquisitions, our focus on building long-term value for stockholders while simultaneously supporting the broader Ethereum ecosystem remains unwavering,” adds Chalom.

Strong Capital Position from ATM Facility

The company’s At-the-Market (ATM) facility played a central role in fueling the latest purchases. SharpLink raised $360.9 million in net proceeds during the week of August 18–22, giving the company a robust cash position. Approximately $200 million remains undeployed, earmarked for additional ETH acquisitions in the near term.

This capital influx highlights institutional confidence in SharpLink’s aggressive treasury program. Since June 2, 2025, when the initiative began, the firm has consistently converted fiat proceeds into ETH, boosting its concentration ratio on a cash-converted basis above 4.00 — more than doubling in just over two months.

Growing Rewards Through ETH Staking

Alongside its purchases, SharpLink continues to benefit from Ethereum’s proof-of-stake yield. The company’s staking rewards reached 1,799 ETH since the program’s launch, adding another layer of revenue generation on top of its growing digital asset base.

With nearly 800,000 ETH locked, the compounding rewards could become a meaningful driver of value for shareholders.

Analysts note that SharpLink’s dual approach — aggressive acquisitions combined with staking yield — sets the company apart as one of the most committed corporate advocates of Ethereum’s ecosystem.

In addition to expanding its ETH treasury, SharpLink’s Board of Directors approved a $1.5 billion stock repurchase program on August 18, 2025. The buyback plan shows confidence in the company’s long-term financial outlook and complements its ETH-driven growth model.

By simultaneously returning capital to investors and scaling its ETH exposure, SharpLink aims to balance shareholder value with forward-looking digital asset adoption. With a strong liquidity buffer and clear strategic direction, the company positions itself at the forefront of corporate crypto treasury management.

You May Also Like

The Manchester City Donnarumma Doubters Have Missed Something Huge

Marathon Digital BTC Transfers Highlight Miner Stress