Bitfinex Flags Mid-Cycle Reset as Bitcoin LTH Supply Hits 14.3M

- Long-term Bitcoin holders increased supply to 14.3M BTC, signaling renewed accumulation after months of decline.

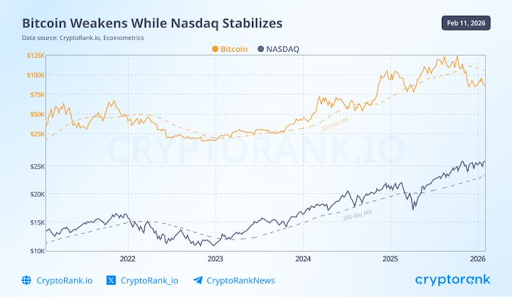

- Bitcoin’s 200-day moving average weakens sharply, showing stress without a full macro market collapse.

- Traders focus on $67K–$65K liquidity zones as price retraces and volatility rises across the market.

Bitcoin’s long-term holders are back in accumulation mode. On-chain data reveals they now control 14.3 million BTC after months of distribution.

Bitfinex analysis shows this shift could signal a mid-cycle reset rather than a final market top. The pattern mirrors previous bull cycles where similar accumulation preceded major price movements.

Long-Term Holder Supply Turns Upward

Bitfinex reports that long-term holder supply has reversed its declining trend. These holders keep coins unmoved for over 155 days.

The supply bottomed in December 2025 before climbing again. This reversal marks a significant shift in investor behavior during current market volatility.

Historical data from past cycles offers insight into what comes next. Long-term holder supply increases typically led Bitcoin price peaks by three to four months. If this pattern holds, the current accumulation phase suggests room for further upside.

The data counters fears of a prolonged bear market.

200-Day Moving Average Flashes Warning

CryptoRank highlights a concerning technical signal. Bitcoin’s 200-day moving average is deteriorating at the fastest pace since 2022.

This type of momentum collapse historically appears during periods of real market stress. The pattern hasn’t occurred during healthy pullbacks in previous cycles.

Bitcoin displays bear-market weakness, Source: CryptoRank

Bitcoin displays bear-market weakness, Source: CryptoRank

However, the current environment differs from 2022’s bear market. Back then, equities crashed and liquidity dried up completely. Today’s Nasdaq shows caution but not capitulation.

Bitcoin displays bear-market weakness while broader risk sentiment only moderates.

This creates an uncomfortable middle ground for traders. Bitcoin lacks the strength to absorb shocks easily. Fading momentum and thin participation make sharp moves possible in either direction. The asset remains vulnerable despite stable conditions in wider markets.

Trading Levels and Market Structure

Trader Lennaert Snyder identifies key liquidity zones for BTC’s current retracement.

After grabbing liquidity, Bitcoin continued moving toward recent lows. The trend remains confirmed down on higher timeframes. Yet the price holds an important support zone.

Short positions target liquidity pools around $67,810 and $68,560. These levels could trigger market structure breaks after retests. The first scenario eyes a move toward $65,200. This area represents the previous range low and holds significant liquidity.

For long positions, traders watch the support zone below $65,200. High-probability reversals require serious liquidity mitigation first. The current bias stays bearish despite holding key support levels.

Current Bitcoin Price Action and Outlook

Bitcoin trades at $67,474.42 according to CoinGecko data. The 24-hour trading volume reached $47.6 billion. Price dropped 2.07% in the last day and 11.32% over the past week.

The signals present a complex picture. Long-term holders accumulate while technical indicators flash warnings.

Bitfinex’s analysis suggests this could be a mid-cycle consolidation. The 3-4 month historical lag between holder accumulation and price peaks remains relevant.

Market participants face turbulence in the short term. Yet the broader risk environment leaves room for stabilization. Conditions could improve if macro factors turn favorable. The current phase tests whether Bitcoin can maintain support while building for another leg up.

The post Bitfinex Flags Mid-Cycle Reset as Bitcoin LTH Supply Hits 14.3M appeared first on Live Bitcoin News.

You May Also Like

Transforming Customer Experience with AI-powered Business Process Services

A Netflix ‘KPop Demon Hunters’ Short Film Has Been Rated For Release