Solana and ADA Consolidate While Rollblock’s Presale Momentum Accelerates

Solana, Cardano, and Rollblock are starting to move in very different directions, and that’s why investors are paying attention.

While Solana and Cardano consolidate near important levels, Rollblock’s presale has been catching fire, with some analysts saying it could rally up to 50x this year. Here’s what has caught their eye.

Rollblock (RBLK): Becoming the Talk of Crypto

Rollblock (RBLK) is quickly becoming the talk of crypto, and not without reason. The Web3 platform has been fully live for more than a year, offering over 12,000 games including live poker, blackjack, and even a sports prediction league.

Every wager and payout is secured on Ethereum’s blockchain, giving players trust through full transparency. Rollblock integrates a crypto wallet system, accepts Apple Pay, Google Pay, Visa, and Mastercard, and has built a reputation as one of the top crypto projects redefining GambleFi.

- Over $15 million in bets placed on Rollblock

- RBLK holders share weekly rewards from platform revenue

- 30% of revenue used for token buybacks, with 60% of the supply burned

- Thousands of active daily users already on the platform

- Staking rewards up to 30% APY

One of the most attractive features is how Rollblock combines elements of DeFi, staking crypto, and crypto payment solutions with real revenue from iGaming. Holders of RBLK are not just speculating, they are literally sharing in the success of the platform.

Rollblock’s hard cap of 1 billion tokens means the supply can never be inflated. Currently, more than 82% of tokens have been sold at $0.068, raising over $11.4 million, with the presale ending date due to be announced in just 41 days.

According to Rollblock’s own updates, bonuses and rewards are drawing in thousands of new buyers.

Adding to the hype, Freddie Finance recently broke down the project in an engaging review, presenting it as one of the best crypto presale opportunities of the year. https://youtu.be/qztj3p8uy_c?si=U1TVQ94C6Anvi6Vp

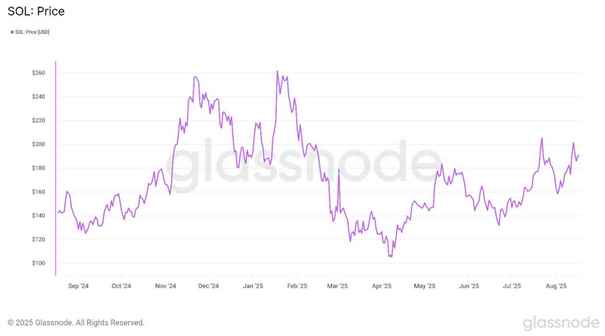

Solana: Climbing Toward the Next Move

Solana is up by 0.83% today at $182.05.

The token has recovered from a sharp drop after running from $140 to $210, with Teresa noting, “Feels like Solana is just getting warmed up before the next leg higher.”

The blockchain has just introduced the Alpenglow upgrade, which improves block finalization and security. It also set a record with 107,664 transactions per second, proving Solana is still leading in blockchain interoperability and scalability.

The minting of $1.25 billion USDC on Solana has added liquidity across DeFi, NFTs, and payments. These catalysts could make Solana one of the top altcoins to watch if it pushes beyond $200 again.

Cardano: Whale Activity and ETF Speculation

Cardano is up 1.71% today, trading at $0.9276.

The token has held support above $0.90 but faces strong resistance at $1.02, with analyst Hype DYOR warning, “a negative RSI divergence hints at weakening momentum.”

Still, Cardano has seen futures volume soar to $7 billion as ETF approval odds hit 75%. Its Voltaire governance updates, 70% staking rate, and growth of DeFi projects like Liqwid and Midnight all support long-term adoption.

Whale purchases, including a recent 200 million Cardano buy, show big investors still see Cardano as a best long-term crypto. If ETF approval comes through, Cardano could break out, but for now it continues to consolidate.

Comparing Rollblock, Solana, and Cardano

| Token | Price | Market Cap | Total Supply | Revenue Share | Deflationary Model |

| Rollblock | $0.068 | Presale $11.4M raised | 1B (hard cap) | 30% of revenue | Yes (burn + staking) |

| Solana | $182.05 | $98.32B | 607.75M (∞ max) | None | No |

| Cardano | $0.9276 | $33.11B | 45B max | None | No |

This table highlights just how much upside Rollblock has compared to more established networks.

The Biggest Upside Remains For RBLK Holders

Solana and Cardano remain strong players in the cryptocurrency market, each with solid ecosystems and real use cases. But Rollblock is catching fire because it offers what many investors want: upside linked to real adoption.

With its deflationary design, strong presale, and rising community momentum, it looks like the best crypto to buy now. In a crowded field of new altcoins to watch, Rollblock has the most upside potential and could be the breakout next 100x crypto of 2025.

Discover the Exciting Opportunities of the Rollblock (RBLK) Presale Today!

Website: https://presale.rollblock.io/

Socials: https://linktr.ee/rollblockcasino

The post Solana and ADA Consolidate While Rollblock’s Presale Momentum Accelerates appeared first on Blockonomi.

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise