Cardano (ADA) Price Surges 10% as Whales Accumulate and CME Futures Near Launch

The post Cardano (ADA) Price Surges 10% as Whales Accumulate and CME Futures Near Launch appeared first on Coinpedia Fintech News

Cardano’s native token ADA has made a strong comeback, rising nearly 10% today to trade around $0.27 after falling close to $0.22 earlier this week. The sharp recovery has renewed optimism among investors and raised fresh questions about whether ADA is preparing for a bigger rally ahead.

Institutional & whale Buying Boosts ADA Confidence

One major reason behind the rebound is renewed institutional interest. Grayscale, a leading crypto investment firm managing over $35 billion in assets, recently increased its ADA holdings.

The firm raised Cardano’s weight in its Smart Contract Fund from 18.55% to 19.50%, showing stronger confidence in the project.

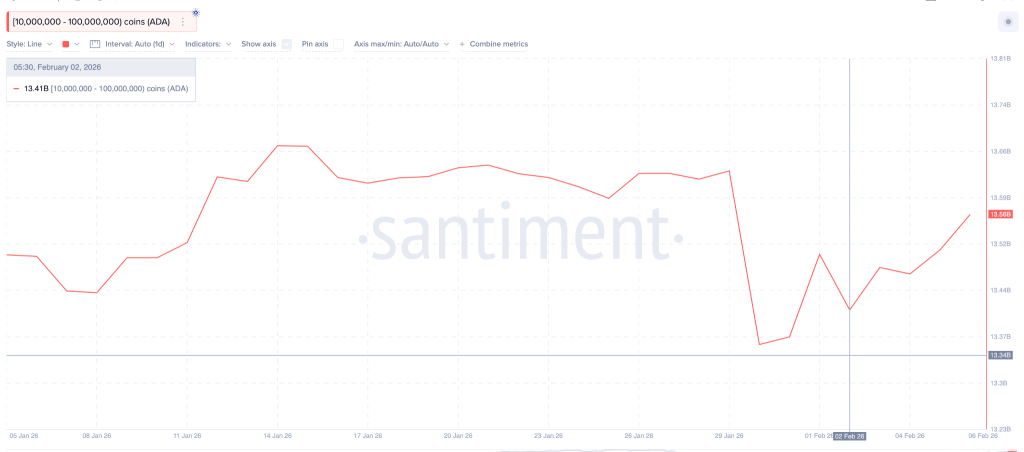

Data from santiment shows that large ADA holders took advantage of the recent price drop. Wallets holding between 10 million and 100 million ADA increased their combined balances from about 13.41 billion to 13.56 billion ADA since early February. This represents an accumulation of roughly $40 million worth of tokens.

More importantly, these mid-sized whales did not sell during the crash. Their holdings remained stable even when prices briefly fell to $0.22.

- Also Read :

- WLFI Price Slumps as Regulatory Concerns Eclipse Crypto Market Recovery

- ,

Big Milestone Ahead: ADA Futures on CME

Adding to the positive momentum, Cardano futures are set to launch on the CME exchange on February 9. The new contracts will give institutional investors regulated access to ADA trading. CME will introduce both standard contracts of 100,000 ADA and smaller micro contracts of 10,000 ADA.

This upcoming launch could increase liquidity and bring more professional participation into the Cardano market.

Cardano ADA Price Outlook

On the weekly chart, ADA has been moving sideways for a long time after its last major peak. The price is forming higher lows near the $0.26 support zone, showing steady buying interest. ADA is also testing a long-term resistance line that has blocked earlier rallies.

A weekly close below $0.20 would weaken the bullish structure and invalidate the current setup. That level acts as the main line of defense for bulls.

However, if momentum improves, analysts see potential for a mid-cycle move toward the $2 to $3 range.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

Cardano (ADA) price is rising due to strong whale accumulation, increased Grayscale exposure, and optimism ahead of CME ADA futures.

Yes, wallets holding 10M–100M ADA added nearly $40M worth of tokens, signaling confidence and long-term accumulation.

ADA holds strong support near $0.26, while a weekly close below $0.20 would weaken bullish momentum.

Analysts expect ADA to trade between $0.90 and $1.50 by February 2026 if adoption grows and bullish momentum holds.

You May Also Like

The Future of Metalworking: Advancements and Innovations

Fed rate decision September 2025