Bitcoin Price Prediction: After Losing $81K and $75.3K, is BTC Plunging Below $60,000?

The post Bitcoin Price Prediction: After Losing $81K and $75.3K, is BTC Plunging Below $60,000? appeared first on Coinpedia Fintech News

Bitcoin price has officially erased all the gains incurred in the past couple of years, specifically after Donald Trump was elected as the president of the US. The current trade dynamics and the market structure suggest Bitcoin bears may still be in control, highlighting the possibility of a deeper correction in the coming days.

The BTC price has come under pressure after losing key support zones between $75,000 and $81,000, shifting the short-term market structure in favour of the bears. With the momentum fading and volatility picking up, the attention has now shifted to the next major support and resistance zones.

BTC Price Rally Resembles a ‘Liquidity Hunt’

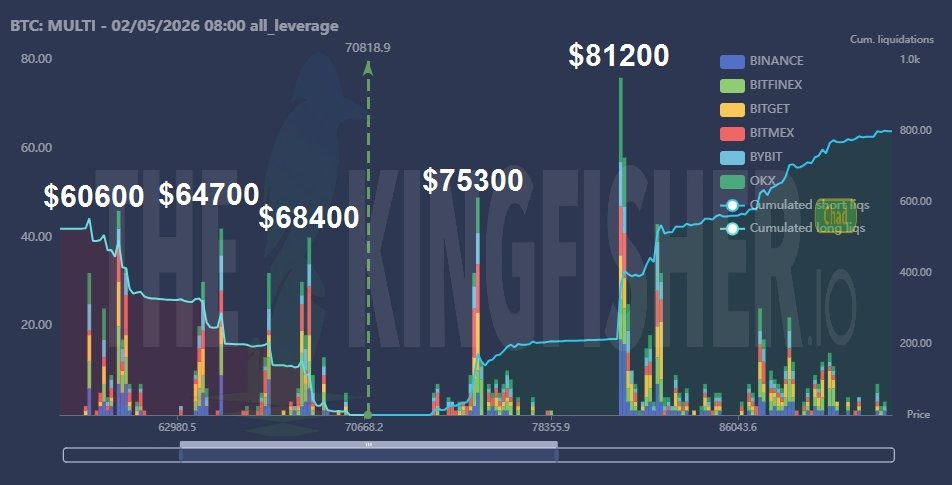

Bitcoin’s recent price action looks less like a clean trend and more like a liquidity-driven move. On the all-leverage liquidation map, the largest clusters of open positions sit below the current price, which makes downside moves easier to trigger.

Source: X

Source: X

The biggest liquidity pools are stacked around $81,200, $75,300, $68,400, $64,700, and $60,600. Each time BTC loses a support level, the price drifts toward the next pocket where leveraged long positions are concentrated. Those levels act like magnets, as forced liquidations add momentum to the downside.

This also explains why the rebounds have struggled to hold. Without steady spot buying to absorb sell pressure, prices continue to sweep lower liquidity zones. Until that changes, volatility is likely to stay high, and risk remains tilted toward further downside moves.

Will Bitcoin (BTC) Price Test $60,600?

In the long-term, the Bitcoin price broke down from the rising wedge in mid-Q4 2024. This was believed to be a correction that could rebound as the price was accumulating within an ascending trend. However, a rejection of $90,000 has pushed the BTC price into a strong bearish trap. Currently, the support at $74,500 is also broken, which suggests the BTC bears are still in control.

On the price side, Bitcoin has clearly been rejected from the upper supply zone near the $100K–$120K region, confirming strong selling pressure at higher levels. The sell-off has now pushed BTC into a well-defined weekly demand zone around $60K–$65K, an area where buyers have historically stepped in.

RSI adds an important layer here. The weekly RSI has dropped toward the lower end of its range, nearing oversold territory compared to prior cycles. This suggests that while momentum is still weak, selling pressure is starting to look stretched. In past instances, similar RSI conditions inside major demand zones have often preceded either a relief bounce or a period of consolidation rather than an immediate continuation lower.

Put together, the indicators suggest Bitcoin is at a critical turning point: holding this demand zone with stabilizing RSI could trigger a short-term rebound or sideways base, while a breakdown, especially with RSI slipping further, would point to deeper downside risk in the weeks ahead.

The Bottom Line

Bitcoin has now entered a demand zone just below $70,000, where the buyers have previously stepped in. The weekly RSI has dropped to the lower threshold below the lower threshold for the first time since November 2022, followed by a strong rebound backed by volume. But the volume has drained now, indicating a massive drop in the trader’s participation. In such a scenario, the BTC price is feared to drop below $60,000 before the end of the week.

You May Also Like

TROPTIONS Corporation Announces Strategic Partnership with Luxor Holdings to Bridge Real-World…

Foreigner’s Lou Gramm Revisits The Band’s Classic ‘4’ Album, Now Reissued