Bitcoin price prediction: Liquidations surge as BTC plunges below $70K

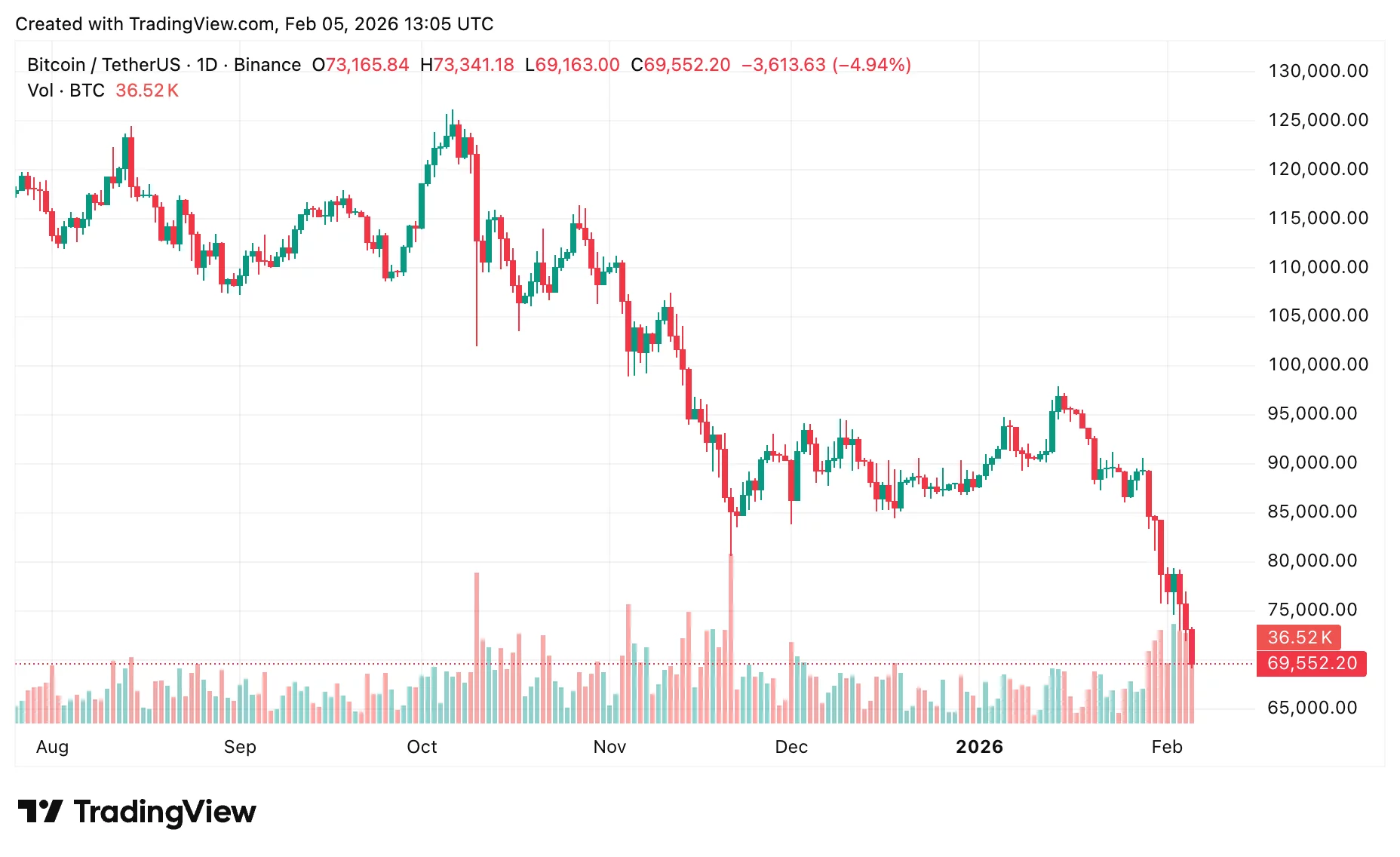

The crypto market is still struggling, with no clear sign that the selling has ended. On February 5, Bitcoin price dipped close to $69,000, a level not seen in over a year. The last time BTC traded around this range was back in October 2024, amid the U.S. elections.

Table of Contents

- Current market scenario

- Bitcoin price prediction: further downside?

- Final thoughts

So, where does Bitcoin go from here? Let’s take a closer look at the setup and jump into a fresh Bitcoin price prediction.

- Bitcoin fell near $69,000 on Feb. 5, 2026, its lowest level since October 2024, amid a sharp spike in volatility.

- BTC has traded in a wide $69,060–$76,075 range, posting daily losses of 8.7% and weekly declines near 21%.

- The selloff has been driven by long liquidations, weakness in tech stocks, and spot Bitcoin ETF outflows, reinforcing a risk-off market environment.

Current market scenario

Bitcoin (BTC) is hovering near $69,550, with markets still clearly under pressure. Today, the coin has bounced between $69,060 and $76,075, highlighting just how volatile and uncertain things remain.

On a daily basis, BTC is down about 8.7%, with weekly losses approaching 21%. From a bigger-picture view, the coin has dropped nearly 45% from its all-time high of $126,198 set just four months ago.

The drop in Bitcoin has been fueled by several key factors. Long liquidations kicked things off, while losses in U.S. tech stocks and steady outflows from spot Bitcoin ETFs piled on extra pressure. All of this has created a risk-off mood in the market, quickly wiping out leveraged positions and keeping traders on edge.

Bitcoin price prediction: further downside?

Technically, $70,000 was a major support level, and Bitcoin failed to hold it. In this BTC price prediction, the next potential target is around $67,500, a level that has seen buyers step in before.

On the upside, $76,100 remains a tough resistance, and only a clean break above it could open the way toward $78,500–$80,000, which has repeatedly capped rallies in the past.

Final thoughts

According to this Bitcoin forecast, the market remains choppy, and the odds of further downside have risen now that BTC has fallen below $70,000. Breaking this major support has triggered selling pressure, and lower support zones could be in play, keeping traders on high alert.

You May Also Like

Crypto News: Donald Trump-Aligned Fed Governor To Speed Up Fed Rate Cuts?

Vitalik Buterin Backs an Altcoin Focused on Privacy and Finality