Silver Crashes 17% as Crypto Leverage Triggers Mass Liquidations

TLDR

- Silver crashed 17% in 24 hours, erasing its recent recovery and pulling gold and copper prices down with it

- Tokenized silver on Hyperliquid saw $16.82 million in forced long position liquidations due to heavy leverage

- Michael Burry warned of a “collateral death spiral” where falling crypto collateral forces traders to sell tokenized metals

- The selloff stems from thin liquidity, heavy speculative positioning, and forced selling rather than macro factors

- Silver has now fallen over 33% from its January 29 all-time high after last Friday’s record single-day drop

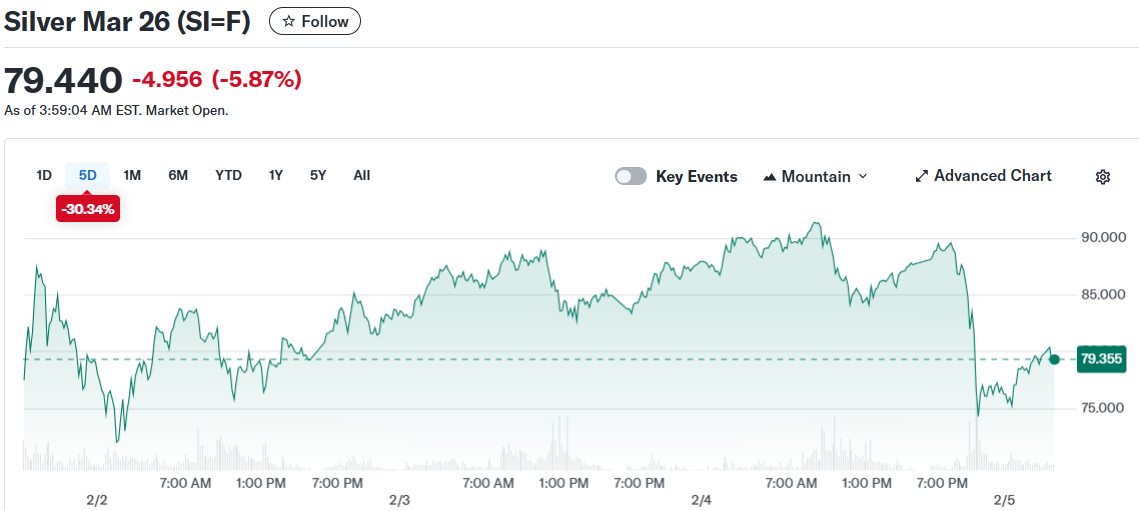

Silver prices plunged 17% in a single day, wiping out a brief two-day recovery. The white metal fell to $76.99 an ounce after briefly touching $90 earlier in Asian trading.

Silver Mar 26 (SI=F)

Silver Mar 26 (SI=F)

The sharp decline pulled other metals lower. Gold dropped 3.5% in volatile trading while copper slipped below $13,000 per ton.

Silver has now retreated more than 33% from its all-time high reached on January 29. The metal experienced its largest single-day drop ever last Friday.

Thin market liquidity and heavy speculative positioning drove the selloff. Christopher Wong from Oversea-Chinese Banking Corp said sentiment turned negative across most asset classes.

The decline created what Wong called a “feedback loop” in thin trading conditions. Forced selling accelerated as prices fell.

Crypto Markets Amplify Metal Selloff

Tokenized silver markets saw major forced liquidations. On Hyperliquid, about $16.82 million in long positions on XYZ:SILVER were forcibly closed.

The total liquidation reached roughly $17.75 million. The lopsided nature shows traders betting on a rebound got caught when volatility spiked.

Hedge fund manager Michael Burry warned of this scenario earlier this week. He described a “collateral death spiral” where leverage builds as metals rise.

When crypto collateral values fall, traders must sell tokenized metals to meet margin requirements. Burry specifically noted bitcoin losses could force institutions to liquidate profitable metals positions.

Speculation Drove Rally Before Collapse

Precious metals soared in January on speculative momentum and geopolitical concerns. Worries about Federal Reserve independence also fueled the rally.

Investors built large positions in precious metals. Heavy inflows into leveraged exchange-traded products added fuel to the surge.

A wave of call-options buying pushed prices higher. The rally appeared to run too far, too fast before reversing.

The collapse started during Asian trading hours last Friday. It continued into early this week before dip-buyers briefly supported prices.

Markets are now weighing Kevin Warsh’s nomination as Federal Reserve chair. President Trump said Wednesday he would not have nominated Warsh if he wanted to raise interest rates.

Trump told NBC News there was “not much” doubt the Fed would lower rates again. Lower interest rates typically support precious metals prices since they don’t pay interest.

Standard Chartered analysts said gold prices will likely stay volatile until monetary policy becomes clearer. Some volatility may come from investors selling their exchange-traded product holdings.

The bank’s analysts said structural drivers remain intact. They expect a rebuild to higher prices over time.

Silver’s smaller market size makes it more volatile than gold. Lower liquidity amplifies price swings in the white metal.

Recent moves stand out for their scale and speed. Heavy speculative inflows and thinner over-the-counter trading magnified the swings.

Positioning and forced selling now outweigh macro drivers like Federal Reserve policy expectations. The liquidation data shows leverage remains the primary factor moving prices.

The post Silver Crashes 17% as Crypto Leverage Triggers Mass Liquidations appeared first on CoinCentral.

You May Also Like

The Arweave network has not produced a block for over 24 hours.

HOT MOMENTS: FOMC Statement Released Following the Fed Interest Rate Decision – Here Are All the Details of the Full Text