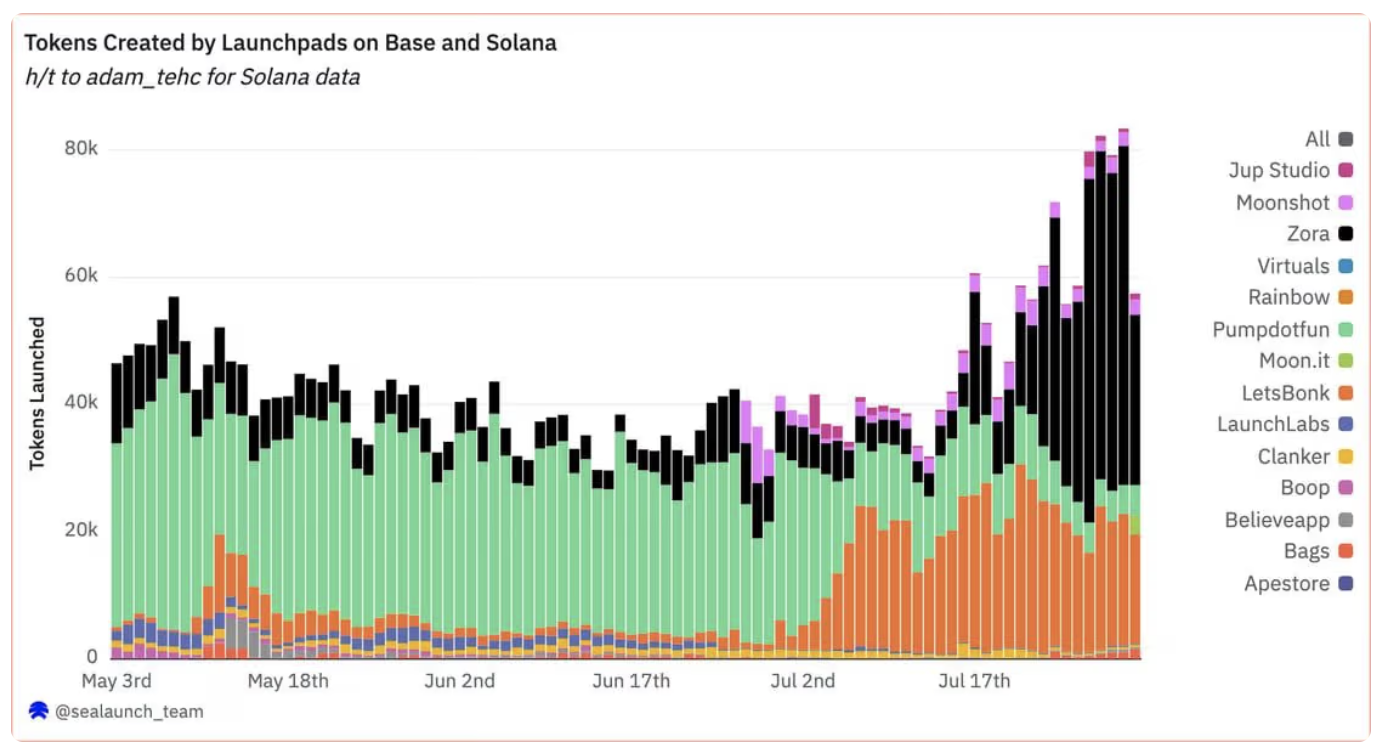

Zora’s creator coins push Base past Solana in daily token launches — but will it last?

Base has surpassed Solana in daily token launches, driven by a boom in creator coins minted from social posts on the Base app. But with most of the activity driven by short-term traders, the question now is whether this new creator economy can last.

- Base has surpassed Solana in daily token launches, driven by “creator coins” minted automatically by Zora’s smart contracts whenever users post social content on the Base app (formerly Coinbase Wallet).

- Over 1.6M tokens launched and nearly 3M traders active within weeks, generating $470 million in trading volume.

- Leading creator coins by market cap include Zeebu ($487.9M), Wormhole ($355.8M), and Zora ($205.3M), with Zora also dominating in trading volume at $102.8M daily.

The Ethereum (ETH) Layer 2 network Base, developed by Coinbase, has just surpassed Solana (SOL) in daily token launches.

This was largely driven by a powerful new mechanism that turns social content into tradable tokens. Each time a user posts on the Base app, Zora’s smart contracts automatically mint an ERC-20 token linked to that piece of content. This token or “creator coin” is then launched on Base and becomes instantly tradable. The original creator then receives a portion of the supply and earns fees every time the token is traded, turning every post into a potential revenue stream.

This new creator economy has led to over 1.6 million tokens launched and nearly 3 million traders participating, generating around $470 million in trading volume since the Base app relaunch. The flagship ZORA token itself now boasts a market cap of around $200 million—an increase of approximately 185% from its ~$70 million valuation in April. It peaked at about $310 million in late July before retracing to current levels.

Other notable creator coins on Base have also achieved substantial market caps and are driving substantial trading volumes, including:

- Zeebu (ZBU), with a market cap of $487.9 million, though daily trading remains relatively light at $371K—suggesting strong valuation but limited liquidity.

- Wormhole (W) follows closely, boasting a $355.8 million market cap and a healthy $22.6 million in 24-hour volume, making it one of the more actively traded tokens in the ecosystem.

- Yield Guild Games (YGG) holds a $81.3 million market cap and sees $12 million in daily volume.

- Zentry (ZENT) rounds out the group with a $54 million valuation and $6.7 million in 24-hour volume.

For context, the Base app, which has served as a user-friendly front end to the Zora’s creator token ecosystem, was rebranded from Coinbase Wallet in mid-July. It’s now a comprehensive SocialFi platform that combines social networking (powered by Farcaster), USD Coin (USDC) payments, onchain identity management, and dApp discovery.

Are Zora’s creator coins on Base more than a hype cycle?

Despite the rapid growth in these creator coins, much of the activity is driven by short-term traders who are after quick profits, which isn’t sustainable. To address this, Jesse Pollak, the creator of Base, has suggested that crypto funds step up by taking sizable, long-term positions—such as $5 million or more— in creator coin indexes, calling this a “a relatively no-brainer opportunity to win as the onchain creator economy grows.”

You May Also Like

MoneyGram launches stablecoin-powered app in Colombia

Solana Treasury Firm Holdings Could Double as Forward Industries Unveils $4 Billion Raise