TRON becomes primary settlement layer for Tether’s USDT, data show

TRON has pulled ahead of Ethereum in stablecoin activity, processing nearly seven times more daily Tether transactions and surpassing $80 billion in supply by mid-2025. The growth appears to be fueled by gasless transactions and low fees, though concerns persist.

- TRON now handles nearly seven times more daily USDT transactions than Ethereum, with total USDT supply on the network reaching $80.8 billion in H1 2025.

- Its rise is fueled by gasless transactions, allowing users to avoid fees through staked resources or app-level sponsorship.

- While stablecoin use is surging, TRON’s centralized governance and limited DeFi complexity raise questions about long-term sustainability.

TRON (TRX), once seen as an underdog in the battle for blockchain utility, is now seems to be pulling ahead of Ethereum. At least in one critical metric: stablecoin activity.

A recent report from on-chain analytics firm CryptoQuant suggests that TRON has cemented its role as a leading settlement layer for Tether’s USDT (USDT), the largest stablecoin by market capitalization.

The network processed 2.3-2.4 million daily USDT transactions in the first half of 2025, nearly seven times the number handled by Ethereum (ETH), according to the report. TRON’s total USDT supply surged to $80.8 billion, surpassing Ethereum’s $73.8 billion for the first time.

“TRON positioned itself as the preferred network for the use of USDT for day-to-day and P2P transactions due to its high throughput and low transaction cost. This is why there is higher USDT transfer activity on TRON than on Ethereum,” said Julio Moreno, head of research at CryptoQuant, in a statement to crypto.news.

TRON’s success may hinge on a design decision that many other chains have avoided: gasless transactions, where users don’t pay fees because costs are covered by staked resources or app-level sponsorship. According to CryptoQuant, 75% of all TRON activity in H1 2025 was fee-free for the user, up from 60% in late 2023. The model, which allows dApps, wallets, or exchanges to subsidize transaction costs via TRX staking or sponsorship, has apparently played a vital role in driving user adoption.

That bet seems to be paying off. TRON processed 273 million transactions in May, the second-highest in its history, while active addresses reached 28.7 million in June, a level not seen since mid-2023. More than that, the average user made 10.5 transactions per month, the highest in two years.

Despite most users paying nothing, the network still generated $308 million in fees in June — a record high — suggesting enterprise users or dApps with higher resource needs may be making up the difference.

Stablecoin machine

TRON’s grip on the stablecoin market appears stronger than ever as USDT alone accounted for 98% of the top 10 token transfers on TRON during the first half of 2025, totaling 384 million movements.

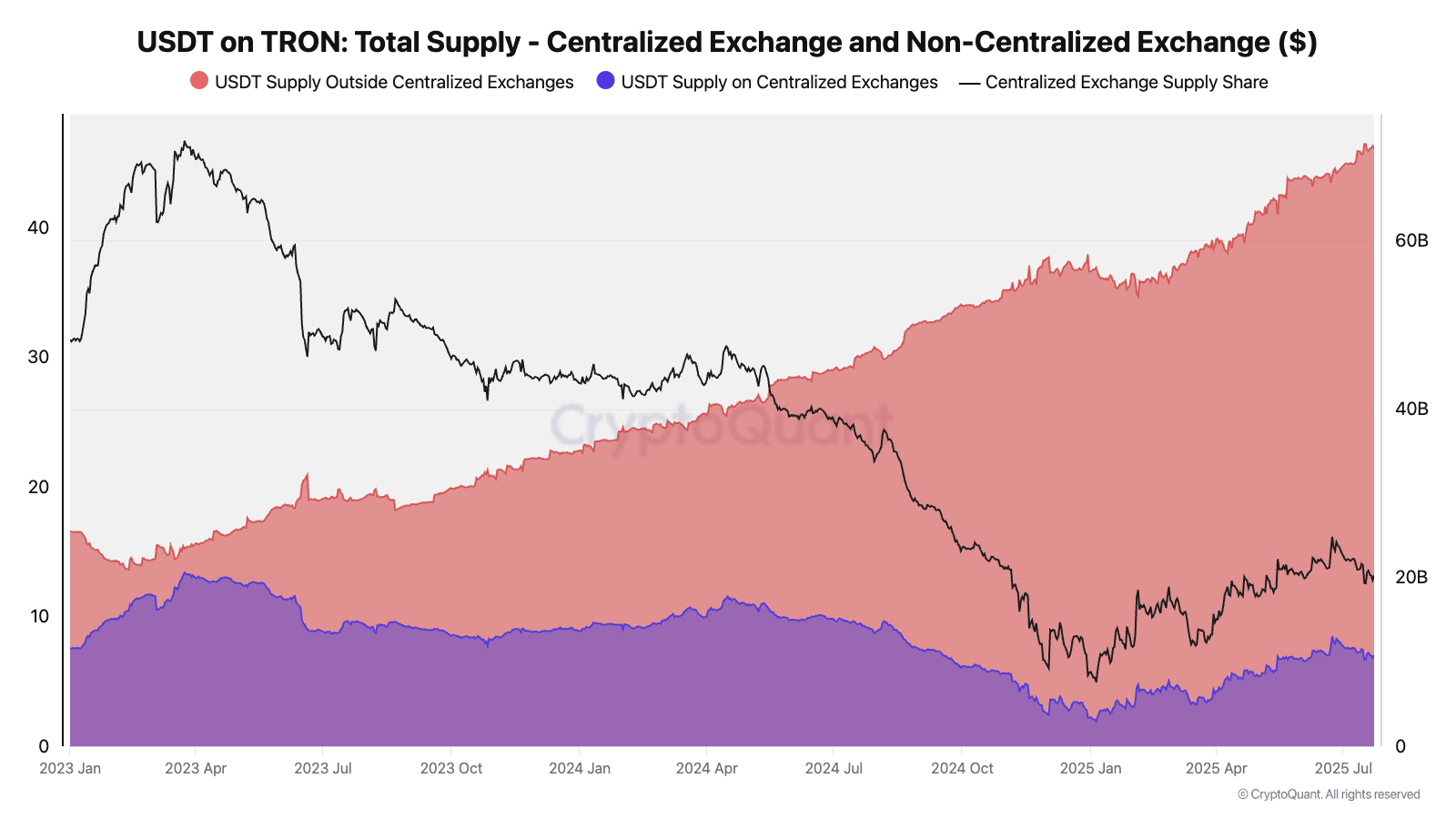

Moreno noted that the vast majority of USDT on TRON is held off centralized exchanges, with the CEX supply share falling from 46% in early 2023 to just 13% today. “Users increasingly leverage TRON for DeFi protocols, lending/borrowing, cross‑border remittances or P2P payments rather than merely parking funds on centralized venues,” he said.

TRON’s dominance in stablecoin usage may also reflect a more practical focus. Unlike Ethereum, which is often used for complex smart contracts and experimentation, TRON has found its niche in fast, low-cost transfers, especially in emerging markets and informal finance.

Still, dominance in transfer volume doesn’t necessarily equate to network health as much of the usage may come from repetitive or automated transactions rather than active, diverse engagement.

DeFi expands, but slowly

Although TRON’s decentralized finance is still far from levels seen on Ethereum, activity is still showing signs of maturity. SunSwap, its decentralized exchange, saw monthly wTRX swap volumes top $3.8 billion in May, with transaction counts significantly higher than 2024 averages. The platform also saw a diversification in trading pairs, as wTRX’s dominance in swaps fell from 98% to 70%, making way for stablecoin- and memecoin-based activity.

JustLend, TRON’s lending protocol, also saw a 23% rise in borrowing transactions, driven largely by stablecoins, while daily deposit volumes on JustLend tripled since January, peaking at $740 million in April, according to the report.

These developments suggest TRON’s ecosystem is expanding beyond simple transfers. Still, as noted above, TRON’s DeFi landscape remains smaller and less complex than Ethereum’s or Solana’s, and critics have pointed to the outsized role of centralized governance in TRON’s architecture.

While the data points to what seems to be real traction, the story of TRON’s USDT dominance isn’t one of pure technological superiority; it’s also about tradeoffs: low fees and gasless transactions have made the network attractive, especially for stablecoin users in regions with limited access to traditional banking.

But whether TRON can sustain that growth without leaning heavily on USDT remains uncertain. Its broader ecosystem — governance, developer activity, novel dApps — still trails behind Ethereum and other platforms.

You May Also Like

Solana Hits $4B in Corporate Treasuries as Companies Boost Reserves

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End