He turned $1k into $4.5m with SHIB, now he’s all in on XYZVerse

Disclosure: This article does not represent investment advice. The content and materials featured on this page are for educational purposes only.

The investor who made $4.5m from Shiba Inu is now going all in on XYZVerse — here’s why.

- SHIB investor bets big on XYZVerse as presale nears $20m.

- XYZVerse presale heats up with 12 of 15 rounds complete.

- YZVerse fuses sports, gamified rewards, and deflationary tokenomics.

An investor transformed $1,000 into $4.5 million by backing Shiba Inu early on. Now, this individual is putting everything into XYZVerse, a new player in the crypto arena.

What makes XYZVerse compelling enough to warrant such a bold move? Dive into the story behind this significant shift in investment strategy.

XYZVerse presale accelerates as 12 of 15 stages sell out ahead of token launch

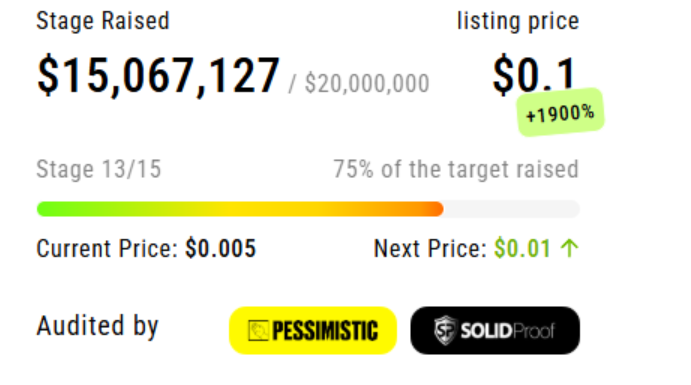

XYZVerse, a memecoin project fusing sports fandom with crypto speculation, is gaining traction as its presale moves into its final stages. With 12 of 15 rounds already completed, the offering has drawn heightened investor interest ahead of the project’s upcoming Token Generation Event (TGE).

Launched at $0.0001 in Stage 1, the XYZ token now trades at $0.005 in Stage 13. The current phase will close once total fundraising crosses the $20 million threshold. According to the project’s team, this structured price ladder rewards early participants with steeper entry discounts.

A Sports-themed play in the memecoin arena

Targeting a niche intersection of football, basketball, MMA, and esports fans, XYZVerse is building what it describes as a community of “crypto warriors” — users united by their passion for competition and high-risk upside.

Unlike many memecoins that rely on momentum alone, XYZVerse has mapped out a multi-pronged growth strategy:

- Token Generation Event (TGE): Set to follow presale completion, supported by a large-scale marketing rollout.

- Exchange Listings: Planned on both centralized (CEX) and decentralized (DEX) platforms to expand liquidity and retail accessibility.

- Community Rewards: The project promises gamified engagement, including fan contests and token incentives.

- Deflationary Model: 17.13% of total supply earmarked for token burns, designed to reduce circulating supply over time.

- Brand Expansion: Active efforts to partner with athletes and sports entities aim to bring mainstream visibility.

Investor interest builds on execution, not just hype

With over 80% of the presale already complete and more than $19 million raised, XYZVerse has positioned itself as one of the more structured campaigns in the current memecoin cycle. Investors are responding not just to presale pricing dynamics, but to a roadmap that combines token utility, sports culture branding, and community-first engagement.

Three stages remain before the presale concludes, offering latecomers a limited window to acquire XYZ prior to its public listing. Whether XYZVerse can sustain momentum post-launch will depend on the execution of its roadmap and the market’s appetite for memecoins with broader thematic ambition.

Still time to get in before the presale ends.

Shiba Inu

Shiba Inu (SHIB) has seen notable price movements recently. Over the past week, its price has fallen by 7.05%, but it has gained 14.86% in the last month. However, looking at the six-month period, SHIB has decreased by 32.51%.

Currently, SHIB is trading between $0.00001356 and $0.00001666. The nearest resistance level is at $0.00001780, and the nearest support is at $0.00001160. If the price breaks above the resistance, it could move toward the second resistance level at $0.00002090, potentially increasing by a significant percentage. On the downside, falling below the support level might lead to a test of the second support at $0.000008506.

Technical indicators show mixed signals. The Relative Strength Index (RSI) is at 44.56, suggesting that SHIB is neither overbought nor oversold. The Stochastic value is 30.27, approaching the oversold territory. The 10-day Simple Moving Average (SMA) is $0.00001340, slightly below the current price, while the 100-day SMA is $0.00001458. The MACD level is negative at -0.0000001489, indicating bearish momentum. Based on this data, SHIB’s price may consolidate or experience further fluctuations in the near future.

Conclusion

SHIB’s success is notable, but XYZVerse aims to surpass it by uniting sports fans and meme culture in a community-driven token targeting 20,000% growth.

To learn more about XYZ, visit its website, Telegram, and Twitter.

Disclosure: This content is provided by a third party. Neither crypto.news nor the author of this article endorses any product mentioned on this page. Users should conduct their own research before taking any action related to the company.

You May Also Like

SHIB Price Prediction: Mixed Signals Point to $0.0000085 Target by February End

Fed rate decision September 2025